[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12131″ img_size=”full” css=”.vc_custom_1708329184660{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In the context of the global economy, the export of goods and services has become integral, and India, as one of the fastest-growing economies, presents abundant opportunities for businesses seeking international expansion. Export factoring, an increasingly popular financial mechanism, plays a crucial role in aiding businesses to navigate cash flow challenges and mitigate risks associated with international trade.

This blog delves into the burgeoning landscape of export factoring in India, shedding light on the opportunities it presents for both exporters and the overall growth of the nation’s economy.

What is Export Factoring?

Export factoring is like a helpful financial service for businesses doing global trade. Here’s how it works: businesses, especially those sending out invoices, can sell these invoices to a financial friend called a “factor” at a lower price. In return, they get quick cash, which is super handy for their day-to-day money needs. The cool part is, the factor now deals with collecting payments from customers abroad, so the business doesn’t have to worry about that part.

This whole setup is great because it speeds up the process of turning invoices into quick money. Export factoring becomes like a smart money tool for businesses, making it easier for them to manage their cash and handle the tricky parts of international trade. It’s like a teamwork thing between the businesses and the factors, not only making things smoother for each business but also making the whole global trade world a bit safer and less risky.

Also Read: 9 Ways Export Factoring Reduces Risk and Boosts Your Bottom Line

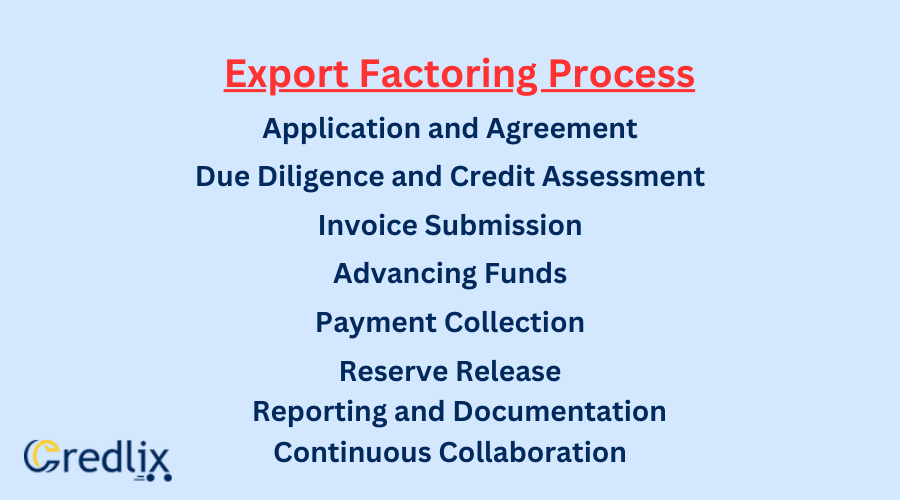

Export Factoring Process

The export factoring process involves several key steps, facilitating efficient cash flow management and risk mitigation for businesses engaged in international trade. Here’s a concise overview of the typical export factoring process:

Application and Agreement

The exporting business initiates the process by applying for export factoring services. This involves submitting relevant documentation, financial records, and information about the foreign buyers. Once approved, the business and the export factor enter into a factoring agreement outlining terms and conditions.

Due Diligence and Credit Assessment

The factor conducts due diligence on the foreign buyers to assess their creditworthiness. This step is crucial in determining the risk associated with each transaction. Based on the assessment, the factor establishes credit limits for the buyers.

Invoice Submission

After delivering goods or services, the exporting business submits invoices to the factor for eligible accounts receivable. The factor verifies the authenticity of the invoices and the corresponding transactions.

Advancing Funds

Upon approval, the factor advances a significant portion (usually a percentage) of the invoice amount to the exporting business. This provides quick access to working capital, addressing immediate cash flow needs.

Payment Collection

The factor assumes the responsibility of collecting payments from the foreign buyers on behalf of the exporting business. This includes sending notifications, managing the payment process, and handling any disputes or inquiries.

Reserve Release

Once the factor successfully collects the full payment from the foreign buyer, they deduct their fees and release the remaining funds, known as the reserve, to the exporting business. The reserve amount is the difference between the advanced funds and the total invoice value.

