[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12313″ img_size=”full” css=”.vc_custom_1710233012036{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Navigating the complexities of international trade can be daunting for Indian exporters, but the Export Credit Guarantee Corporation of India (ECGC) serves as a steadfast ally in this journey. ECGC, a vital entity under the Ministry of Commerce and Industry, acts as a protective shield for exporters, offering insurance coverage against various risks associated with overseas trade. Its mission is clear: to bolster and promote India’s exports by instilling confidence in exporters and facilitating their ventures into global markets.

Through its comprehensive services and support, ECGC empowers exporters to expand their horizons, secure payments, and mitigate risks, thereby contributing significantly to the growth and sustainability of India’s export sector.

Let’s delve deeper into the indispensable role, benefits, and workings of ECGC, essential knowledge for any Indian exporter navigating the intricacies of international trade.

About ECGC

ECGC, previously named the Export Credit Guarantee Corporation of India, is a governmental entity in India under the Ministry of Commerce and Industry. It operates from its main office located in Mumbai, Maharashtra, and serves the crucial role of safeguarding Indian exporters and banks against the various risks inherent in international trade.

ECGC’s primary objective is to bolster and advance Indian exports by offering insurance coverage for export credit. Essentially, it guarantees that Indian exporters receive payment even if their overseas clients default on payments. This assurance empowers Indian businesses to venture into global markets with confidence.

Established in July 1957 as the Export Risks Insurance Corporation (ERIC), ECGC has evolved through various name changes to its current form. Since its inception, it has adapted to meet the needs of Indian exporters, providing crucial insurance coverage for export risks, ensuring their stability in international trade.

ECGC functions under the Department of Commerce, which falls under the Ministry of Commerce and Industry. Its management team comprises representatives from the government, the Reserve Bank of India, banks, insurance companies, and the exporting community, all working together to oversee its operations.

In 2014, the name was officially updated to ECGC (Export Credit Guarantee Corporation of India Limited). With a paid-up capital of ₹4,338 crores and an authorized capital of ₹10,000 crores, it demonstrates strong financial capability to assist Indian exporters effectively.

ECGC, also known as the Export Credit Guarantee Corporation of India, is a crucial institution that actively boosts and advocates for India’s exports worldwide. Its core mission and operational strategies are aimed at enhancing the country’s export activities on the global stage. Let’s delve deeper into understanding ECGC, its purpose, and the methods it employs to achieve its goals.

Mission and Objectives of ECGC (Export Credit Guarantee Corporation of India)

The mission and objectives of ECGC (Export Credit Guarantee Corporation of India) encompass a range of critical functions aimed at supporting and promoting Indian exporters in the global market. Here are ten key objectives:

Protecting Exporters: ECGC makes sure Indian exporters don’t lose out when selling goods abroad. If the buyer can’t pay, ECGC steps in to cover the loss, ensuring exporters still get their money.

Boosting Confidence: With ECGC’s insurance, Indian businesses feel more secure about selling goods overseas. They know they’ll still get paid, which gives them the confidence to explore new markets and grow their business internationally.

Making Exporting Easier: ECGC works with banks, insurance companies, and the government to find simple and effective ways to manage risks in international trade. This makes it easier for exporters to do business globally.

Supporting Small Businesses: ECGC focuses on helping small and medium-sized businesses (SMEs) with their exporting efforts. They offer affordable insurance options tailored to the needs of SMEs, making it easier for them to compete in the global market.

Encouraging Growth: By protecting exporters and giving them confidence, ECGC encourages them to expand their businesses internationally. This helps Indian companies grow and diversify their markets, contributing to overall economic growth.

Collaborative Approach: ECGC works closely with banks, insurance companies, and the government to develop customized risk management strategies for exporters. This collaborative approach ensures that exporters get the support they need to navigate the complexities of international trade.

Ensuring Economic Stability: ECGC’s efforts to protect export earnings and maintain a healthy balance of trade contribute to the stability and growth of the Indian economy. This stability is important for overall economic health and prosperity.

