[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11648″ img_size=”full” css=”.vc_custom_1702883559510{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]A good invoicing process is important for handling money well and making sure your business can grow. It’s a big part of managing finances, making sure you get paid on time, and keeping your cash flow healthy. As your business gets bigger and you have more clients, making your invoicing process work even better becomes really crucial.

In this article, we’re going to look at ways to make your invoicing process smoother. We’ll talk about why using technology to automate things is a game-changer, and we’ll show you how online invoicing software can make handling your business money way easier. So, let’s jump in and figure out how to make your invoicing process awesome for you and your business!

What is an Invoicing Process?

An invoicing process is like sending a friendly reminder to get paid for the work or goods you’ve provided. It includes listing what you did, how much it costs, and when you expect to be paid. Invoicing helps keep track of earnings and ensures clarity in business transactions.

Impact of Invoicing on Business Relationships

Invoicing plays a big role in how businesses get along with each other. When you send clear and timely invoices, it keeps things friendly and smooth. It shows you’re professional and serious about your work. On the flip side, if invoices are confusing or late, it can cause misunderstandings and stress. Getting paid on time is important for both parties, and a good invoicing system helps make this happen.

It builds trust and respect in business relationships. When everyone knows what to expect, it creates a positive vibe, making it more likely for people to work together happily and for businesses to thrive. Invoicing isn’t just about money; it’s a key part of keeping good relationships in business.

11 Tips to Efficiently Streamline Invoice Processing in 2023

Here are 11 tips to streamline and enhance invoice processing:

1. Create Simple Rules for Invoices and Payments

Make easy-to-understand rules for how you send bills and get paid. When you finish deals, tell everyone involved—employees, vendors, suppliers, clients—about these rules. Make sure they understand things like when to pay, what happens if they’re late, and how to send invoices (like through email or other ways).

Write down clear steps for sending bills, how to get paid, and what to do if there’s a problem. Having simple and clear rules helps everyone know what to expect and avoids any mix-ups.

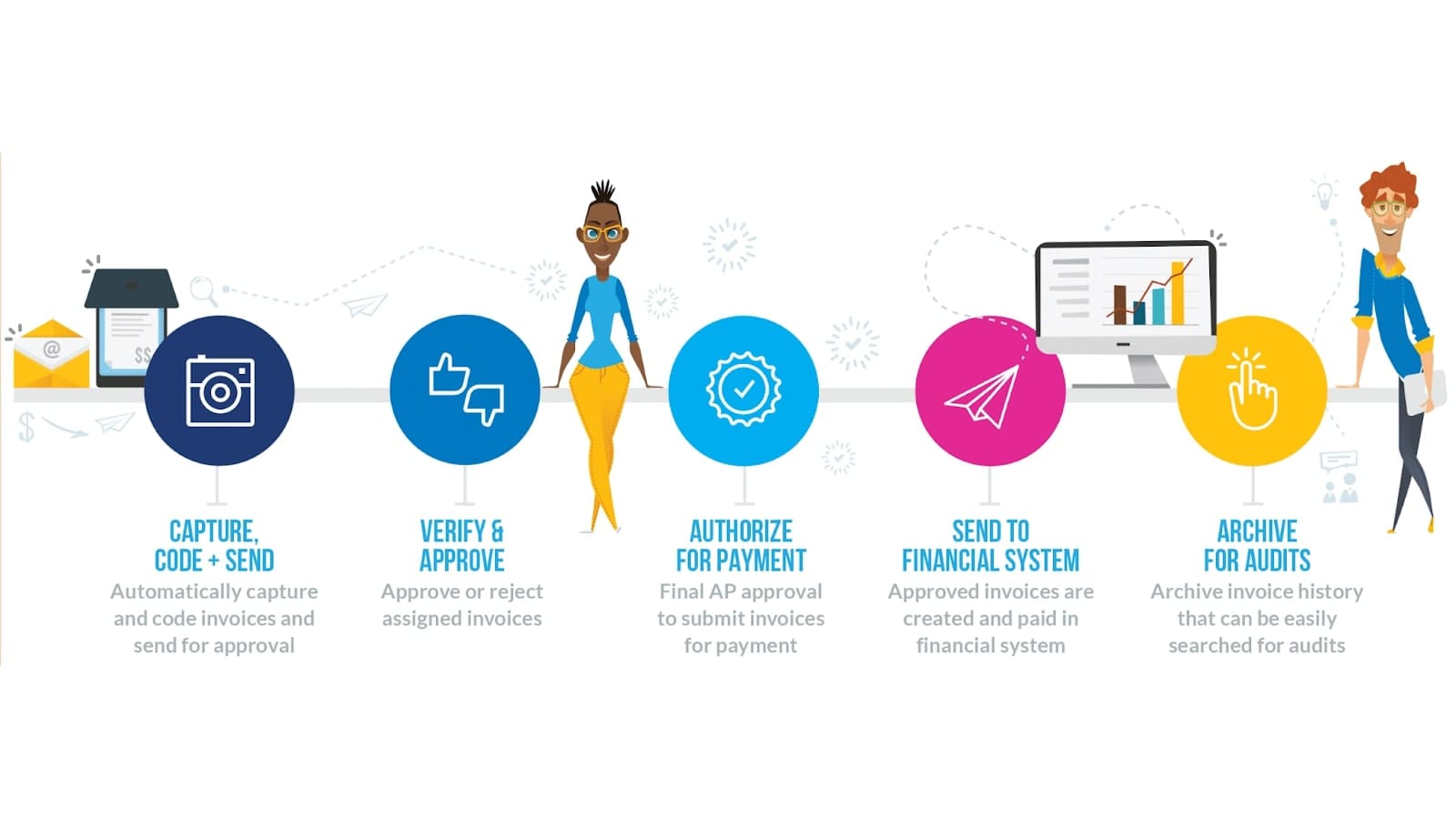

2. Streamline Your Invoicing with Automation

Simplify invoicing tasks by embracing automation. It handles jobs like printing invoices, verifying agreements, and securing approvals efficiently, reducing errors.

