[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”13097″ img_size=”full” css=”.vc_custom_1718258859307{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Did you know that approximately 75% of global trade is supported by some form of trade finance, with letters of credit being a cornerstone of these transactions? Transferable letters of credit (LCs) are a particularly powerful tool in this domain, enabling smoother, more secure trade operations. Whether you’re a seasoned professional or new to the world of international trade, understanding the intricacies of transferable LCs can unlock new opportunities and mitigate risks.

In this blog, we will delve into the process flow of transferable letters of credit, explore the associated risks, and provide practical examples to illustrate their application. Join us as we unravel the complexities and benefits of this vital financial instrument.

What are Transferable Letters of Credit?

A transferable letter of credit (LC) is a financial instrument that allows the first beneficiary to transfer the credit facility to another party, known as the second beneficiary. This arrangement is particularly useful when sellers are intermediaries, such as agents or dealers, rather than the actual suppliers or manufacturers of the goods.

With a transferable LC, the seller can instruct the bank to make the credit available, either wholly or partially, to one or more secondary beneficiaries. This means the first beneficiary can allocate the available credit to other parties involved in the transaction. However, this process is only possible if the buyer designates the LC as transferable when it is issued to the bank.

Why is a Transferable Letter of Credit Necessary?

Transfers typically involve a beneficiary of the LC, often a seller, who has an impending sale but lacks the resources to complete the merchandise order from the manufacturer on an open account. Export brokers frequently use transferable LCs. By transferring a portion of the export LC to the manufacturer, the broker can leverage the buyer’s banker’s credit. This arrangement provides the manufacturer with assurance of payment, provided they comply with the terms and conditions of the transferable LC.

How to Apply for a Transferable Letter of Credit?

Applying for a transferable letter of credit is similar to applying for a loan. The buyer must submit an LC application that includes their credit profile details. The bank will then evaluate the buyer’s credit score and financial stability during the underwriting process. Upon approval, the LC will indicate that the bank is willing to issue a loan for a specified amount to the buyer, if needed, to cover the payment to the seller.

How Does a Transferable Letter of Credit Work?

A transferable letter of credit (LC) creates a redeemable facility between all the parties involved. Here’s how it works step-by-step:

Buyer Requests the LC: The buyer of the goods requests their bank to issue an LC, naming the seller as the first beneficiary. This step involves the buyer submitting an application and necessary credit profile details.

Bank Issues the LC: The buyer’s bank evaluates the buyer’s credit score and financial stability. Upon approval, the bank issues the LC, assuring the seller that the buyer will make the payment.

Seller Receives Assurance: The seller receives the LC and is assured of payment. This assurance allows the seller to proceed with processing the order without worrying about payment risks.

Seller Transfers the LC: If the seller is an intermediary (such as an agent or broker), they can transfer the LC to another party, such as the actual supplier or manufacturer, who is the second beneficiary.

Second Beneficiary Fulfills the Order: The second beneficiary (e.g., the manufacturer) receives the transferred LC and fulfills the order, knowing they are assured of payment by the issuing bank, provided they comply with the terms and conditions of the LC.

Payment Process: Once the second beneficiary fulfills the order and meets all terms and conditions, they can draw on the LC. The bank pays the second beneficiary, and the buyer ultimately settles the amount with the bank.

This stepwise process ensures that all parties involved have the necessary payment assurances, facilitating smooth and secure international trade transactions.

Calculating Insurance for a Transferable Letter of Credit

The insurance coverage for a transferable letter of credit (LC) can be adjusted to meet the specified amount mentioned in the credit. Typically, the insurance policy covers up to 110% of the invoice value, in the currency of the invoice, under the bank’s name. This policy includes coverage for all risks specified in the standard agreement clause.

If the LC permits on-deck shipment, the insurance must also cover the risk of goods being discarded or washed overboard. Additionally, the validity of the insurance should align with the terms of the LC or the contract.

Transferable Letter of Credit – Charges

All charges associated with a transfer, including commissions, fees, costs, and other expenses, must be paid by the first beneficiary unless otherwise agreed upon at the time of transfer.

Transferable Letter of Credit – Example

Kento, an Italian firm, places an order with United Services, an American company. United Services requests Kira Ltd to issue a transferable LC, enabling them to access a credit facility from their supplier based on this letter.

Kento instructs its bank to issue a transferable LC. If the bank approves the request, United Services can transfer the LC to their supplier, the secondary beneficiary.

