[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12641″ img_size=”full” css=”.vc_custom_1713332581985{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Trade finance plays an important role in facilitating international trade and commerce by providing financial assistance through various specialized products. These products are designed to streamline transactions between importers and exporters, ensuring smooth and efficient business operations across borders.

Let’s get deeper into the types of trade finance available in India and their significance in supporting businesses engaged in global trade.

Also Read: How Much Finance is Required to Start an Export Business?

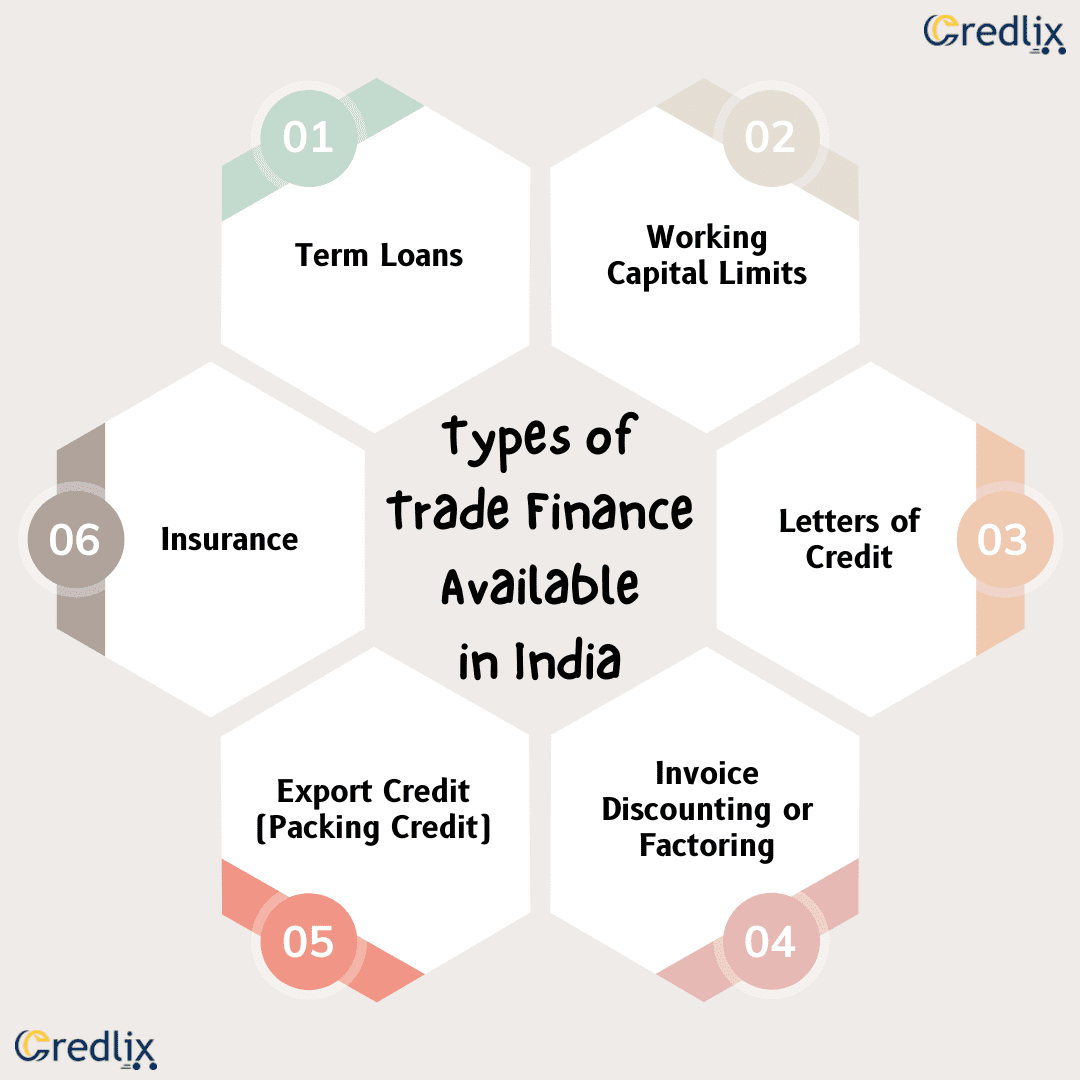

Types of Trade Finance Available in India

There are different types of trade finance available in India. Here are some of those:

Term Loans

Term loans provide businesses with a lump sum amount that must be repaid in installments over a predetermined period. Typically, term loans are utilized for long-term projects or investments, with repayment terms ranging from a few years to several decades. These loans are offered by banks and financial institutions, providing businesses with the necessary capital to fund growth and expansion initiatives.

Benefits of Term Loans

- Term loans offer businesses access to a lump sum amount of capital, enabling them to finance long-term projects or investments.

- Repayment terms for term loans are flexible, ranging from a few years to several decades, allowing businesses to choose a repayment schedule that aligns with their financial needs.

- Businesses can use term loans to fund growth and expansion initiatives, such as expanding operations, purchasing equipment, or investing in technology upgrades.

