[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”13112″ img_size=”full” css=”.vc_custom_1718779163733{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Sometimes, customers delay payments until the last minute, putting financial strain on small enterprises trying to fulfill other business opportunities and orders. For instance, Sushil Kumar, a small business owner who runs a crockery manufacturing company, recently delivered a large order to a supermarket. According to the sales agreement, he will be paid in two months. However, he currently lacks the funds to purchase raw materials for a new order. Despite the guaranteed payment from the first order, he risks losing the second if he cannot meet the production deadline.

In such critical situations, sales bill discounting or invoice discounting services serve as a lifeline, supporting the company’s future growth.

What is Sales Bill Discounting?

Sales bill discounting is a short-term financing facility that allows individuals or business owners to borrow money from banks and non-bank financial companies (NBFCs) to address late payments from customers and manage cash flow. This crucial tool enhances a company’s working capital by converting unpaid invoices into immediate funds. As a form of debtor finance, sales bill discounting involves selling outstanding invoices to a third party, using them as collateral for a loan, thereby freeing up cash flow for business operations.

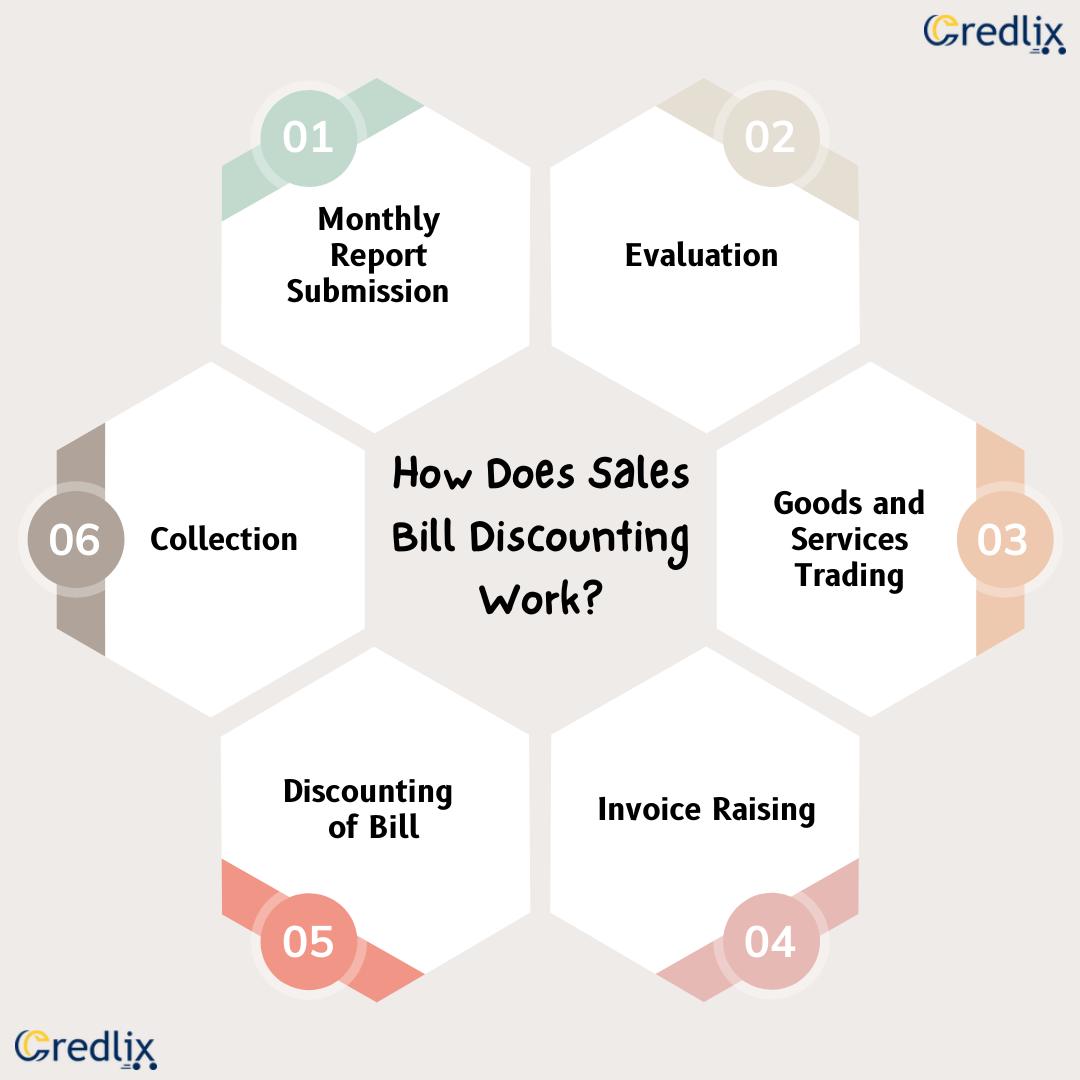

How Does Sales Bill Discounting Work?

