[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11645″ img_size=”full” css=”.vc_custom_1702880539394{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Ever thought about how some businesses just seem to have their money stuff figured out? Well, get this: a bunch of them owe their money skills to something called Net Working Capital (NWC). But wait, don’t let the big words freak you out.

Net Working Capital is like the superhero of business, working behind the scenes to save the day and keep everything running smoothly. Think of it like Batman in the finance world, silently making sure everything’s in order.

In this blog, we’re going to break down Net Working Capital into super simple terms. No jargon, no complicated stuff—just easy-to-understand insights into how Net Working Capital becomes the superhero that keeps businesses on top of their game. Ready for a financial adventure? Let’s dive in from the basics!

Key Takeaways!

- Net working capital is a vital concept, not only for company analysis but also for its direct influence on cash flow calculations.

- The standard calculation involves subtracting non-cash current assets from non-debt current liabilities.

- It’s essential to grasp the net working capital formula to assess whether a company is generating cash through its working capital or consuming cash.

What is Net Working Capital?

Net Working Capital (NWC) is a financial metric that provides insight into a company’s operational liquidity and short-term financial health. It represents the difference between a company’s current assets and its current liabilities. In simpler terms, it’s a measure of the resources a company has to cover its short-term obligations and run its day-to-day operations.

Net Working Capital Formula

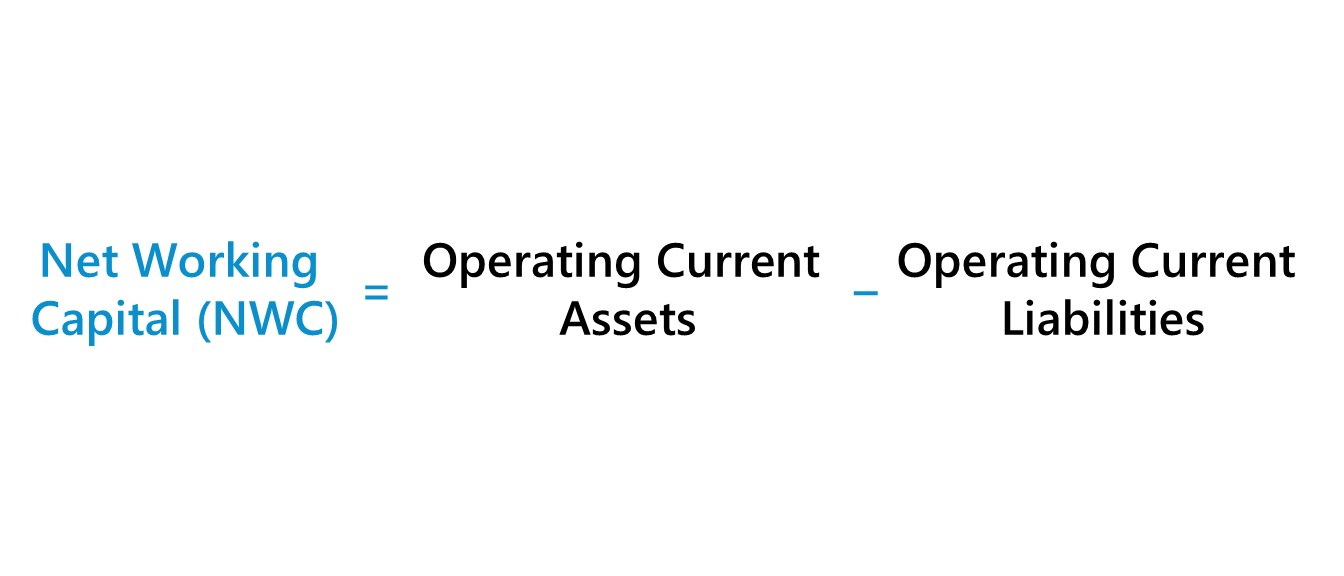

Net Working Capital (NWC) is calculated using the following formula:

NWC=Current Assets−Current Liabilities

The components of the formula are:

Current Assets: These are assets that are expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, and inventory.

Current Liabilities: These are obligations or debts that are expected to be settled within one year. Examples include accounts payable and short-term debt.

By subtracting current liabilities from current assets, you get the net working capital, which represents the operating liquidity or short-term financial health of a business. A positive NWC indicates that a company has enough short-term assets to cover its short-term liabilities, while a negative NWC suggests potential liquidity issues.

Elements Included in Working Capital

The current assets and liabilities used to calculate working capital typically include the following items:

Current Assets

- Cash and Equivalents: Actual money in the bank and checks awaiting deposit.

- Marketable Securities: Investments like Treasury bills and funds ready to turn into cash.

