[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12877″ img_size=”full” css=”.vc_custom_1715583914300{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Are you curious about the measures in place to ensure fair competition in international trade? Ever wondered how the US tackles issues of dumping and unfair pricing practices? Join us as we explore the world of anti-dumping duties within the United States, uncovering the laws, procedures, and real-life examples that shape trade dynamics. From understanding the complexities of anti-dumping calculations to examining the role of organizations like the WTO, we’ll navigate through the intricacies of trade regulations, shedding light on their impact on both local and global economies.

What is Anti-Dumping Duties?

Anti dumping duty is a duty imposed on goods manufactured in foreign countries and imported into the US. This duty is applied to goods imported from foreign countries if they are priced below the fair market value of comparable goods in the domestic market. Essentially, it acts as a protective measure for local businesses, ensuring they can compete on a level playing field.

When imports are suspected of being “dumped” into the market due to their artificially low prices, the government imposes anti-dumping duties. In essence, it serves as a form of protectionist tariff, shielding domestic industries from unfair trade practices.

How Anti-Dumping Duty Works in the United States?

Here’s a step-by-step breakdown of how anti-dumping duty works in the United States:

- The process begins when the International Trade Commission (ITC) identifies instances of dumping, which is when imported products are sold in the U.S. market at significantly lower prices than in their country of origin (home market). This practice undermines fair competition and can harm domestic industries.

- Upon identification of potential dumping, the Department of Commerce (DOC) initiates an investigation to determine the extent of the dumping and its impact on the domestic market. This investigation involves analyzing pricing data and conducting assessments to ascertain if anti-dumping laws have been violated.

- Based on the findings of the investigation, the DOC makes recommendations to the ITC regarding the imposition of anti-dumping duties. The ITC then evaluates these recommendations and takes appropriate action to enforce anti-dumping laws.

- If the ITC determines that dumping has indeed occurred and is causing harm to domestic industries, it imposes anti-dumping duties on the imported products. These duties are typically set at a rate that compensates for the price discrepancy between the imported goods and their fair market value.

- The primary objective of imposing anti-dumping duties is to protect domestic markets and businesses from unfair competition. By levying these duties, the U.S. government aims to safeguard local industries and preserve jobs.

- In addition to protecting domestic jobs, anti-dumping duties also serve to mitigate the level of competition faced by local companies selling similar or comparable products. This helps maintain a level playing field for domestic businesses and prevents them from being undercut by cheap imports.

- With the rise in globalization and international trade, there has been a significant increase in the instances of anti-dumping cases initiated by American businesses. This underscores the importance of strict enforcement of anti-dumping laws and heightened vigilance to prevent unfair trade practices from harming domestic industries.

Types of Dumping in International Trade

Types of dumping in international trade can be understood through four distinct categories:

Sporadic Dumping

This occurs when companies find themselves with excess inventory in their home market. To avoid price wars and protect their competitive edge, they may choose to dump these surplus goods either by destroying them or by exporting them to foreign markets where the products aren’t typically sold.

Think of a shoe company that produces more shoes than there is demand for in its home country. Instead of letting them sit unsold, they might send them to a country where there’s a shortage of shoes.

Predatory Dumping

Unlike sporadic dumping, predatory dumping is a deliberate, long-term strategy. Here, a company consistently sells its products in a foreign market at a lower price than in its domestic market. The aim? To gain a foothold in that foreign market and eventually dominate it.

Imagine a multinational corporation selling smartphones at a loss in a new market to undercut local competitors and establish itself as the go-to brand. Once it achieves market dominance, it gradually raises prices.

Persistent Dumping

This occurs when a country continuously sells its products in a foreign market at a lower price compared to its domestic market. This typically happens when there’s consistent demand for the product abroad.

For example, if a country produces high-quality chocolates but sells them at a lower price in another country where there’s a strong craving for imported sweets.

Reverse Dumping

In reverse dumping scenarios, price changes don’t affect demand significantly. This allows a company to charge higher prices in foreign markets while keeping prices lower in its domestic market.

Consider a tech company that sells its latest gadgets at premium prices in affluent foreign markets where consumers are willing to pay more, while simultaneously offering discounted rates in its home country to maintain market share and competitiveness.

