[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12738″ img_size=”full” css=”.vc_custom_1714117885841{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]The Uniform Customs and Practice for Documentary Credits, commonly known as UCP 600, is a set of regulations established by the International Chamber of Commerce (ICC). These rules govern the issuance and utilization of documentary credits on a global scale.

The ICC and UCP 600 play a vital role in facilitating international trade by providing a standardized framework for trade transactions. By establishing clear rules and standards, they promote smooth and equitable trade practices, reducing the risks of disputes and uncertainties. Moreover, these regulations contribute to fostering confidence among traders and financial institutions, ultimately promoting economic growth and development worldwide.

In this guide, we’ll explore the fundamentals of UCP 600, helping you navigate the complexities of documentary credit with ease. Let’s dive into the essential principles and key considerations that explain this essential aspect of international trade.

What is UCP 600?

UCP 600, which replaced UCP 500 in 2007, is a set of rules governing documentary credits established by the International Chamber of Commerce. It introduced stricter guidelines for document presentation, streamlined the types of acceptable documents, and addressed new aspects like e-commerce.

These changes aimed to enhance clarity and certainty in documentary credit transactions, providing a standardized framework for parties involved. By adhering to UCP 600, businesses can ensure smoother and more reliable international trade operations.

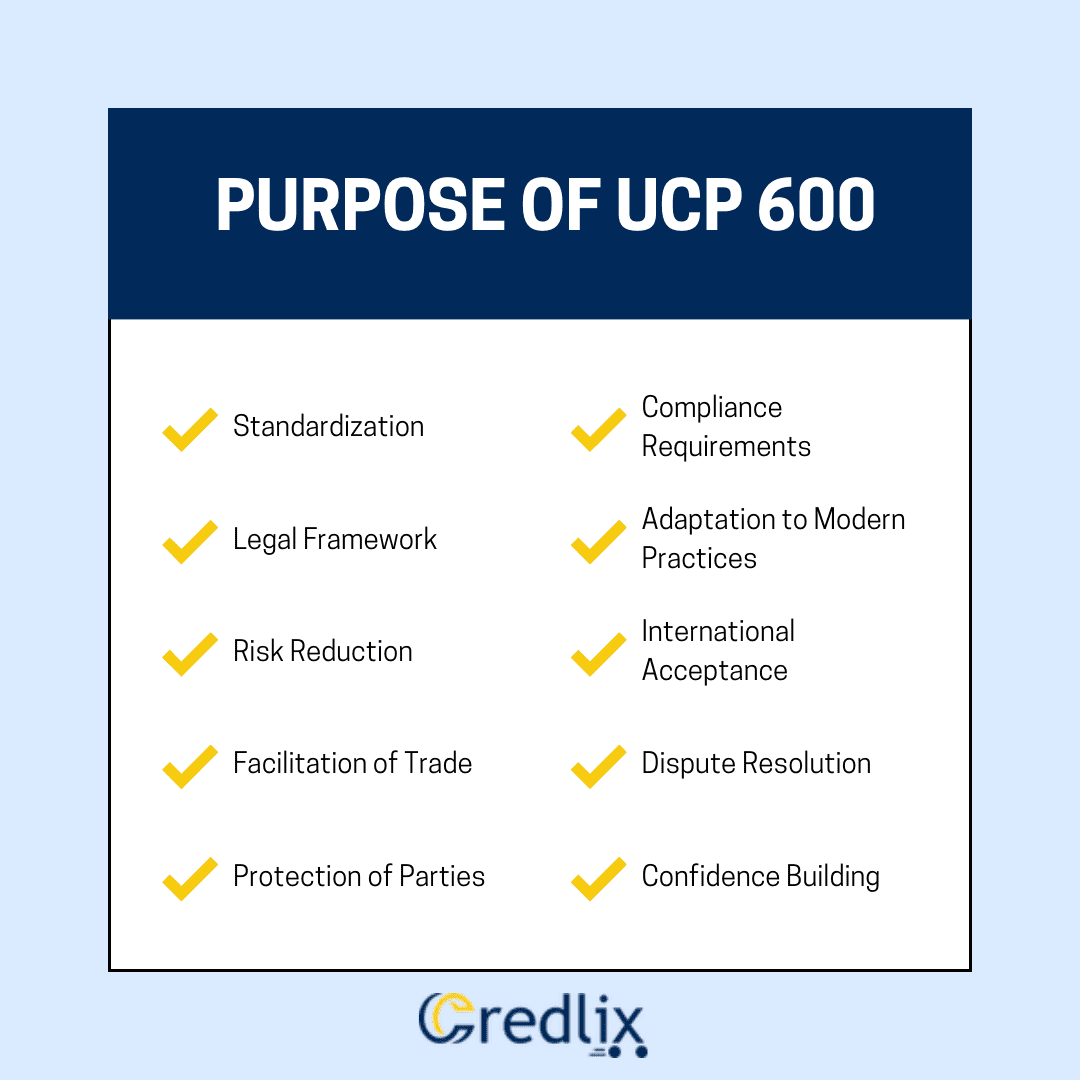

Purpose of UCP 600

Here are all the major purposes served by UCP 600:

Standardization

UCP 600 serves as a globally accepted framework, ensuring uniformity and consistency in the interpretation and application of rules governing documentary credits. This standardization minimizes confusion and discrepancies, providing a reliable foundation for international trade.

Legal Framework

Acting as a legal framework, UCP 600 clarifies the rights and obligations of parties involved in documentary credit transactions, including banks, exporters, importers, and insurers. It offers a structured approach to contractual relationships, enhancing legal certainty and minimizing disputes.

Risk Reduction

By establishing clear guidelines for document examination and compliance, UCP 600 helps mitigate the inherent risks associated with international trade. It sets forth rigorous standards for document presentation, reducing the likelihood of discrepancies or fraudulent activities.

Facilitation of Trade

UCP 600 plays a pivotal role in facilitating global trade by providing a common set of rules that streamline the documentary credit process. This harmonization promotes efficiency, expedites transaction processing, and fosters smoother trade flows across borders.

Protection of Parties