- Short-term Investments: Assets the company plans to sell within a year for extra moolah.

- Accounts Receivable and More: Money owed by customers, short-term loans, and other receivables like tax refunds or cash advances.

- Inventory: Everything from raw materials to finished goods waiting to be sold.

- Prepaid Expenses: Paying in advance for things like insurance premiums or future purchases.

Current Liabilities

- Accounts Payable: Bills to suppliers.

- Notes Payable: Short-term loans.

- Wages Payable: Salaries to be doled out.

- Taxes and Interest Payable: Money set aside for taxes and loan interest.

- Loan Principal Coming Due: Any loan amount that must be paid within a year.

- Accrued Expenses: Bills in the waiting room.

- Deferred Revenue: Customer payments for goods or services not yet delivered.

Who Uses Net Working Capital?

Net Working Capital is like a money health check that everyone can use:

Small Business Owners:They use it to see if their business has enough money to pay upcoming bills and keep things running smoothly.

Big Companies’ Finance Teams: These folks also rely on Net Working Capital. It helps them figure out how well the company can manage its short-term money matters.

Accountants: They’re like financial wizards. They can easily calculate and track Net Working Capital for businesses because they deal with all the money details.

Investors and Lenders: People who invest money or lend it to businesses find Net Working Capital super helpful. It gives them a heads-up on how a company deals with its short-term money stuff, helping them decide if it’s a good place to put their money.

So, whether you’re running a small shop, working for a big company, doing the money magic as an accountant, or thinking about investing, Net Working Capital is a handy tool to understand a business’s financial situation. It’s like a financial GPS telling you if the road ahead is smooth or if there might be a few bumps!

Why Is Working Capital Important?

Imagine working capital as the piggy bank that keeps a business rolling smoothly:

Paying the Bills: Working capital is like the money a business has for everyday stuff. It pays employees, keeps suppliers happy, and handles things like taxes and interest payments. So, even if there’s a hiccup in cash flow, the show goes on.

Growing Without Debt: If a business wants to grow—maybe open a new store or launch a cool project—it can dip into its working capital piggy bank. This means it can expand without borrowing a ton of money. And guess what? If the business ever needs to borrow, having a healthy working capital piggy bank makes banks more likely to say, “Sure, here’s a loan!”

Finance Team Goals: The money wizards in the finance team aim for two things. First, they want to know exactly how much cash is in the piggy bank right now. Second, they work with the business to make sure the piggy bank is fat enough to cover all the bills, with a bit extra for unexpected surprises or exciting growth moments.

In simple terms, working capital is the go-to buddy that businesses rely on to keep the lights on, pay the team, and even dream big without drowning in debt. It’s like having a financial safety net and a green light for growth all in one!

Working Capital and the Balance Sheet

Working capital is like a financial puzzle piece, and the balance sheet is where we find it:

Balance Sheet Basics: A balance sheet is like a snapshot capturing all the money stuff a company has and owes at a specific time—usually the end of a quarter or year. It’s one of the three big financial statements businesses show off, alongside the income statement and cash flow statement.

Assets and Liabilities: On the balance sheet, you’ll find two main dance partners—assets and liabilities. Assets are everything a company owns, and liabilities are what it owes. They’re like the yin and yang of finance.

Short and Long-Term Friends: The balance sheet doesn’t play favorites. It lists both short-term and long-term pals. Short-term friends are things the company deals with soon—like paying bills. Long-term buddies are commitments that hang around for a bit longer.

Balance Sheet Order: The balance sheet organizes assets and liabilities in an orderly fashion. It starts with cash and cash equivalents (the quick-to-use money) and then lists liabilities, putting the short-term ones upfront, followed by the long-term crew.

So, when we’re talking about working capital, we’re diving into the balance sheet world, looking at the company’s assets, liabilities, and how they’re all hanging out together. It’s like checking the company’s financial passport to see where it stands at a particular moment.

Working Capital vs. Net Working Capital

Working capital and net working capital are closely related financial metrics that provide insights into a company’s short-term financial health. Working capital refers to the difference between a company’s current assets and current liabilities, representing the funds available for day-to-day operations. It serves as a measure of a company’s ability to cover its short-term obligations and maintain its operational efficiency.

On the other hand, net working capital is a more refined metric that specifically calculates the difference between a company’s current assets and current liabilities. This distinction excludes short-term debt from current liabilities, providing a clearer picture of a company’s liquidity without considering obligations that are immediately due. A positive net working capital indicates that a company has enough liquid assets to cover its short-term liabilities.