Furthermore, automation swiftly extracts details from invoices, cross-references them with commitments, and sends for speedy approval. This not only accelerates the entire process but also guarantees precision and transparency, making your invoicing hassle-free.

3. Make Your Invoices Look the Same

When we talk about standardizing invoice format, it just means making all your bills look the same way. Doing this has a lot of good points, like making things smoother, reducing mistakes, and making your business look more professional. It’s essential to use this same format for all your suppliers. Even though a clear invoice format doesn’t guarantee you’ll get paid right away, it helps prevent delays caused by mistakes or missing info.

Your standard invoice should have all the necessary details at the top—like your company name, address, contact info, and logo. Keep this info the same on every invoice. Give each invoice a unique number so you can find it easily later. Include customer details, when they need to pay, what they bought, the prices, any discounts, the total amount (including taxes), and how they can pay. Keeping it all in a standard way makes everything clearer.

4. Switch to Digital Invoices

Get your vendors and clients to use digital invoices, known as e-invoices, whenever they can. These are electronic bills that you send and receive online, so no need for paper. Using e-invoices makes things faster, cuts down on mistakes, and is better for the environment and your budget.

5. Centralized Invoice Management System

It’s a good idea to have a central spot for all your bills, whether they’re on paper or online. This helps you keep things neat and find what you need easily. Using a strong invoice management system lets you organize, track, and get back invoices without a fuss.

If you use a system that’s on the internet (like the cloud), it’s even better. This way, you can get to your invoices from anywhere, making it easy to work from different places and team up with others.

6. Check Your Invoices Regularly

Take time now and then to look at how you deal with invoices. See if there are any problems, things that slow you down, or rules you might be missing. Look at how long it takes to process invoices, if there are delays in approvals, or if there are mistakes.

Use what you find to make your invoice system work even better. It’s like giving it a tune-up to keep everything running smoothly.

7. Good Follow-Ups

It’s important to make sure you or your clients don’t end up paying extra fees for being late. If the payment isn’t done yet, you can send a friendly reminder about a week before it’s due. These reminders can be like a note that talks about the sales or purchase invoice.

You can send them as a paper note to the office or as an email or text message, just like e-invoices. Remember to be polite and professional in the reminders. It’s like a friendly nudge to make sure everything gets paid on time.

8. Use Numbers to Understand Your Invoices Better

Take a closer look at your invoice work using numbers. This helps you see important things like trends, where you can save money, and places where you can do things better. For instance, you can look at how well your suppliers are doing, when payments are usually late, or where you might get discounts for paying early. It’s like using smart math to make your invoice process even better.

9. Stick to Your Schedule

Make sure things move on time when it comes to sending or getting bills. Whether you’re the one sending bills or getting them, set up a clear schedule for when things start. This schedule can depend on how long it takes to check the bill, get approval, write a check, or transfer money. Being consistent is key, so create a plan that gives you plenty of time to go through the steps before making payments. It’s like having a reliable routine to make sure everything happens when it should.

10. Transparency in Communications

Maintain open and clear communication with all stakeholders involved in the invoicing process. Clearly convey rules, expectations, and any changes in procedures. This transparency fosters understanding, reduces confusion, and promotes smoother collaboration.

11. Collaborative Approvals

Encourage collaboration in the approval process by involving relevant stakeholders. Streamline communication channels to expedite approvals and minimize delays. Collaboration ensures everyone is on the same page, contributing to a more efficient invoicing workflow.

Final Words

So, having a good invoicing process is like having a smooth way of asking to get paid for your hard work. We talked about simple rules, using smart technology, and keeping things organized. Making invoices look the same and using digital ones can really help, too. Checking your invoices regularly and reminding about payments nicely are important.

Numbers can also show you how to make things even better. Stick to your schedule, talk openly, and get everyone involved. Remember, good invoicing isn’t just about money; it’s about keeping everyone happy and making businesses grow. So, keep those invoices clear, friendly, and on time for a successful and friendly business journey!

Also Read: How Investing In Invoice Discounting Is More Profitable Than Stock Market

FAQs

Why is a good invoicing process important for my business?

A good invoicing process is crucial because it helps you get paid on time, manage your money well, and keeps your business running smoothly.

How can simple rules for invoices and payments benefit my business?

Simple rules make sure everyone knows what to do – when to pay, what happens if they’re late, and how to send invoices. This avoids confusion and keeps things clear.

Why should I consider using automation in my invoicing process?

Automation makes things easier by handling tasks like printing invoices and getting approvals, reducing errors, and speeding up the whole process.

How does standardizing invoice format help my business?

Standardizing invoices makes everything look the same, reducing mistakes and making your business look more professional. It also prevents delays caused by errors.

What are the advantages of switching to digital invoices (e-invoices)?

Digital invoices save time, cut down on mistakes, and are better for the environment and your budget. They make the whole process faster and more efficient.

How does a centralized invoice management system benefit my business?

A centralized system keeps all your bills in one place, making it easy to find and organize. It helps track and retrieve invoices efficiently, especially if it’s online.

Why is regular checking of invoices important for my business?

Regular checks help identify problems, slowdowns, or missed rules in your invoicing process. It allows you to fine-tune and improve efficiency.

Also Read: The Ultimate Guide on What is Invoice Discounting[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]