Format of Transferable Letter of Credit

Have a look at the format of Transferable letter of Credit:

Transferable Letter of Credit vs. Back-to-Back Letter of Credit

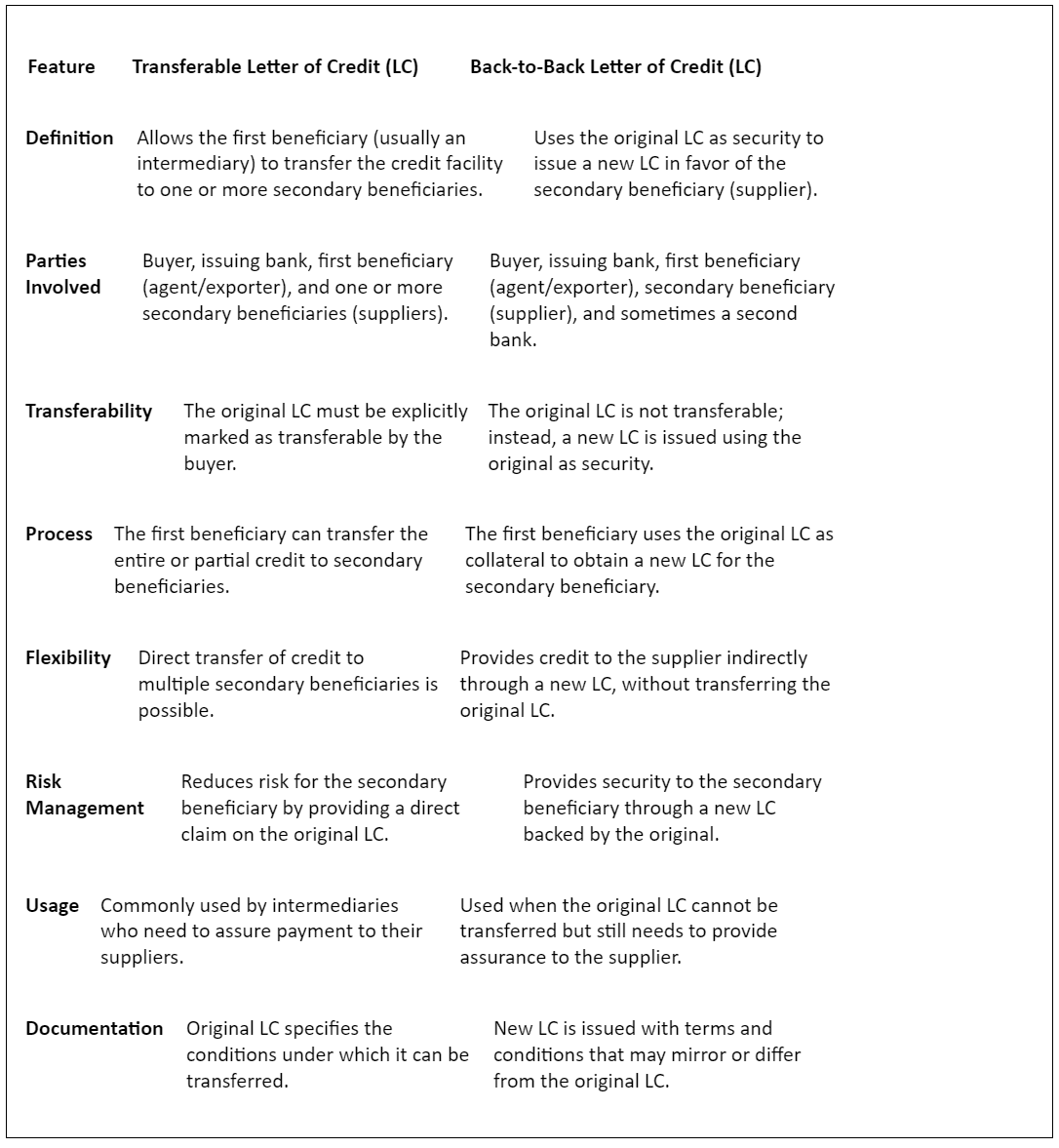

This table below outlines the key differences between transferable letters of credit and back-to-back letters of credit, helping to understand their respective applications and advantages.

