In the import-export business, an Inland Container Depot (ICD) is essential. It acts as a central spot for clearing customs, storing, and distributing containers, making shipping smoother. With services like cargo consolidation and warehousing, it cuts transit times and costs. Plus, it improves connections between ports and inland areas, making shipping faster and more efficient, which is crucial for businesses moving goods.

Let’s dive deeper into its significance in this blog.

What is an Inland Container Depot?

An Inland Container Depot (ICD) is like a big storage center for shipping containers. It’s not at the port but somewhere nearby. At an ICD, containers are checked by customs, stored, and sent to their destinations. They help move goods smoothly between ports and other places, making shipping easier and less crowded. Plus, they offer extra services like handling cargo and paperwork to make everything run even smoothly.

How Does an Inland Container Depot Work?

Inland Container Depots (ICDs) are strategically positioned in the hinterlands, away from seaports, to serve as key nodes in the logistics network. They are equipped to handle various customs-related functions, providing clearance services in close proximity to major production and consumption centers across the country. By decentralizing customs operations and facilitating cargo clearance closer to demand hubs, ICDs play a vital role in alleviating congestion at seaports.

Additionally, they contribute to the efficient flow of goods and support the seamless integration of inland regions into global trade networks.

Importance of an Inland Container Depot

Here’s why an Inland Container Depot is Important:

Simplified Logistics: Inland Container Depots (ICDs) act as centralized hubs for container handling, storage, and distribution, streamlining the entire shipping process. By consolidating these operations in one location, ICDs minimize the complexities and costs associated with transportation logistics.

Efficient Customs Clearance: ICDs play a vital role in expediting customs clearance procedures for imported and exported goods. By providing dedicated facilities and personnel for customs inspections and documentation, ICDs ensure prompt clearance of cargo, reducing delays and administrative bottlenecks.

Consolidation Opportunities: ICDs offer the advantage of cargo consolidation, allowing multiple shipments destined for similar destinations to be combined into a single container. This consolidation optimizes space utilization and maximizes transportation efficiency, resulting in significant cost savings for shippers.

Seamless Intermodal Connectivity: With their strategic location and integrated infrastructure, ICDs facilitate seamless intermodal connectivity between different modes of transportation, including ships, trucks, and trains. This connectivity enables smooth transfer and onward movement of cargo, enhancing supply chain efficiency.

Regional Economic Development: ICDs contribute to regional economic development by attracting businesses, logistics service providers, and related industries to their vicinity. The establishment of ICDs creates employment opportunities, stimulates investment, and fosters economic growth in surrounding areas.

Enhanced Supply Chain Services: In addition to container handling and storage, ICDs often offer a range of value-added services such as warehousing, packaging, and documentation. These services enhance supply chain efficiency by providing comprehensive logistics solutions tailored to the needs of shippers and consignees.

Facilitation of International Trade: By improving the efficiency, reliability, and cost-effectiveness of shipping operations, ICDs play a crucial role in facilitating international trade. By reducing transit times, minimizing costs, and enhancing connectivity, ICDs contribute to the expansion of global trade volumes and the growth of businesses involved in import-export activities.

Functions of Inland Container Depot

Understand some of the major functions of the Inland Container Depot:

Storage Hub: ICDs temporarily store containers before they are transported to the port and loaded onto ships. Exporters can also pack their cargo into containers at an ICD.

Customs Clearance: ICDs offer export and import customs clearances, similar to those provided at ports. This makes it convenient for businesses located far from the port.

Servicing and Repair: ICDs serve as facilities for servicing and repairing containers and other equipment used in transportation.

Who Owns An Inland Container Depot?

Inland Container Depots (ICDs) are owned by both private entities and governments worldwide. In India, however, they are predominantly state-owned and managed by the Container Corporation of India (CONCOR). As part of the Indian government’s initiative to enhance logistics infrastructure, CONCOR plays a pivotal role in operating and overseeing the ICDs across the country, ensuring efficient connectivity between ports and hinterland areas for seamless cargo movement.

How Many Inland Container Depots are There in India?

By March 2017, India boasted a total of 129 Inland Container Depots (ICDs), according to data compiled by the Department of Commerce (DoC). Among these, New Delhi stands out as the location of Asia’s largest ICD. These depots play a crucial role in facilitating the movement of goods between ports and inland destinations, contributing significantly to the efficiency and reliability of the country’s logistics infrastructure.

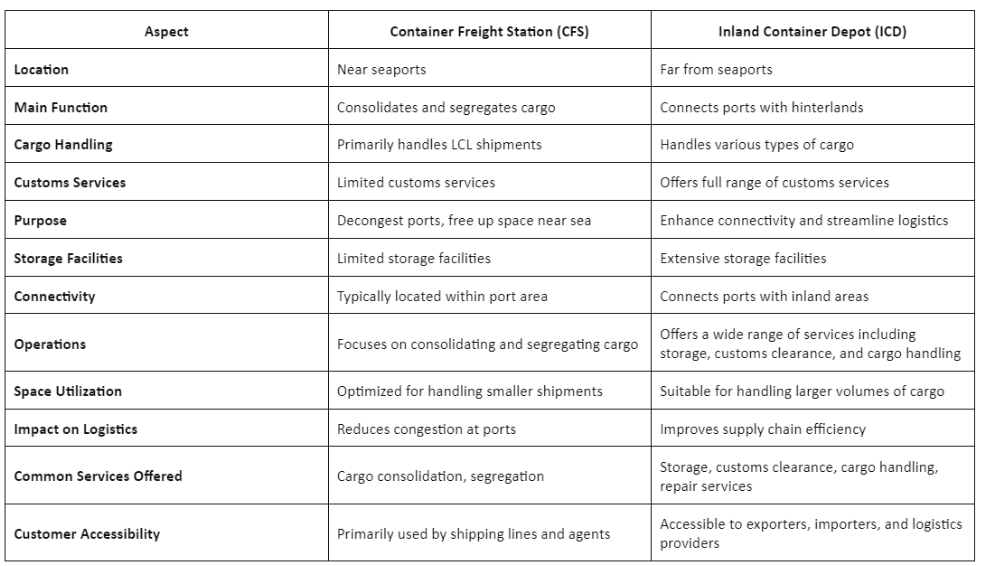

Difference Between Container Freight Stations (CFS) and Inland Container Depots (ICD)

The table below highlights the key differences between Container Freight Stations (CFS) and Inland Container Depots (ICD).

In conclusion, Inland Container Depots (ICDs) play a pivotal role in enhancing the efficiency, reliability, and cost-effectiveness of the logistics sector in India and globally. By providing centralized hubs for cargo handling, storage, and customs clearance, ICDs streamline the import-export process and facilitate seamless connectivity between ports and hinterland areas. With their strategic importance and widespread presence, ICDs contribute significantly to the growth and development of international trade and commerce.

Also Read: 31 Types of Containers used in International Shipping