Promoting Sustainability: ECGC aims to promote sustainable growth by supporting exporters in the long term. They provide the tools and resources exporters need to thrive in the global market while also considering environmental and social impacts.

Innovation: ECGC is always looking for new ways to help exporters succeed in a changing global landscape. They adapt their services to meet the evolving needs of exporters and stay ahead of the curve in terms of global trade trends.

Empowering Exporters: Ultimately, ECGC’s mission is to empower Indian exporters to do business confidently and successfully on the global stage. By providing protection, support, and resources, they make it easier for exporters to seize opportunities and grow their businesses internationally.

Also Read: Is ECGC Related to Export Financing and Insurance?

What all Services ECGC Offer?

To achieve its goals, ECGC provides various services, with export credit insurance being the most significant. Here’s a breakdown of how ECGC works:

Export Credit Insurance

Export credit insurance stands as the cornerstone of ECGC’s services. It entails safeguarding an exporter’s receivables against the potential risk of non-payment by their foreign buyers.

Application Process: When an exporter engages in a trade agreement with a foreign buyer, they have the option to seek export credit insurance from ECGC to mitigate the risk of non-payment.

Risk Assessment: ECGC plays a crucial role in evaluating the creditworthiness of the foreign buyer and conducting a comprehensive risk analysis of the entire transaction. This assessment includes factors such as the political and economic stability of the buyer’s country, the reputation and financial standing of the buyer, and the terms of the trade agreement.

Policy Issuance: Upon successful evaluation and approval, ECGC issues an insurance policy to the exporter. This policy serves as a guarantee, assuring the exporter that they will receive payment for their exported goods or services, even if the foreign buyer defaults on their payment obligations.

Claim Process: In the unfortunate event of non-payment by the foreign buyer, the exporter can file a claim with ECGC. ECGC meticulously reviews the claim, taking into account the terms and conditions outlined in the insurance policy. If the claim is found to be valid and in accordance with the policy provisions, ECGC provides compensation to the exporter for the losses incurred due to non-payment.

Policy Coverage: It’s important to note that the extent of coverage provided by ECGC may vary depending on the specific terms and conditions of the insurance policy. Additionally, exporters are encouraged to familiarize themselves with the policy details to ensure they understand the scope of coverage and any exclusions that may apply.

Export Credit Guarantees

ECGC extends its services beyond exporters directly to banks and financial institutions, offering export credit guarantees. These guarantees serve as a form of protection for lenders who provide credit facilities to exporters, shielding them from the risk of default on export credit loans.

Risk Mitigation for Lenders: Export credit guarantees function as a safeguard against the potential risk of non-payment by foreign buyers. By providing this assurance, ECGC encourages banks and financial institutions to extend financing to exporters, even in situations where there may be heightened uncertainty regarding the buyer’s ability to fulfill payment obligations.

Assurance for Exporters: For exporters, export credit guarantees offer a sense of security. They provide assurance that even if the foreign buyer defaults on payment, ECGC will step in to compensate them for their losses. This assurance encourages exporters to engage in international trade with confidence, knowing that their financial interests are protected.

Enhanced Financing Options: With ECGC’s export credit guarantees in place, exporters gain access to enhanced financing options. This includes the ability to secure larger credit lines and negotiate more favorable loan terms with their financial partners. Such flexibility in financing empowers businesses to access the necessary funds required for their international ventures and operational activities.

Boosting Lender Confidence: Export credit guarantees also play a crucial role in bolstering the confidence of lenders. By mitigating the risk of default, these guarantees make lenders more willing to support exporters, particularly those venturing into markets with higher perceived risks or engaging with buyers who may have limited financial track records.

Encouraging Export Growth: The availability of export credit guarantees serves as a catalyst for exporters to undertake larger and more ambitious projects. This, in turn, leads to increased export growth and revenue generation, benefiting both individual businesses and the broader economy by facilitating trade expansion and market diversification.

