[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12630″ img_size=”full” css=”.vc_custom_1713251766138{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Exporting goods involves navigating a complex web of regulations and procedures, one of which is customs sampling. Customs sampling is a crucial aspect of international trade, designed to ensure compliance with regulations and prevent illicit activities such as smuggling.

This article aims to provide a comprehensive understanding of customs sampling of export goods, covering its purpose, process, challenges, and significance for exporters.

What is Custom Sampling in Export?

Customs sampling in export refers to the process by which customs authorities select and inspect a portion of exported goods to ensure compliance with regulations, standards, and documentation requirements. It is a systematic approach employed by customs agencies to verify the accuracy of information provided by exporters and to detect any discrepancies or violations that may occur during the export process.

Also Read: Steps Involved in Loading of Export Goods

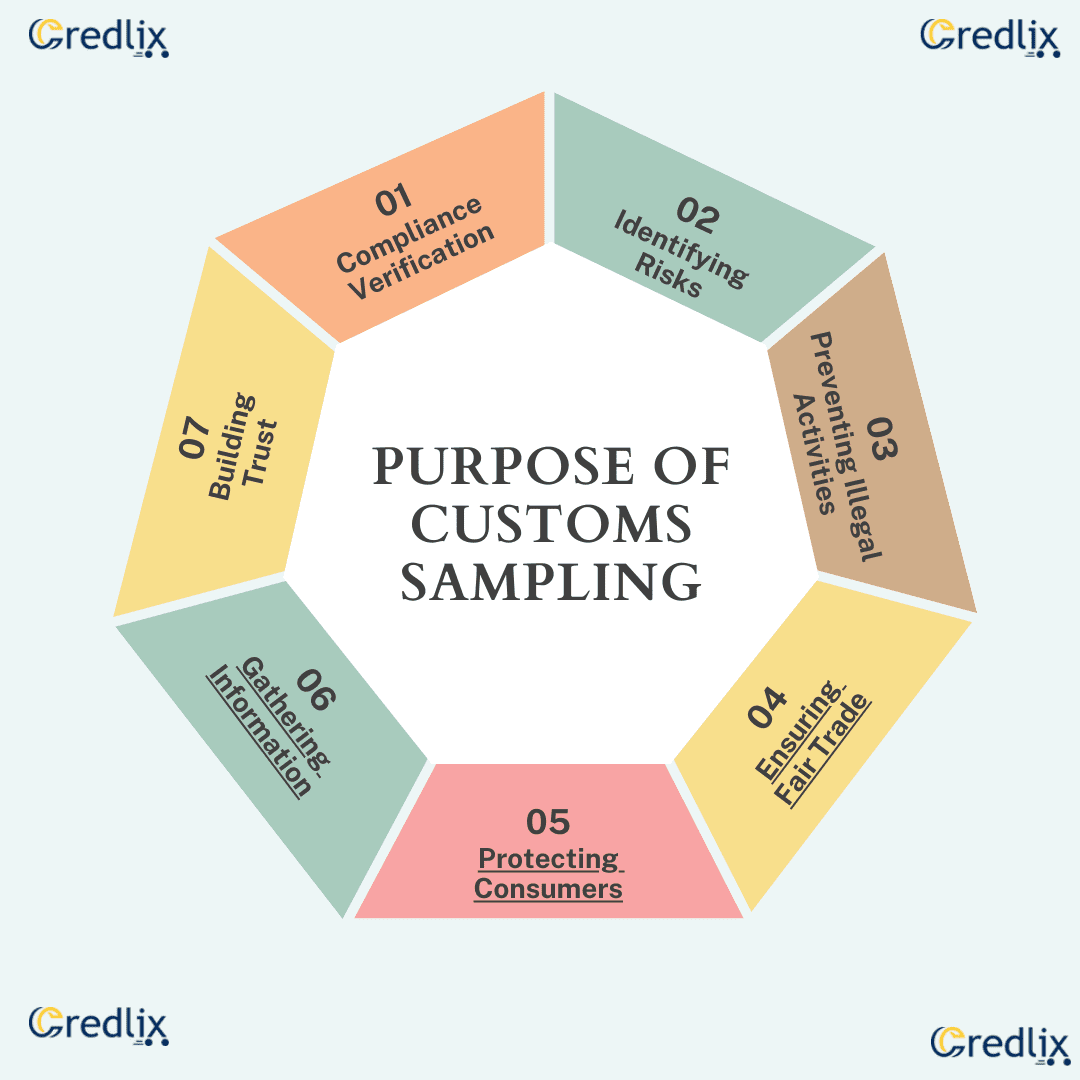

Purpose of Customs Sampling

Customs sampling serves multiple purposes in the export process:

Compliance Verification

When customs authorities sample exported goods, they’re essentially checking to ensure that what’s being sent out of the country follows all the rules. This includes making sure the quality is up to scratch, that the labeling on products is correct, and that everything meets the agreements between countries.