One of the primary objectives of UCP 600 is to safeguard the interests of both buyers and sellers involved in documentary credit transactions. It delineates the rights, obligations, and liabilities of each party, offering a level playing field and ensuring fair treatment.

Compliance Requirements

UCP 600 outlines strict requirements for document presentation under a letter of credit, ensuring that submitted documents comply with specified criteria. This includes details regarding document content, formatting, and timing, thereby minimizing discrepancies and rejection risks.

Adaptation to Modern Practices

Recognizing the evolution of trade practices, UCP 600 incorporates provisions for electronic commerce and digital documentation. It acknowledges the growing importance of technology in trade transactions, providing flexibility and adaptability to modern practices.

International Acceptance

UCP 600 enjoys widespread acceptance and recognition across international borders, making it the preferred choice for governing documentary credit transactions. Its universal applicability fosters consistency and interoperability in global trade finance.

Dispute Resolution

UCP 600 offers mechanisms for resolving disputes that may arise during the course of documentary credit transactions. It provides guidance on dispute resolution procedures, including arbitration and mediation, promoting efficient and equitable outcomes.

Confidence Building

By establishing transparent rules and procedures, UCP 600 instills confidence among stakeholders involved in international trade. This confidence-building aspect is essential for fostering trust, reliability, and long-term business relationships in the global marketplace.

What is Electronic UCP (eUCP)?

Electronic UCP (eUCP) is like a digital version of the UCP rules for handling transactions involving documentary credits. It aims to bring electronic communication methods into the traditional framework of UCP 600 with minimal changes to existing laws and practices.

eUCP builds upon UCP 600, taking into account advancements in technology and the emergence of new types of documentary credits, such as standby LCs. It also provides guidance on how to apply UCP 600 in electronic transactions.

In essence, eUCP offers a modern and comprehensive approach to using electronic communications in documentary credit transactions, ensuring they remain efficient and up-to-date with evolving technologies.

Key Benefits of UCP 600

UCP 600 offers several significant benefits for trade transactions:

Enhanced Clarity and Uniformity: UCP 600 provides clear and standardized guidelines for the interpretation of Letters of Credit (LCs). This clarity reduces ambiguity and ensures consistent understanding among parties involved in trade transactions, facilitating smoother and more efficient processes.

Decreased Risk of Rejection: By establishing stringent compliance requirements, UCP 600 helps reduce the likelihood of LCs being rejected due to discrepancies or errors in document presentation. This minimizes delays and disruptions in trade transactions, enhancing reliability and trust between buyers and sellers.