- Term loans provide predictable monthly payments, making it easier for businesses to budget and manage cash flow effectively.

- Interest rates on term loans are often fixed, providing businesses with stability and protection against interest rate fluctuations.

- Businesses can retain full ownership and control of their assets while using term loans to finance capital expenditures.

- Term loans can be secured or unsecured, giving businesses flexibility in collateral requirements and risk management.

- Repayment of term loans helps build business credit and establish a positive borrowing history, improving access to future financing opportunities.

- Term loans can be customized to meet specific business needs, with options for variable loan amounts and repayment terms tailored to individual circumstances.

- Access to term loans enables businesses to seize growth opportunities, pursue strategic initiatives, and enhance competitiveness in the marketplace.

Working Capital Limits (Overdraft and Cash Credit)

Working capital financing, including overdrafts and cash credit facilities, enables businesses to access funds for day-to-day operations and short-term financial needs. These credit facilities provide flexibility, allowing businesses to borrow funds as needed and repay them as cash flows permit.

Benefits of Working Capital Limits

- Working capital limits, such as overdrafts and cash credit, provide businesses with immediate access to funds for daily operations, ensuring smooth business continuity.

- These facilities offer flexibility, allowing businesses to borrow funds on an as-needed basis, providing liquidity to meet short-term financial obligations.

- Businesses can use working capital limits to bridge temporary cash flow gaps, enabling them to manage seasonal fluctuations or unexpected expenses.

- Working capital limits help businesses maintain optimal inventory levels, ensuring timely procurement of goods and materials to meet customer demand.

- Access to working capital limits allows businesses to take advantage of supplier discounts and negotiate favorable payment terms, enhancing cost efficiency.

- These credit facilities can be easily adjusted to accommodate changes in business needs or market conditions, providing scalability and agility.

- Businesses can use working capital limits to fund marketing initiatives, product launches, or other growth opportunities, driving business expansion and competitiveness.

- Working capital limits can help businesses manage accounts receivable and accounts payable effectively, optimizing cash flow and working capital management.

- Utilizing working capital limits can reduce reliance on expensive short-term borrowing options, minimizing interest costs and improving overall financial health.

- Access to working capital limits enables businesses to seize business opportunities, respond quickly to market changes, and sustain long-term growth and profitability.

Letters of Credit (LC)

Letters of credit serve as payment guarantees issued by a buyer’s bank to a seller, ensuring payment for goods or services upon fulfillment of specified conditions. LCs minimize the risk of non-payment for exporters and provide assurance of payment for importers, facilitating secure and reliable trade transactions.

Benefits of Letters of Credit

- Letters of credit provide exporters with payment security, ensuring that they receive payment for goods or services shipped to international buyers.

- LCs offer importers assurance of product delivery, as payment is only released upon fulfillment of specified conditions, mitigating the risk of non-performance by exporters.

- LCs help establish trust between buyers and sellers in international trade transactions, fostering long-term business relationships.

These payment guarantees minimize the risk of financial loss for both parties, enhancing confidence and reliability in cross-border trade. - LCs enable exporters to access financing options, as banks may offer financing against confirmed LCs, providing liquidity for working capital needs.

- Importers can negotiate favorable terms with exporters, including payment terms and quality requirements, knowing that payment is secured through the LC.

- LCs streamline documentation requirements and reduce administrative burdens associated with international trade, facilitating smoother transaction processes.

- LCs provide protection against political and economic risks in foreign markets, safeguarding businesses against currency fluctuations, trade restrictions, and payment delays.

- Exporters can expand their market reach and explore new business opportunities with confidence, knowing that payment is guaranteed through the LC mechanism.

- LCs enhance the overall efficiency and reliability of international trade transactions, contributing to global economic growth and development.

Invoice Discounting or Factoring

Invoice discounting involves selling accounts receivable to a financial institution at a discount, providing immediate access to cash flow tied up in outstanding invoices. This financing option helps businesses maintain liquidity and manage cash flow effectively, especially in situations where customers have extended credit terms.

Benefits of Invoice Discounting or Factoring

- Invoice discounting enables businesses to access immediate cash flow by converting accounts receivable into liquid funds, improving liquidity and financial flexibility.

- This financing option allows businesses to unlock the value of unpaid invoices, providing timely access to working capital to meet operational expenses or investment needs.

- Invoice discounting helps businesses maintain a steady cash flow, ensuring timely payments to suppliers, employees, and other stakeholders.

Businesses can use invoice discounting to bridge temporary cash flow gaps caused by extended credit terms or delayed customer payments, avoiding disruptions in operations. - By outsourcing invoice management and collection to a financial institution, businesses can streamline administrative tasks and focus on core business activities.

- Invoice discounting is a flexible financing solution that grows with the business, as funding is tied directly to sales volume and accounts receivable.

- This financing option is suitable for businesses of all sizes and industries, providing access to working capital without the need for collateral or lengthy approval processes.

- Invoice discounting can improve cash flow forecasting and financial planning, as businesses have greater visibility into future cash inflows based on outstanding invoices.