Policy Types

ECGC offers a variety of policy types tailored to meet the diverse needs of exporters operating in the international market.

Standard Policies: These policies provide comprehensive coverage against both commercial and political risks associated with international trade. They are designed to accommodate exporters involved in a wide range of transactions, offering flexibility in coverage amounts and terms to suit varying business requirements.

SME Policies: Tailored specifically for small and medium-sized enterprises (SMEs), these policies aim to simplify documentation and procedures. They offer cost-effective coverage focused primarily on mitigating commercial risks, thereby making export credit insurance more accessible and affordable for SMEs looking to expand their international footprint.

Whole Turnover Policies: Ideal for businesses with consistent export sales turnover, these policies cover the entirety of a company’s export sales during a specified period. By consolidating coverage under a single policy, they streamline administrative processes and reduce paperwork, minimizing the administrative burden for exporters.

Buyer-Specific Policies: These policies are designed for businesses engaged in long-term contracts or relationships with specific foreign buyers. They provide customized coverage tailored to the unique risks associated with transactions involving those buyers, offering targeted protection and peace of mind to exporters operating in niche markets or with individual buyers.

Green Cover Policies: ECGC’s Green Cover policies cater to businesses committed to sustainable and environmentally responsible practices in their export activities. These policies offer coverage to enterprises engaged in eco-friendly exports, aligning with global initiatives to promote green trade and support businesses that prioritize environmental sustainability. By incentivizing and rewarding green practices, these policies contribute to the larger goal of fostering sustainable economic development and environmental stewardship in the international trade arena.

Regional Offices

ECGC operates a network of strategically positioned regional offices throughout India, each serving as a vital hub for exporters in its respective region.

Accessibility and Personalized Support: The regional offices are strategically located to ensure accessibility and provide personalized support to exporters. They serve as local points of contact, offering tailored assistance and guidance to exporters navigating the complexities of international trade.

Local Expertise: Each regional office is staffed with local experts who possess a deep understanding of the unique trade dynamics and challenges prevalent in their respective regions. This localized knowledge enables them to offer relevant and informed support to exporters, addressing their specific needs and concerns effectively.

Contribution to Risk Assessment: Regional offices play a crucial role in contributing to ECGC’s risk assessment process. By gathering local market intelligence and assessing the creditworthiness of foreign buyers within their regions, these offices provide valuable insights that enhance ECGC’s overall risk evaluation capabilities.

Range of Support Services: In addition to risk assessment, regional offices offer a comprehensive range of support services to exporters. This includes facilitating policy issuance, assisting with claims processing in the event of non-payment, and providing exporters with detailed information and guidance on ECGC’s suite of services.

Engagement with Stakeholders: Regional offices actively engage with a diverse array of stakeholders, including local exporters, banks, financial institutions, and trade associations. By fostering stronger relationships and partnerships within their regions, these offices contribute to the promotion and facilitation of international trade, driving economic growth and prosperity at the regional level. Through collaboration and cooperation, regional offices play a pivotal role in building a robust and vibrant export ecosystem that benefits exporters and stakeholders alike.

Digital Transformation

ECGC is going digital! They’ve introduced online platforms where exporters can easily apply for and get policies without all the paperwork. This saves time and hassle.

Submitting Claims Online: Exporters can also submit their claims online, which speeds up the process of getting compensated if something goes wrong. It’s much quicker and simpler.

Improving Services: ECGC is using e-governance to make things more transparent and accountable. This means better service for exporters and smoother operations overall.

Using Data Better: They’re also using data analysis to understand risks better. This helps them offer more accurate insurance options tailored to each exporter’s needs.

Accessible Services: With these digital changes, ECGC’s services are now easier to access for exporters, no matter where they are. It’s all about making international business simpler and more straightforward for everyone involved.

