- August 14, 2024

- Posted by: admin

- Categories: Invoice discounting, Blog

To keep your business running smoothly, having enough working capital is crucial. Unexpected costs or slow payments from customers can create cash flow problems. In these cases, business financing can help. Two common options are unsecured business loans and bill discounting.

Unsecured business loans offer some flexibility, but bill discounting can be a better choice if you have regular, reliable customers.

In this blog, we will compare unsecured business loans and bill discounting in a simple table. We’ll also explain each option in detail, showing why bill discounting might be the better solution for many businesses.

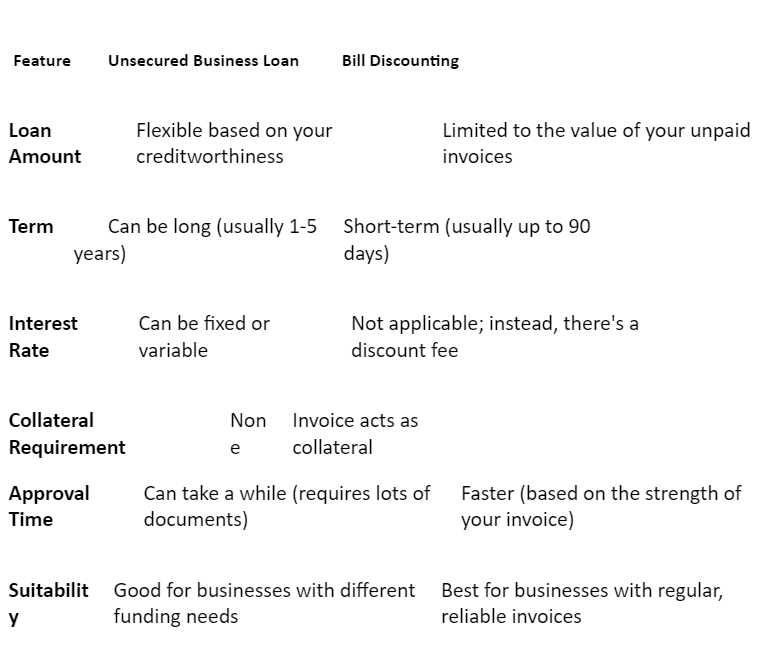

Table Comparing Unsecured Business Loans and Bill Discounting

This table below should help you see the main differences between these two financing options in a clear and easy way.

Unsecured Business Loans

Unsecured business loans are a popular way for businesses to get a lump sum of money without putting up any assets as security. This means you don’t need to offer property or equipment as collateral. Banks, online lenders, and other financial institutions provide these loans.

Who Can Use Them?

Unsecured business loans are a good choice for startups and young businesses that don’t have a lot of valuable assets to use as collateral.

What to Know About Unsecured Business Loans:

Approval Process: Getting an unsecured business loan can take some time. Lenders will look at your financial documents very carefully to decide if you are a good candidate for the loan. They check your creditworthiness and your ability to repay the loan.

Interest Rates: These loans usually have either fixed or variable interest rates. This affects how much you will pay in total for borrowing the money.

Repayment Period: You can pay back an unsecured business loan over a flexible period, which usually ranges from 1 to 5 years. However, the longer the repayment period, the longer you’ll have to manage the loan.

In summary, unsecured business loans are helpful for businesses that need funds but don’t have assets to use as collateral. Just be aware that the process can be slow and the interest rates can affect your overall costs.

Bill Discounting: A Simple Way to Get Cash Fast

Bill discounting, also called invoice discounting, is a way for businesses to get cash quickly by selling their unpaid invoices to a financial company. Here’s how it works in easy terms:

What Is It?

Imagine your business has sent out invoices to customers, but they haven’t paid yet. Instead of waiting for them to pay, you can sell these invoices to a financial company. The company gives you cash right away, but they keep a small part of the invoice amount as a fee. This fee is the cost of getting the cash sooner.

Why Is It Good?

- Quick Approval: It’s faster to get money this way compared to applying for a regular business loan. The financial company looks at how reliable your customer is and how good your invoices are, not just your business’s credit history.

- No Interest Rates: Instead of paying interest, you just pay a one-time fee. This fee is a percentage of the invoice amount and is easy to understand.

- Short-Term Solution: This method works for a short time, usually up to 90 days. This matches how long it takes for your customers to pay their invoices. It helps you cover immediate cash needs without taking on more long-term debt.

In summary, bill discounting is a straightforward way to get cash quickly by selling your unpaid invoices. It’s a fast, transparent, and short-term financing option.

Advantages of Bill Discounting

Let’s look at why bill discounting is a great choice for many businesses:

Get Cash Quickly

Bill discounting helps you get cash fast. Unlike traditional business loans, which can take a lot of time because of paperwork and credit checks, bill discounting lets you turn your unpaid invoices into cash much quicker.

This can be really helpful if you have sudden expenses, need to pay employees, or need to buy inventory urgently. Plus, getting money quickly can help you take advantage of special deals from suppliers.

Easy Credit Requirements

With regular loans, you usually need a strong credit history to qualify. This can be tough for new businesses or startups that are still building their credit. Bill discounting is different because it focuses more on how reliable your customers are rather than your own credit history.

If your customers are known for paying their bills on time, you can still get cash even if your business doesn’t have a long credit history. This helps businesses that might not qualify for traditional loans.

Focus on Strong Invoices

Bill discounting looks at how strong your invoices are. This means it focuses on how reliable your customers are. By working with dependable clients, you not only make it easier to get cash but also build a good credit reputation.

This is especially useful if you’re in a business where customers take a long time to pay. Even if your customers usually take 60 or 90 days to pay, bill discounting lets you get the money sooner, which helps manage your cash flow better.

Better Cash Flow Management

Bill discounting helps you manage your cash flow more effectively. By turning unpaid invoices into immediate cash, you get a clearer picture of your cash flow.

This makes it easier to plan for future costs, investments, and other needs. Improved cash flow also means you might not need to rely on credit lines or other short-term loans as much, which can save you money on financing costs.

Simple Process

The process of getting bill discounting is usually simpler than applying for traditional loans. You mostly need to provide your unpaid invoices and some basic information about your company.

This easy process saves you time and effort, letting you focus on running your business. Bill discounting providers often have good connections with different industries, so they can make quick decisions based on your invoices and your customers’ reliability.

Also Read: How Bill Discounting Can Help Exporters Like You

Conclusion: Which Is Better For Your Business

Choosing between unsecured business loans and bill discounting depends on your business’s needs. Unsecured business loans offer flexibility but can be slow and involve higher costs. Bill discounting, on the other hand, provides quick access to cash by selling unpaid invoices, with minimal credit requirements and a straightforward process. For businesses with reliable customers and a need for fast cash flow, bill discounting often proves to be a more efficient and transparent solution. Evaluate your options to find the best fit for your financial situation.

Also Read: Export Factoring vs. Bill Discounting: Which Financing Option is Right for You?