Accelerated Transaction Timelines: The standardized procedures outlined in UCP 600 streamline the issuance and acceptance of LCs, resulting in shortened transaction timelines. Faster processing times benefit both parties by expediting the flow of goods and payments, ultimately improving overall efficiency in trade operations.

Cost Reduction: UCP 600 helps reduce the costs associated with managing LC transactions by promoting efficiency and reducing the occurrence of errors or disputes. By adhering to standardized rules and procedures, businesses can minimize administrative expenses and mitigate the risk of costly delays or rejections.

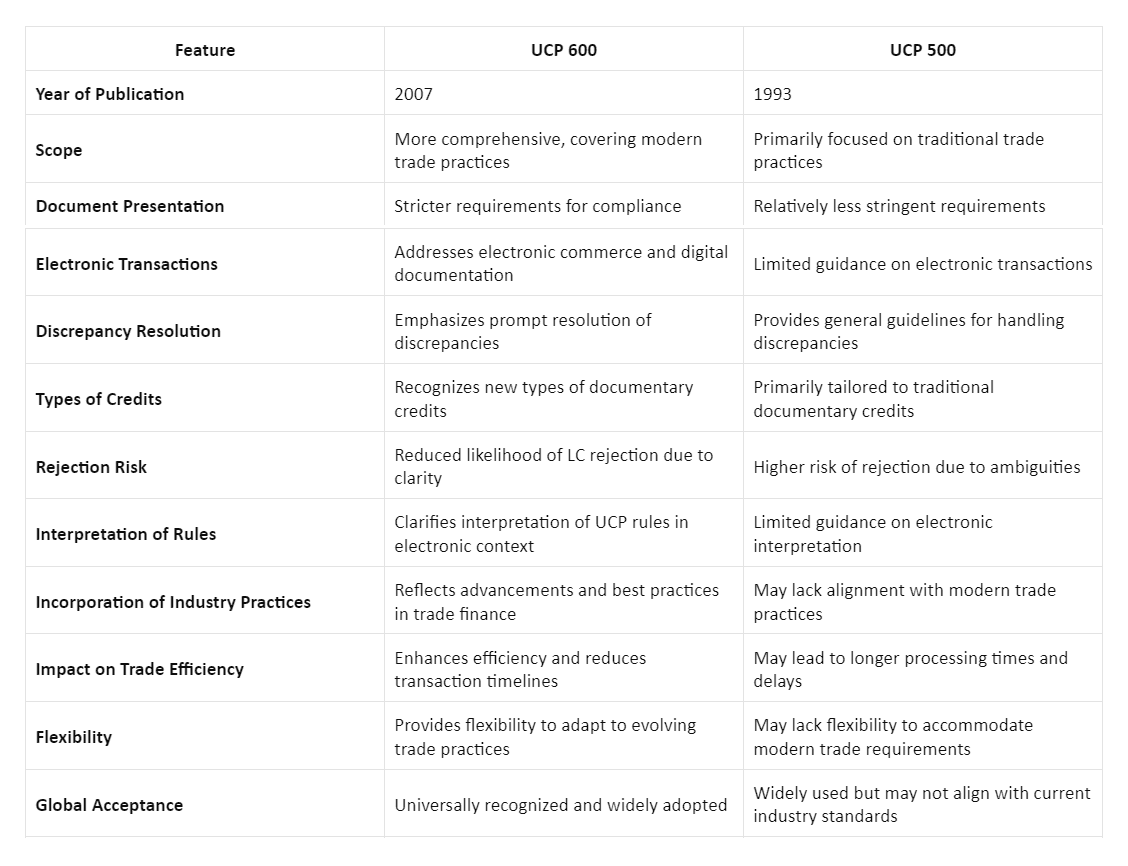

Difference Between UCP 600 and UCP 500

Below are some of the key differences between UCP 600 and UCP 500, highlighting the evolution and improvements introduced in the latest version of the Uniform Customs and Practice for Documentary Credits.

In summary, UCP 600 is like the rulebook for international trade, making things clear and organized. It helps everyone involved, like banks, businesses, and traders, to understand what they need to do. Plus, it reduces the chances of mistakes and disagreements, making trade smoother and more reliable.

Also, with the introduction of eUCP, it’s like adding a digital twist to the traditional rulebook, keeping up with the times and making things even easier for everyone.

Overall, UCP 600 is a big help in making global trade work better for everyone involved, from big companies to small businesses. Understanding it is key to making trade transactions go smoothly and confidently.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]