In simple terms, ECGC is like a safety blanket for exporters. It gives them the courage to explore international markets without worrying too much. By handling the risks of global trade smartly, it helps keep India’s exports safe and sound in a world that’s always changing.

Benefits of ECGC for Indian Exporters

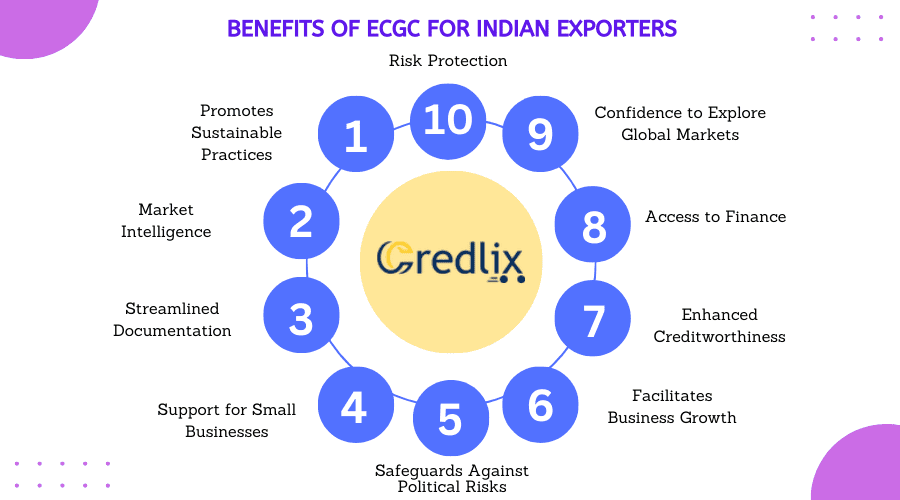

Here are 10 benefits of ECGC for Indian exporters:

Risk Protection: ECGC provides insurance coverage that protects exporters against the risk of non-payment by foreign buyers, ensuring they receive payment for their exported goods or services.

Confidence to Explore Global Markets: With ECGC’s support, exporters feel more confident to venture into international markets, knowing that they are financially protected against uncertainties.

Access to Finance: ECGC’s guarantees make exports more attractive to banks and financial institutions, increasing their access to finance and credit facilities.

Enhanced Creditworthiness: Exporters with ECGC cover are perceived as less risky by lenders, leading to improved creditworthiness and better loan terms.

Facilitates Business Growth: By mitigating risks and providing financial security, ECGC enables exporters to expand their businesses globally, leading to increased sales and market diversification.

Safeguards Against Political Risks: ECGC protects exporters against political risks such as war, civil unrest, or changes in government policies that could impact their overseas transactions.

Support for Small Businesses: ECGC offers specialized policies and support services tailored to the needs of small and medium-sized enterprises (SMEs), making export credit insurance more accessible and affordable for them.

Streamlined Documentation: ECGC simplifies the documentation and administrative processes involved in exporting, saving exporters time and effort.

Market Intelligence: ECGC’s regional offices gather local market intelligence, providing exporters with valuable insights into market trends, competition, and potential risks.

Promotes Sustainable Practices: ECGC’s Green Cover policies encourage and support exporters engaged in sustainable and environmentally responsible practices, aligning with global efforts to promote green trade and sustainability.

These benefits collectively contribute to the growth, stability, and competitiveness of Indian exporters in the global marketplace.

Final Note

ECGC stands as a vital ally for Indian exporters, providing essential protection, support, and resources to navigate the complexities of international trade. With its comprehensive services, including risk protection, access to finance, and streamlined processes, ECGC empowers exporters to expand their businesses globally with confidence. By promoting sustainable practices and fostering growth, ECGC plays a pivotal role in advancing India’s export sector and bolstering its position in the global economy. For any Indian exporter venturing into international markets, understanding and leveraging the benefits of ECGC can make all the difference in their journey to success.

Also Read: ECGC – Export Credit Guarantee Corporation of India: Safeguarding Exporters` Interests[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]