For example, if a country has strict rules about the quality of food being exported, sampling helps confirm that those rules are being followed.

Identifying Risks

Sampling helps customs officers spot shipments that might be risky. This could mean goods that seem suspicious or shipments from places known for illegal activities. By picking out these risky shipments, customs can focus more attention on them to make sure everything is above board.

For instance, if there’s a history of smuggling certain items from a particular region, customs sampling helps catch those attempts.

Preventing Illegal Activities

One of the main jobs of customs is to stop illegal stuff from leaving or entering a country. Sampling is like a first line of defense against this. By checking a sample of exports, customs can catch things like smuggling, where people try to sneak forbidden items or avoid paying taxes.

For example, if someone tries to send out goods without declaring them properly, sampling can help catch them.

Ensuring Fair Trade

Sampling isn’t just about making sure goods are safe and legal—it’s also about making sure trade between countries is fair. By checking samples of exported goods, customs can make sure that everyone is playing by the same rules. This helps protect businesses and consumers by ensuring that nobody gets an unfair advantage by breaking the rules.

For instance, if one country is known for producing cheaper knock-off versions of expensive products, sampling helps ensure those knock-offs don’t flood other markets unfairly.

Protecting Consumers

When goods are exported, they’re often used by people in other countries. Sampling helps ensure that these products are safe for consumers to use. This might mean checking that medicines are genuine, that toys don’t have dangerous parts, or that food isn’t contaminated.

For example, if a batch of exported toys is found to have small parts that could be a choking hazard for kids, sampling helps catch that before they reach store shelves.

Gathering Information

Sampling provides customs and government agencies with valuable data about what’s being exported, where it’s going, and how much of it is moving around. This information helps them make decisions about trade policies, plan for future needs, and forecast revenue.

For instance, if a certain type of product suddenly starts being exported in large quantities, sampling helps authorities understand that trend and its potential impact on the economy.

Building Trust

By conducting sampling, customs authorities show that they’re actively monitoring exports and enforcing regulations. This builds trust among trading partners and consumers, reassuring them that exported goods meet high standards of quality, safety, and legality. This trust is crucial for maintaining strong relationships between countries and ensuring the smooth flow of goods across borders.

For example, if a country consistently shows that it’s serious about checking exports, other countries are more likely to trust their products and do business with them.

Process of Customs Sampling

The process of customs sampling typically involves the following steps:

Selection Criteria: Customs authorities use various criteria to select shipments for sampling, including the nature of the goods, country of origin, exporter’s compliance history, and intelligence-based risk assessment.

Sampling Methods: Customs officers may employ different sampling methods, such as random sampling, stratified sampling (based on risk categories), or targeted sampling (based on specific concerns or intelligence).

Sample Collection: Samples are collected from selected shipments according to established protocols, ensuring representative sampling and minimizing contamination or tampering.

Laboratory Analysis: Samples are sent to designated laboratories for analysis, where they undergo testing for various parameters such as quality, authenticity, composition, and safety.

Results Evaluation: The results of laboratory analysis are evaluated against relevant regulations and standards to determine compliance. Non-compliant shipments may be subject to further inspection, penalties, or refusal of entry.

Challenges in Customs Sampling

Despite its importance, customs sampling faces several challenges:

Resource Constraints: Limited resources, including manpower and laboratory facilities, may hamper the effectiveness of customs sampling efforts, leading to delays and inefficiencies.

Complexity of Goods: Some goods, such as perishable or hazardous items, pose challenges in sampling and analysis, requiring specialized expertise and equipment.

International Coordination: Harmonizing sampling procedures and standards across different countries is essential for seamless trade but can be challenging due to divergent regulatory frameworks and enforcement practices.

Technological Advances: Rapid technological advancements, including 3D printing and encryption, present new challenges in detecting counterfeit or illicit goods through traditional sampling methods.

Significance for Exporters

Understanding customs sampling is crucial for exporters due to its impact on:

Compliance Costs: Compliance with customs sampling requirements may entail additional costs for exporters, including sampling fees, testing charges, and potential delays in shipment clearance.

Reputation and Market Access: Non-compliance with sampling regulations can damage exporters’ reputation and jeopardize their access to international markets, leading to loss of business opportunities.

Risk Management: Exporters need to proactively manage the risk of customs sampling by ensuring accurate documentation, product labeling, and adherence to relevant standards and regulations.

Conclusion

Customs sampling plays a vital role in ensuring the integrity and safety of international trade by verifying the compliance of export goods with regulatory requirements. While facing challenges such as resource constraints and technological advancements, customs sampling remains indispensable for maintaining the security and efficiency of global supply chains. Exporters must understand the purpose, process, and significance of customs sampling to navigate the complexities of international trade successfully.

Also Read: How To Start Import Export Business In India: The Complete Guide[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]