Reporting and Documentation

Throughout the process, the factor provides regular reports to the exporting business, detailing the status of invoices, payments collected, and any relevant information. Proper documentation ensures transparency and clarity in the transaction.

Continuous Collaboration

Effective communication and collaboration between the exporting business and the factor are crucial. This includes discussing any changes in the business’s operations, addressing concerns, and maintaining transparency to optimize the export factoring relationship.

By streamlining the export factoring process, businesses can benefit from improved cash flow, reduced credit risk, and a more efficient approach to managing international transactions. This financial tool proves especially valuable for companies looking to navigate the complexities of cross-border trade while maintaining a strong and stable financial position.

Export Factoring Opportunities in India

Explore lucrative export factoring opportunities in India, unlocking cash flow, mitigating risks, and fostering global growth.

Growing Market Demand: With India being a rapidly expanding economy, there’s an increasing demand for goods and services both domestically and internationally, presenting a plethora of opportunities for businesses to explore export markets.

Cash Flow Management: Export factoring provides a robust solution for businesses to efficiently manage their cash flow. By converting accounts receivable into immediate funds, businesses can meet operational needs and invest in growth without waiting for customer payments.

Risk Mitigation: International trade often involves risks related to delayed payments or defaults. Export factoring helps mitigate these risks by shifting the responsibility of collecting payments from foreign buyers to the factor, offering a level of security to exporters.

Access to Working Capital: Exporters can access working capital swiftly through export factoring. This is particularly beneficial for small and medium-sized enterprises (SMEs) that may face challenges in obtaining traditional financing.

Credit Risk Reduction: Export factors assume the task of evaluating and managing the creditworthiness of international buyers. This reduces the credit risk for exporters, allowing them to focus on their core operations rather than worrying about payment uncertainties.

Enhanced Competitiveness: By availing export factoring services, businesses in India can enhance their competitiveness in the global market. The improved cash flow and risk mitigation contribute to a more robust and attractive proposition for international buyers.

Flexibility in Funding: Export factoring offers flexibility in funding based on the volume of accounts receivable. This adaptability is advantageous for businesses with varying sales cycles or those entering new markets.

Simplified Administration: The factor takes charge of administrative tasks related to invoicing and payment collection. This simplifies the administrative burden on exporters, allowing them to focus on core business activities.

Global Market Expansion: Export factoring facilitates global market expansion by providing a financial mechanism that supports businesses in reaching new international customers. This is particularly valuable for Indian businesses looking to diversify their customer base.

Contributing to Economic Growth: The widespread adoption of export factoring in India can contribute significantly to the nation’s economic growth. By empowering businesses to engage more confidently in international trade, it fosters economic resilience and strengthens India’s position in the global marketplace.

Challenges and Considerations

In the realm of export factoring, businesses must navigate various challenges and considerations to ensure a balanced and well-informed approach. One pivotal factor is the cost of factoring, which involves fees charged by the factor for assuming credit risk and managing the collection process. While the benefits of accelerated cash flow are significant, businesses must weigh these against the associated costs to determine the overall financial impact.

Another critical consideration revolves around the potential impact on customer relationships. The involvement of a third-party factor in the payment collection process may raise concerns among clients. Maintaining transparent and open communication becomes paramount to address any apprehensions and foster continued trust.

Clear communication with the factor is equally crucial. Businesses must establish a transparent dialogue to discuss terms, conditions, and expectations. Miscommunication can lead to misunderstandings, potentially affecting the efficiency of the export factoring arrangement. A proactive and collaborative approach ensures a smooth working relationship between the business and the factor, optimizing the benefits of export factoring.

In essence, a well-informed business approach involves a meticulous assessment of the cost dynamics, a strategic plan to preserve customer relationships, and transparent communication channels with the factor. By navigating these challenges adeptly, businesses can capitalize on the advantages of export factoring while effectively managing any associated complexities.

Final Note

Export factoring emerges as a powerful ally for Indian businesses venturing into international trade. It opens doors to faster payments, risk reduction, and global expansion. While challenges like costs and customer relationships exist, clear communication and strategic planning can overcome them. By embracing export factoring, businesses not only enhance their financial flexibility but also contribute to India’s economic growth, making international trade smoother, safer, and more accessible for all.

Also Read: A Comprehensive Guide to Export Finance in India[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]