Sales bill discounting is a process where businesses get immediate cash by using their outstanding invoices as collateral for a loan. Here’s how it works in a simple way:

Monthly Report Submission

The borrowing company sends a report of their accounts receivable to the sales discounting finance company at least once a month. This report lists the unpaid invoices they have issued to their customers.

Evaluation

The finance company (like a bank or non-bank financial company, NBFC) reviews the accounts receivable report to decide how much money they can lend to the borrower based on these invoices.

Goods and Services Trading

Initially, the business sells goods or services to customers or vendors and completes the transaction.

Invoice Raising

The business then issues invoices to the customers or vendors, specifying the payments expected within a certain period, usually within 90 days.

Discounting of Bill

The business takes these invoices to a bank or NBFC to get a loan against them. The finance company deducts a small fee and provides the business with the remaining amount as a loan. For small and medium-sized enterprises (MSMEs) that can’t access major financial institutions directly, companies help secure these loans and discounts.

Collection

Customers pay the bank or NBFC directly by the invoice due date. This payment helps the business repay the loan received against the invoices.

This process ensures that businesses have the cash flow they need to continue operations smoothly, even if their customers take time to pay.

Also Read:Export Factoring vs. Bill Discounting: Which Financing Option is Right for You?

How Sales Bill Discounting Impacts a Company’s Financial Well-Being

Sales bill discounting plays a crucial role in maintaining and improving the financial health of businesses. Here are 10 points on how it impacts a company’s financial well-being:

Improves Cash Flow

Sales bill discounting provides immediate cash by converting outstanding invoices into liquid assets. This enhances cash flow, ensuring businesses have the necessary funds to cover day-to-day expenses and invest in growth opportunities without waiting for customer payments.

Facilitates Timely Payment to Suppliers

By securing funds through bill discounting, businesses can pay their suppliers on time. This helps maintain strong supplier relationships, potentially leading to better credit terms, discounts, and a more reliable supply chain.

Reduces Financial Strain

Waiting for customer payments can create cash flow gaps that strain a business’s finances. Sales bill discounting alleviates this pressure by providing immediate funds, allowing businesses to operate smoothly and focus on their core activities.

Enables Acceptance of Larger Orders

With immediate cash availability, businesses can confidently accept and fulfill larger orders without worrying about financing the production. This capability can lead to increased sales and market expansion.

Supports Business Expansion

The funds obtained from bill discounting can be used to invest in new opportunities, such as expanding product lines, entering new markets, or scaling operations. This strategic investment drives business growth and competitiveness.

Enhances Creditworthiness

Consistently using sales bill discounting and managing it well can improve a business’s credit profile. A better credit score can open up additional financing options with more favorable terms in the future.

Maintains Operational Efficiency

Immediate access to cash ensures that businesses can maintain their operational efficiency by paying for necessary expenses such as payroll, utilities, and inventory. This stability supports continuous and efficient operations.

Mitigates Risk of Bad Debt

Since the discounting process involves selling invoices to a third party, the risk of non-payment or delayed payment from customers is transferred to the financer. This reduces the business’s exposure to bad debt and financial uncertainty.

Flexible Financing Option

Sales bill discounting is often more flexible and easier to obtain compared to traditional loans. It doesn’t usually require extensive credit checks or collateral, making it accessible to small and medium-sized enterprises (SMEs) and startups.

Improves Customer Relations

By ensuring that cash flow issues don’t delay operations, businesses can meet delivery deadlines and maintain high levels of customer satisfaction. Satisfied customers are more likely to provide repeat business and positive referrals, contributing to long-term success.

Also Read: LC Backed Bill Discounting in Exports

Conclusion

Sales bill discounting is a vital financial tool that enhances the financial health of businesses by providing immediate cash flow and reducing financial strain. It enables timely payments to suppliers, acceptance of larger orders, and supports business expansion. By improving creditworthiness and operational efficiency, mitigating bad debt risks, and offering flexible financing, sales bill discounting helps businesses maintain strong customer relations and achieve sustainable growth. This strategic solution ensures businesses can capitalize on opportunities and thrive in competitive markets.

Also Read: How Bill Discounting Can Help Exporters Like You[/vc_column_text][vc_column_text][/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]