[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12189″ img_size=”full” css=”.vc_custom_1708932308485{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Export factoring is a financial mechanism that empowers businesses engaged in international trade to optimize their cash flow by converting accounts receivable into immediate working capital. As exporters navigate the complex landscape of global commerce, a well-structured documentation process is paramount for the seamless execution of export factoring transactions.

This process involves a careful interplay of legal agreements, financial records, and transaction-specific documents that not only facilitate the exchange of funds but also ensure transparency and mitigate risks. In this exploration, we delve into the fundamental aspects of the documentation process in export factoring, shedding light on the essential steps and key documents that underpin this vital financial tool for businesses operating on the international stage.

Understanding this process is pivotal for exporters seeking to leverage export factoring to enhance their liquidity and navigate the intricacies of cross-border trade.

Documentation Required for Export Factoring

Export factoring involves several documents to facilitate the smooth operation of the financing arrangement. The specific documentation required may vary depending on the factors involved, but here is a general list of documents commonly associated with export factoring:

Factoring Agreement: A legally binding document outlining the terms and conditions of the factoring arrangement. It typically includes details about fees, responsibilities of each party, termination clauses, and other relevant terms.

Application Form: Completed by the exporter, providing information about the business, its financial health, and the invoices to be factored.

Invoices: Original invoices issued by the exporter to the overseas buyers for the goods or services provided.

Shipping Documents: Documents such as bills of lading, airway bills, or other relevant transport documents confirming the shipment of goods.

Credit Notes: Any credit notes issued by the exporter related to the invoices being factored.

Sales Contracts or Purchase Orders: Documents specifying the terms of the sale between the exporter and the overseas buyer.

Credit Reports: Information on the creditworthiness of the overseas buyers. This may be obtained by the factor during the due diligence process.

Insurance Documents: If applicable, documents related to the insurance coverage for the shipped goods.

Legal Documentation: Any legal agreements related to the export transactions or the factoring arrangement, including jurisdiction-specific documents.

Collection Instructions: Details on how payments should be made by the buyers, including information on where and how to remit funds.

Payment Confirmation: Documents confirming that payments have been received from the buyers. This is crucial for the factor to release the remaining balance to the exporter.

Acknowledgment of Assignment: A document signed by the overseas buyers acknowledging that their debts have been assigned to the factor.

Reserve Release Instructions: Instructions from the factor to release any remaining funds (reserve) to the exporter after all invoices have been paid.

Regular Reports: Periodic reports detailing the status of invoices, collections, and other relevant financial information.

It’s important for exporters to carefully review the documentation requirements with the chosen factor and ensure that all necessary documents are accurate and complete. Adhering to the documentation process helps in reducing the risk of disputes and ensures a transparent and efficient export factoring arrangement.

Parties Involved in the Documentation Process in Export Factoring

The documentation process in export factoring involves various parties, each playing a crucial role in facilitating the financial transaction. Here are the key parties involved:

Exporter: The entity or business that sells goods or services to overseas buyers and seeks immediate working capital by factoring its accounts receivable.

Factor: The financial institution or third-party entity that purchases the exporter’s accounts receivable. Factors provide immediate funds, typically a percentage of the invoice value, to the exporter.

Buyer (Debtor): The overseas customer or entity that owes payment to the exporter for the goods or services provided. In an export factoring arrangement, the buyer is typically notified of the factoring agreement and directed to remit payments directly to the factor.

Legal Advisors: Professionals or legal representatives involved in drafting and reviewing legal documentation associated with the export factoring arrangement. They ensure that contracts and agreements adhere to relevant laws and regulations.

Credit Agencies: Organizations providing credit reports and financial information about the overseas buyers. Credit agencies assist the factor and exporter in assessing the creditworthiness and financial stability of the buyers.

Insurance Providers: If applicable, insurance companies provide coverage for the shipped goods. Insurance documentation may be required to mitigate risks associated with the transportation of goods.