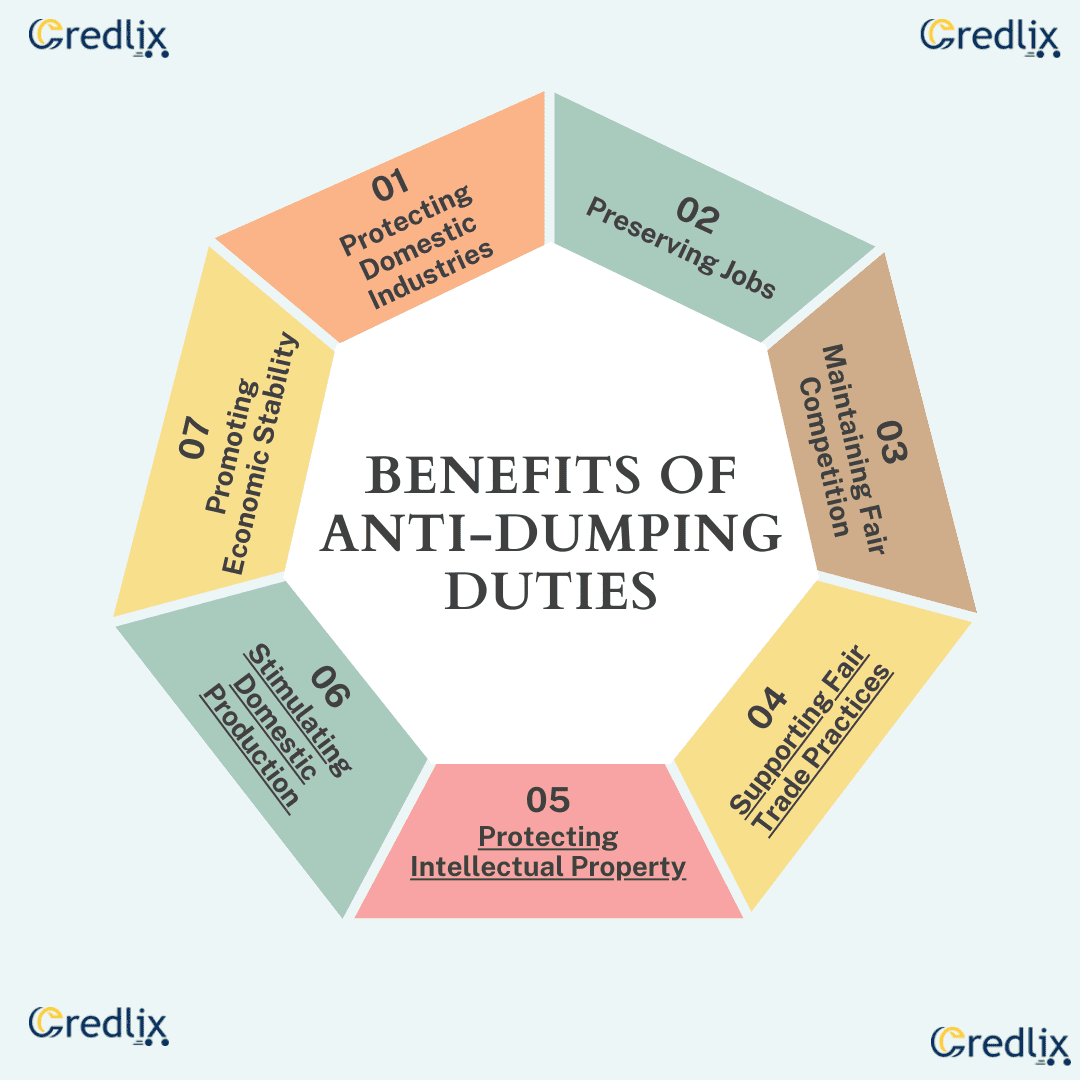

Benefits of Anti-Dumping Duties

Here are seven benefits of anti-dumping duties:

Protecting Domestic Industries

Anti-dumping duties shield domestic industries from unfair competition by preventing foreign companies from flooding the market with underpriced goods. This protection helps sustain local businesses and preserve jobs within the domestic economy.

Preserving Jobs

By safeguarding domestic industries from the adverse effects of dumping, anti-dumping duties help prevent job losses that may occur if local companies are unable to compete with cheaper imports. This preservation of jobs contributes to the overall stability of the labor market.

Maintaining Fair Competition

Anti-dumping duties promote fair competition by ensuring that imported goods are priced at levels comparable to their fair market value. This prevents foreign companies from gaining an unfair advantage by selling their products at artificially low prices.

Supporting Fair Trade Practices

Imposing anti-dumping duties discourages unethical trade practices such as predatory pricing and dumping. By penalizing such practices, anti-dumping measures encourage adherence to fair trade principles and discourage market manipulation.

Protecting Intellectual Property

Anti-dumping duties can also help protect intellectual property rights by discouraging the importation of counterfeit or infringing goods. By deterring the influx of low-priced counterfeit products, these duties help safeguard the interests of innovators and creators.

Stimulating Domestic Production

Anti-dumping duties incentivize domestic production by reducing the competitive disadvantage faced by local manufacturers. This can lead to increased investment in domestic industries, technological innovation, and enhanced productivity.

Promoting Economic Stability

By safeguarding domestic industries and preserving jobs, anti-dumping duties contribute to economic stability and resilience. By preventing disruptions caused by unfair trade practices, these measures support sustainable growth and development in the long term.

Examples of Anti-Dumping Duties

Here are two examples of anti-dumping duties:

Flat Panel Display Screens (1991): Japanese companies were accused of dumping flat panel display (FPD) screens in the US market during the 1990s. The US Department of Commerce investigated and found evidence supporting these claims. Consequently, the International Trade Commission (ITC) imposed a 62.5% anti-dumping duty on FPD screens imported from Japan.