- Businesses can negotiate favorable terms with financial institutions, including competitive discount rates and flexible repayment schedules, tailored to their specific needs.

- Invoice discounting enhances financial stability and resilience, enabling businesses to seize growth opportunities, expand operations, and navigate economic challenges with confidence.

Export Credit (Packing Credit)

Export credit, also known as packing credit, provides financing to exporters against confirmed export orders. This pre-shipment finance enables exporters to fulfill orders and cover production costs before receiving payment from overseas buyers, supporting timely shipment of goods and fostering international trade.

Benefits of Export Credit

- Export credit facilitates timely fulfillment of export orders by providing upfront financing to cover production and shipment costs.

- This pre-shipment finance enables exporters to seize business opportunities and capitalize on international market demand without delays.

- By providing access to funding against confirmed export orders, export credit helps exporters avoid liquidity issues and financial strain.

- Export credit enhances competitiveness in global markets by enabling exporters to offer competitive pricing and meet customer demand promptly.

- Export credit supports business growth and expansion initiatives by providing the necessary capital to scale operations and enter new markets.

- This financing option helps mitigate the risk of non-payment or payment delays from overseas buyers, safeguarding exporters’ financial interests.

- Export credit fosters trade relationships and partnerships by providing exporters with reliable financing solutions and building trust with international buyers.

- Export credit can be tailored to meet the specific needs of exporters, with flexible terms and repayment options designed to align with business cycles.

- By facilitating timely shipment of goods and ensuring on-time delivery to overseas buyers, export credit contributes to overall customer satisfaction and retention.

Export credit minimizes cash flow constraints for exporters, allowing them to manage working capital effectively and maintain smooth business operations.

Also Read: The Role of Export Credit Agencies in Export Financing

Insurance

Trade insurance products, such as export credit insurance, protect businesses against risks associated with international trade, including non-payment, shipment delays, and political instability. Trade insurance mitigates risks and enhances confidence in cross-border transactions, enabling businesses to expand their global reach with greater security.

Benefits of Insurance

- Trade insurance provides protection against non-payment risks, safeguarding businesses from financial losses due to default by overseas buyers.

Insurance coverage helps mitigate the impact of shipment delays, ensuring timely delivery of goods to international markets and preserving business relationships. - Trade insurance offers peace of mind by protecting businesses from the adverse effects of political instability, such as trade embargoes or currency fluctuations.

- Insurance coverage enhances financial stability and resilience, enabling businesses to navigate uncertainties in global markets with confidence.

By minimizing risks associated with international trade, trade insurance fosters trust and confidence among business partners, facilitating smoother transactions. - Insurance protection enables businesses to expand their global reach and explore new markets with greater security and confidence.

Trade insurance provides a safety net for businesses, allowing them to focus on growth and expansion initiatives without fear of unforeseen risks.

Insurance coverage can be tailored to meet the specific needs of businesses, with customizable policies and coverage options designed to address unique risks. - With trade insurance in place, businesses can access financing and credit facilities more easily, as lenders perceive reduced risk in cross-border transactions.

- Insurance coverage enhances the overall resilience of businesses operating in international markets, enabling them to withstand challenges and seize opportunities for growth and success.

Also Read: Top 5 Ways To Finance Your International Trade/Export Business in 2024

Difference Between Trade Finance and Traditional Working Capital Products

Both trade finance and traditional financing options offer working capital solutions for businesses. Traditional financing products, such as cash credit, bank overdrafts, and working capital loans, have long been used to meet short-term financial needs. These products provide businesses with flexibility, allowing them to access funds as needed and repay them based on specific terms.

Traditional working capital products, including bank guarantees and commercial paper, offer businesses the ability to manage cash flow and operational expenses on an as-needed basis. These products can be tailored to meet the unique requirements of businesses, providing liquidity and financial stability when required.

On the other hand, trade finance options, such as discounting and factoring, are specifically designed to support international trade transactions. These financing options are closely linked to export trade activities and are often utilized to address specific challenges associated with cross-border transactions.

Trade finance products, such as receivable discounting and post-shipment financing, provide exporters with access to immediate cash flow by leveraging accounts receivable or inventory. These solutions help businesses manage working capital efficiently and navigate the complexities of international trade.

Unlike traditional financing options, which are more general in nature, trade finance products are tailored to meet the unique needs of exporters and importers engaged in global trade. These products offer specialized solutions that address the specific risks and challenges associated with international trade, providing businesses with greater flexibility and security.

In conclusion, trade finance products and traditional working capital solutions play vital roles in supporting businesses engaged in domestic and international trade. While traditional financing options offer general working capital solutions, trade finance products are specifically designed to address the unique challenges of cross-border transactions. Whether it’s term loans, working capital limits, letters of credit, invoice discounting, export credit, or insurance, businesses have access to a diverse range of financial tools to facilitate trade and ensure smooth business operations. By leveraging these financing options, businesses can enhance liquidity, manage risks effectively, and seize growth opportunities in the global marketplace.

Also Read: What is Factoring in Finance and How Does It Work?

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]