Transportation Companies: Entities responsible for the physical movement of goods. Shipping documents provided by transportation companies, such as bills of lading or airway bills, play a vital role in the export factoring process.

Auditors: Professionals who may be involved in auditing financial records and ensuring the accuracy and completeness of the documentation submitted by the exporter.

Collection Agents: Individuals or entities responsible for the collection of payments from the overseas buyers on behalf of the factor. They play a role in ensuring timely and efficient payment processing.

Regulatory Authorities: Government bodies or agencies overseeing international trade regulations. Compliance with regulatory requirements is crucial, and exporters may need to submit specific documentation to these authorities.

Technology Platforms: In some cases, technology platforms or systems may be used to facilitate the exchange of electronic documents, communication between parties, and the monitoring of the export factoring process.

Understanding the roles and responsibilities of each party is essential for a smooth and effective documentation process in export factoring. Clear communication and collaboration among these stakeholders contribute to the success of the financial arrangement and help mitigate potential challenges.

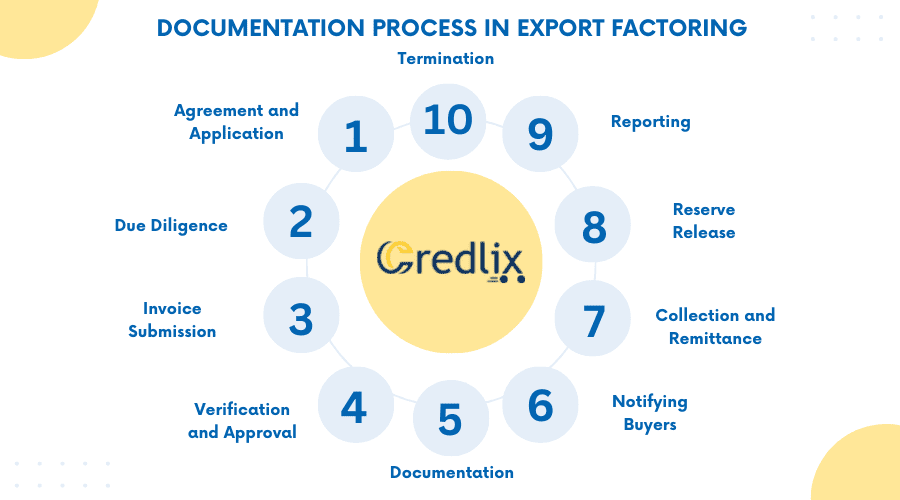

Documentation Process in Export Factoring

Export factoring involves the sale of accounts receivable (invoices) to a third-party financial institution known as a factor. This practice helps businesses improve cash flow by obtaining immediate funds for their export sales rather than waiting for customers to pay. The documentation process in export factoring is crucial for the smooth functioning of this financial arrangement. Below are the key steps and documents involved:

Agreement and Application

- The exporter initiates the process by entering into an agreement with the export factor.

- An application form is usually submitted, providing details about the exporter, the nature of the business, and the invoices to be factored.

Due Diligence

- The factor conducts due diligence on the exporter and the customers involved in the invoices.

- Creditworthiness and financial stability assessments may be carried out.

Invoice Submission

- The exporter submits the invoices to the factor for approval.

- The invoices should meet the factor’s criteria, including authenticity and the creditworthiness of the buyers.

Verification and Approval

- The factor verifies the authenticity of the submitted invoices and checks for any discrepancies.

- Once approved, the factor notifies the exporter and advances a certain percentage (usually 70-90%) of the invoice value.

Documentation

- Various documents are required for the export factoring process, including invoices, shipping documents, and credit notes.

- Legal documentation outlining the terms and conditions of the factoring arrangement is also prepared.

Notifying Buyers

- Buyers are informed about the factoring arrangement, and they may be required to make payments directly to the factor.

Collection and Remittance

- The factor takes responsibility for collecting payments from the buyers.

- Upon receipt of payment, the factor deducts its fees and remits the remaining amount to the exporter.

Reserve Release

- Once the factor receives full payment from the buyers, any remaining percentage (minus fees) is released to the exporter.