Steel Dumping by Chinese Companies (2015): In 2015, American steel producers raised concerns about Chinese companies dumping steel in the US market at unfairly low prices. Following an investigation, the ITC confirmed these allegations and imposed a 500% import duty on certain steel imports from China to protect the domestic steel industry.

Goods with Anti-Dumping Duties in the US

Anti-dumping duties have been applied to various imported products entering the United States. Some examples include:

- Bikes

- Ceramic tiles

- Certain cold-rolled flat steel products

- Ironing boards

- Pump trucks from China

These are just a selection of items that have been subject to anti-dumping duties in the past. For the most up-to-date information on recently applied anti-dumping duty measures, individuals can refer to the government website for a comprehensive list.

The Role of WTO in Anti-Dumping Measures

The World Trade Organization (WTO) serves as a key regulator in overseeing anti-dumping measures globally. While it doesn’t directly regulate companies accused of dumping, the WTO has authority over how member governments handle instances of dumping within their territories.

In cases where governments respond forcefully to dumping by foreign firms by imposing punitive anti-dumping duties, the WTO acts as a check to ensure that such actions adhere to WTO principles of free trade.

Under the WTO’s anti-dumping agreement, dumping itself is not illegal unless it causes material injury to the domestic market of the importing country or significantly retards the development of that market. In such instances, the affected country’s government is permitted to take legal action against the dumping country.

However, for such action to be justified, there must be substantial evidence of genuine material injury to the domestic market. The affected government must demonstrate:

- The occurrence of dumping.

- The extent of the dumping’s financial impact.

- The injury or threat posed to the domestic market.

By establishing these criteria, the affected government can pursue legal recourse within the framework provided by the WTO to address instances of dumping and protect its domestic industries from unfair trade practices.

What is a WTO Anti-Dumping Agreement?

The WTO Anti-Dumping Agreement allows countries to take unilateral action, such as imposing anti-dumping duties, if thorough investigations confirm that products are being dumped in their markets. This measure aims to protect domestic industries from losses caused by dumped products. However, it must be justified to uphold WTO’s commitment to free-market principles, as anti-dumping duties have the potential to distort markets. In a free market, governments typically cannot dictate fair market prices for goods or services.

How To Calculate Anti-Dumping Duty?

Anti-dumping duty is calculated fairly to avoid discrimination between trading partners, following guidelines set by the WTO’s Anti-Dumping Agreement and the GATT 1994 principle. This principle ensures fairness by treating imported goods like domestic ones, preventing excessive taxes or regulations.

When determining anti-dumping duty, there are three common methods:

Normal Price: This method calculates duty based on the product’s normal price.

Price in Another Country: Duty can also be based on the price of the same product in a different country.

Total Product Costs: Another approach calculates duty using the total costs, expenses, and manufacturer’s profit margins.

By using these methods, countries ensure fair trade practices and protect domestic markets from harmful dumping activities.

How to Find if a Product Falls Under Anti-Dumping Duty?

To check if a product is subject to anti-dumping duty, follow these steps:

Review ADD/CVD Orders: Check if the merchandise falls under the scope of an anti-dumping duty/countervailing duty (ADD/CVD) order by reviewing its scope.

Scope Ruling Request: Submit a scope ruling request to the International Trade Administration (ITA) with detailed product information, including technical characteristics, uses, and US tariff classification number.

Serve Copies: Serve copies of the scope ruling request to all parties on the Comprehensive Scope Service List, including Company Certification of Accuracy and Representative Certification of Accuracy.

Submit Electronically: Use the Anti-dumping and Countervailing Duty Centralized Electronic Service System (ACCESS) to submit the scope ruling request.

Await Ruling: If a scope inquiry is initiated, await notice from ITA, solicit comments, and expect a final ruling within 120 days of inquiry initiation.

HTS Classification: Consider the US Harmonized Tariff Schedule (HTS) classification of the product, which can sometimes aid in determining its status under ADD/CVD orders.

Drawbacks of Anti-Dumping Duty

Anti-dumping duty, while aiming to protect domestic industries, can hinder free trade between economies. By imposing barriers to entry, the country implementing such duties may experience restricted market access, potentially impacting its economy negatively. Furthermore, anti-dumping measures can disadvantage domestic consumers by limiting their access to lower-priced goods, thereby reducing consumer choice and affordability.

Also Read: Exploring Forfaiting Financing in International Trade

Conclusion

In conclusion, anti-dumping duties serve as a tool to protect domestic industries and ensure fair competition. While they offer benefits such as job preservation and market stability, they also pose challenges by potentially hindering free trade and limiting consumer access to affordable goods. It’s essential to strike a balance between protecting domestic interests and promoting global trade.

Also Read: Top 5 Ways To Finance Your International Trade/Export Business in 2024[/vc_column_text][vc_column_text]In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]