Monitoring both working capital and net working capital is crucial for assessing a company’s financial flexibility and risk management. While working capital offers a broad overview of liquidity, net working capital provides a more focused perspective by excluding short-term debt. Together, these metrics help stakeholders, including investors and management, gauge a company’s ability to meet its short-term obligations and sustain its ongoing operations.

Setting up a Net Working Capital Schedule

Let’s break down the steps in a simpler way:

Step 1: Write down the sales and cost of goods sold at the top of your worksheet. You’ll need these numbers later to figure out some important things.

Step 2: Below sales and cost of goods sold, list the important stuff from the balance sheet. Split them into things that are like money coming in (current assets) and things that are like money going out (current liabilities). Don’t include actual cash in current assets, and leave out any parts of debts in current liabilities.

Step 3: Make groups for all the things in current assets that are not cash, and all the things in current liabilities that are not debts. Subtract the total non-debt current liabilities from the total non-cash current assets. This gives you the net working capital. If you want, add another line to see if net working capital is growing or shrinking compared to the previous period.

Step 4: Fill in the worksheet with past data. You can get this from the balance sheet. If you have future predictions, put those in too.

Step 5: If you don’t have future predictions, make a section where you guess how things will change. Look at past data to figure out what drives these changes. Then, use these guesses to figure out what the future numbers might be.

Problems Due To Insufficient Net Working Capital

Insufficient net working capital can lead to several problems for a business. Net working capital is crucial for day-to-day operations, and a shortage can impact a company’s ability to meet its short-term obligations. Here are some problems associated with insufficient net working capital:

Liquidity Issues: A low or negative net working capital indicates that a company may struggle to cover its short-term liabilities with its current assets. This can lead to liquidity problems, making it difficult to pay suppliers, meet payroll, or address other immediate financial needs.

Supplier and Creditor Relations: When a business faces liquidity issues, it may delay payments to suppliers and creditors. This can strain relationships with key business partners and suppliers, potentially leading to a deterioration in credit terms or even disruptions in the supply chain.

Increased Borrowing Costs: Companies with insufficient net working capital may need to rely on external financing to cover short-term obligations. This could result in increased borrowing costs, as lenders may view the business as higher risk and charge higher interest rates.

Opportunity Cost: Without enough working capital, a company may miss out on investment opportunities or be unable to take advantage of favorable business conditions. It might also struggle to fund necessary business expansions or capitalize on bulk purchase discounts.

Inability to Seize Discounts: Some suppliers offer early payment discounts to encourage prompt payment. Insufficient net working capital may prevent a business from taking advantage of these discounts, leading to higher costs for goods and services.

Impact on Credit Rating: Consistently low or negative net working capital may negatively affect a company’s credit rating. This, in turn, can make it harder to secure financing and may result in higher costs when obtaining credit.

Reduced Flexibility: Adequate working capital provides flexibility for a company to navigate unforeseen circumstances or take advantage of unexpected opportunities. Insufficient net working capital limits this flexibility, making it challenging to adapt to changing market conditions.

Risk of Insolvency: If a business consistently operates with insufficient net working capital and cannot meet its short-term obligations, it may face the risk of insolvency. This is a serious situation where the company may be unable to continue its operations.

To address these problems, businesses need to carefully manage their working capital, monitor cash flow, and implement strategies to improve liquidity, such as optimizing inventory levels, managing receivables efficiently, and negotiating favorable payment terms with suppliers.

Transform Your Financial Landscape with Credlix

Credlix is dedicated to empowering businesses with cutting-edge cash flow solutions, expertly crafted to seamlessly bridge working capital gaps. Explore the potential of our advanced invoice discounting services to elevate your financial strategy and propel your business to new heights.

Join forces with Credlix on a transformative journey, where our innovative solutions become the driving force behind your financial successes. Discover the myriad ways in which Credlix acts as the catalyst for your triumphs, delivering agile working capital solutions to fuel your path towards growth and prosperity. Experience the distinctive impact of Credlix and take command of your business’s financial destiny.

Final Words

In summary, net working capital is a critical metric for assessing a company’s financial health and operational liquidity. Acting as a financial superhero, it ensures the smooth functioning of daily operations. Calculated by subtracting current liabilities from current assets, it offers insights into a company’s ability to cover short-term obligations.

Insufficient net working capital can lead to problems like liquidity issues, strained relations, and increased borrowing costs. Therefore, proactive management is crucial. Net working capital serves as a vital tool for small business owners, finance teams, accountants, and investors, offering a quick money health check and guiding financial decisions.

In conclusion, understanding and optimizing net working capital is essential for businesses aiming at sustained growth, financial stability, and resilience in a dynamic market environment.

Also Read: How Working Capital Prepares Manufacturers for the Festive Rush

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]