Reporting

- Regular reporting on the status of invoices and collections is provided to the exporter.

Termination

- The export factoring arrangement can be terminated by either party based on the terms specified in the agreement.

Documentation in export factoring is critical to ensuring transparency, legal compliance, and effective communication between all parties involved. It provides a structured framework for the financing arrangement and helps mitigate risks associated with international trade. Exporters should carefully review the terms and conditions outlined in the factoring agreement and work closely with the factor to streamline the documentation process.

Points to Be Careful of While the Documentation Process in Export Factoring

Navigating the documentation process in export factoring demands meticulous attention to detail and adherence to specific considerations to ensure a smooth and risk-mitigated financial transaction. Here are key points to be careful of during the documentation process in export factoring:

Accuracy and Completeness

Ensure that all submitted documents, including invoices, shipping documents, and credit notes, are accurate and complete. Any discrepancies can lead to delays or complications in the factoring process.

Compliance with Legal Requirements

Verify that all legal documents, such as the factoring agreement and jurisdiction-specific paperwork, comply with relevant laws and regulations in both the exporter’s and buyer’s countries. Legal oversights can have serious implications.

Due Diligence on Buyers

Conduct thorough due diligence on the creditworthiness and financial stability of the overseas buyers. Inaccurate assessments may result in higher risk exposure.

Clear Terms in Factoring Agreement

Review and clearly understand the terms and conditions outlined in the factoring agreement. Pay attention to fees, responsibilities, termination clauses, and any other contractual obligations to avoid misunderstandings.

Transparent Communication with Buyers

Clearly communicate the factoring arrangement to buyers, including instructions for payment to the factor. Open and transparent communication can help prevent misunderstandings and ensure a smoother collection process.

Verification of Shipping Documents

Scrutinize shipping documents such as bills of lading or airway bills to ensure they align with the invoices being factored. This is crucial for verifying the authenticity of the export transactions.

Insurance Coverage Confirmation

If applicable, confirm and document the insurance coverage for the shipped goods to mitigate potential losses in case of unforeseen events during transit.

Timely Submission of Documents

Submit all required documents promptly to avoid delays in the factoring process. Delays may impact cash flow and disrupt the exporter’s financial planning.

Monitoring Payment Confirmations

Keep a close eye on payment confirmations from buyers. Promptly inform the factor of any discrepancies or delays in payments to facilitate timely resolution.

Regular Reporting and Monitoring

Review regular reports provided by the factor on the status of invoices, collections, and other financial information. Stay informed to address any issues promptly.

Reserve Release Instructions

Clearly understand and communicate the process for the release of reserves once payments are received. Timely instructions are essential to ensure the exporter receives the remaining balance promptly.

Data Security and Confidentiality

Implement robust measures to secure sensitive financial and business information exchanged during the factoring process. Protecting data is crucial for maintaining confidentiality and preventing unauthorized access.

By carefully navigating these considerations, exporters can enhance the efficiency of the export factoring process, minimize risks, and leverage this financial tool effectively to optimize their cash flow in the realm of international trade.

Final Note

In conclusion, the documentation process in export factoring is a critical aspect of international trade, streamlining the conversion of accounts receivable into immediate working capital. Clear communication, accurate document submission, and adherence to legal requirements are imperative for a seamless and risk-mitigated financial transaction.

Exporters should exercise caution, ensuring due diligence on buyers, verifying shipping documents, and confirming insurance coverage. Transparent communication with buyers and timely submission of documents contribute to an efficient process.

As exporters navigate the intricacies of export factoring, monitoring payment confirmations, understanding reserve release instructions, and prioritizing data security are vital components of a successful financial arrangement.

In essence, a meticulous approach to export factoring documentation empowers businesses to optimize cash flow, mitigate risks, and thrive in the global marketplace. By adhering to these considerations, exporters can leverage export factoring as a strategic financial tool for sustained growth and success.

Also Read: Advantages of Export Factoring[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]