In the dynamic landscape of international trade, exporters face various challenges, with financing often topping the list. To navigate these challenges and facilitate cross-border commerce, Export Credit Agencies (ECAs) play a pivotal role. These agencies, often backed by governments, provide crucial financial support to domestic businesses looking to expand their reach.

In this blog, we delve into the fundamental aspects of export financing and explore the multifaceted role that ECAs play in driving economic growth through global trade.

What is Export Factoring?

Export factoring is a financial arrangement that helps businesses involved in international trade manage their cash flow by providing immediate funds for their accounts receivable. It is a form of receivables financing where a company (the exporter) sells its accounts receivable, or invoices, to a financial institution known as a factor. The factor, often a specialized financial institution or a division of a bank, advances a significant portion of the invoice value to the exporter upfront, typically around 70-90%, and then assumes responsibility for collecting payment from the international buyer.

Also Read: Advantages of Export Factoring

What Is an Export Credit Agency?

An Export Credit Agency (ECA) is a financial institution or government agency that provides financial and insurance services to domestic companies involved in international trade. The primary purpose of an ECA is to support and facilitate exports by mitigating the risks associated with cross-border transactions. ECAs play a crucial role in promoting economic growth, enhancing global trade, and fostering international business relationships.

Also Read: How Does Export Financing Promote Trade?

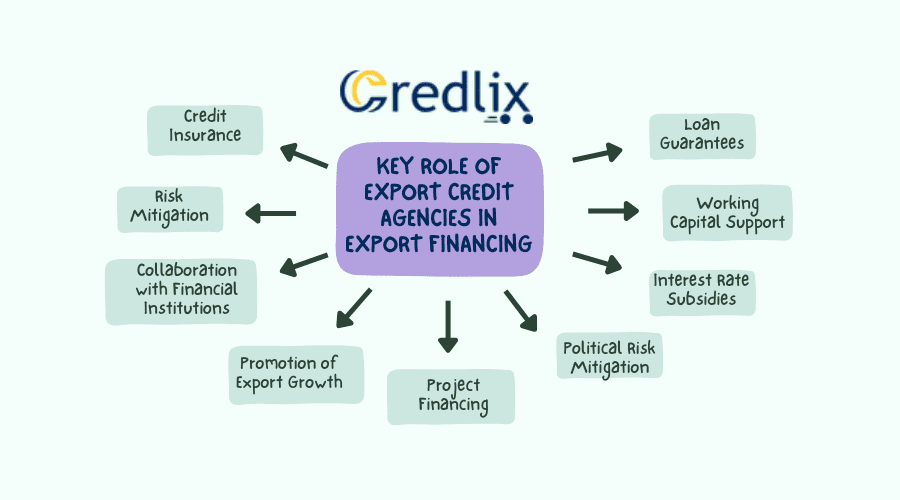

Key Role of Export Credit Agencies in Export Financing

Export Credit Agencies (ECAs) play a pivotal role in export financing, providing critical support to domestic businesses engaging in international trade. Their key functions contribute to overcoming financial barriers, mitigating risks, and fostering economic growth. Here are the key roles that Export Credit Agencies play in export financing:

Risk Mitigation

ECAs help mitigate various risks associated with international trade, including commercial risks (non-payment or delayed payment by foreign buyers), political risks (expropriation, currency inconvertibility, war), and sovereign risks (risks related to the economic and political stability of the buyer’s country). By offering insurance and guarantees, ECAs provide a safety net that encourages exporters to explore new markets.

Credit Insurance

One of the primary roles of ECAs is to provide credit insurance to exporters. This insurance protects businesses from the risk of non-payment by foreign buyers, ensuring that they receive payment for their goods or services even if the buyer defaults.

Loan Guarantees

ECAs issue loan guarantees to lenders, assuring them that they will be compensated in case the borrower (exporter) defaults. This enhances the creditworthiness of exporters, making it easier for them to secure financing from banks and financial institutions.

Working Capital Support

Exporters often face working capital challenges when dealing with international transactions. ECAs provide working capital support, ensuring that businesses have the necessary funds to cover production costs, fulfill orders, and manage day-to-day operations during the export process.

Interest Rate Subsidies

To make export financing more affordable, ECAs may offer interest rate subsidies or favorable financing terms. This encourages exporters to seek financing for their international endeavors, as they can benefit from lower interest rates compared to traditional commercial loans.

Political Risk Mitigation

ECAs specialize in mitigating political risks associated with cross-border transactions. By providing coverage against events such as war, nationalization, or changes in government policies, ECAs create a stable environment for exporters to operate in challenging geopolitical landscapes.

Project Financing

For large-scale projects such as infrastructure development, ECAs collaborate with financial institutions to provide project financing. This support is instrumental in driving economic development and fostering global connectivity.

Promotion of Export Growth

ECAs actively contribute to the growth of exports by facilitating access to financing and reducing the uncertainties and challenges associated with international trade. Their support enables businesses to compete globally and seize opportunities in new markets.

Collaboration with Financial Institutions

ECAs collaborate with commercial banks and financial institutions to ensure that exporters have access to a range of financial products and services. This collaboration strengthens the financial infrastructure supporting international trade.

In summary, the key role of Export Credit Agencies in export financing revolves around providing financial tools, risk mitigation, and support mechanisms that empower businesses to navigate the complexities of global trade. By fostering a more secure and supportive environment, ECAs contribute significantly to the expansion of international commerce and the overall economic development of nations.

Final Note

Export Credit Agencies (ECAs) stand as indispensable pillars in the realm of international trade, offering a robust framework of financial support and risk mitigation for domestic businesses venturing into global markets. By addressing challenges such as credit and political risks, providing working capital support, and fostering collaboration with financial institutions, ECAs play a pivotal role in empowering exporters to thrive on the global stage.

As catalysts for economic growth, ECAs continue to fortify the foundations of cross-border commerce, ensuring a resilient and flourishing landscape for businesses seeking to expand their horizons and contribute to the interconnected world economy.

Also Read: How Many Types of Credit are Available for Export Financing?