Difference Between Transferable and Non-Transferable Letters of Credit

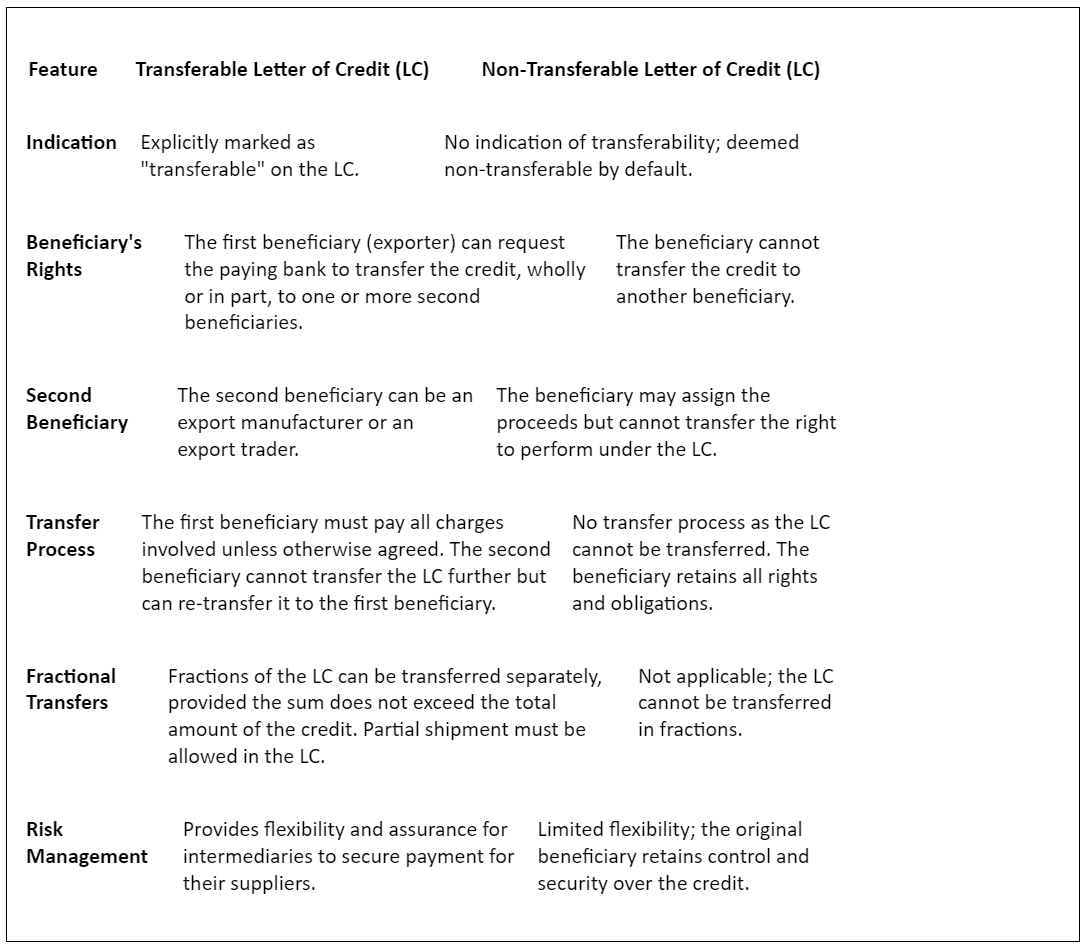

This table below highlights the key differences between transferable and non-transferable letters of credit, emphasizing their respective features and applications.

How Many Times Can a Transferable LC be Transferred?

A transferable LC allows for one-time transfer to one or more second beneficiaries. However, once transferred, it cannot be further transferred to additional parties. This feature ensures that the credit remains within the specified scope of the original transaction, providing security and clarity in international trade dealings.

Can a Transferable Letter of Credit Be Confirmed?

Transferable letters of credit (LCs) are conditional commitments initiated by banks at the importers’ request. These LCs guarantee payment from the importing party to the exporter, contingent upon the correct delivery of specified documents and adherence to stated conditions. Essentially, a transferable LC serves as confirmation that payment will be made upon fulfillment of the terms. The issuing bank holds the authority to confirm the authenticity of the LC.

Can a Transferable Letter of Credit Be Discounted?

Transferable LCs serve as financial security for importers and exporters alike. LC discounting offers a funding avenue to meet financial needs, such as when importers seek to extend payment terms while exporters demand immediate payment, or when importers default on payment deadlines. This option provides flexibility and liquidity to businesses engaged in international trade transactions.

Risks Associated with Transferable Letters of Credit

Challenges may arise for sellers in fulfilling transferable LC terms, prompting requests for amendments due to various reasons:

Shipment Schedule Issues: Sellers may struggle to meet agreed-upon shipment schedules.

Freight Cost Stipulations: Stipulations regarding freight costs may be unacceptable.

Exchange Rate Fluctuations: Fluctuating exchange rates can diminish trade profitability or lead to losses.

Quantity Discrepancies: Ordered product quantities may not align with agreed terms.

Document Difficulties: Specified documents may be difficult or impossible to obtain.

When such issues arise, negotiation between buyer and seller banks may occur, potentially delaying transaction execution. It’s crucial to note that if documents don’t match LC specifications, the buyer’s issuing bank isn’t obligated to make payment. As most LCs are irrevocable, amending them can be challenging.

Conclusion

Transferable letters of credit (LCs) offer a dynamic solution for facilitating international trade, providing flexibility and security for both buyers and sellers. Despite the risks associated with potential challenges in fulfilling LC terms, understanding the process flow, risks, and examples can empower businesses to navigate trade transactions effectively. By leveraging the benefits of transferable LCs while mitigating associated risks, businesses can optimize their global trade operations and unlock new opportunities for growth and success.

Also Read : What is an Irrevocable Letter of Credit and How Does it Work?[/vc_column_text][vc_column_text][/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]