[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12066″ img_size=”full” css=”.vc_custom_1707724747806{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Embarking on the global trade stage, India faces a mix of challenges in exporting goods. It’s like navigating through a maze where the paths are economic uncertainties, rule changes, and financial twists. These challenges, known as export finance risks, can throw a curveball to our businesses. From worries about whether our customers will pay on time to the rollercoaster of currency values, and even the rulebook constantly changing – it’s a lot to handle.

So, let’s dive into the world of export finance risks in India. We’ll break down the hurdles exporters face, explore how they impact businesses, and figure out smart ways to tackle these challenges. Get ready for a journey where we unravel the mysteries of global trade and learn how Indian exporters can stay ahead in the game.

Key Takeaways!

- Reduce risk by expanding your customer base across different countries.

- Thorough market research is your best defense against uncertainties.

- Conduct due diligence on counterparts and engage with export promotion agencies for support and guidance.

- Utilize tools like credit insurance and letters of credit to mitigate risks.

- Implement strategies to counter the impact of exchange rate fluctuations.

What is Export Finance?

Export finance refers to the financial activities and instruments involved in supporting and facilitating international trade transactions. It encompasses the various funding, credit, and insurance mechanisms designed to mitigate the risks associated with selling goods and services across borders. Export finance plays a crucial role in enabling businesses, particularly exporters, to navigate the complexities of global trade and expand their reach into international markets.

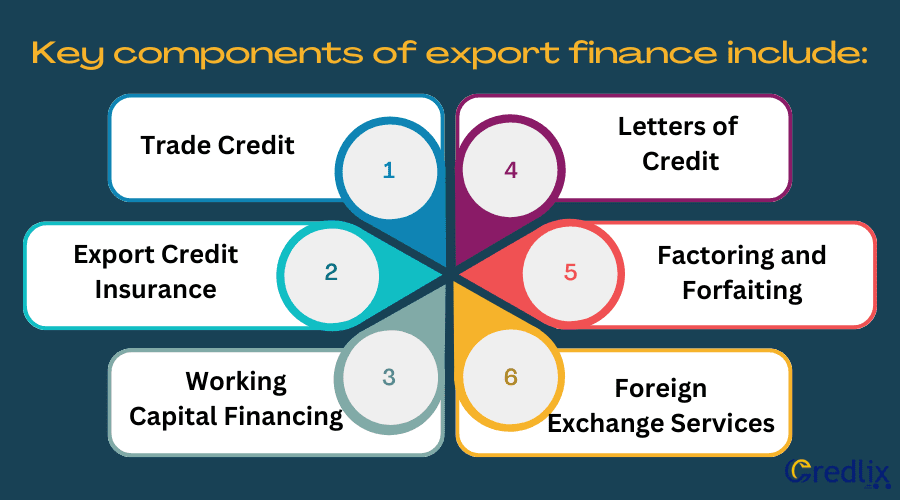

Key components of export finance include:

Trade Credit: Providing credit terms to buyers, allowing them to defer payment for goods or services purchased.

Export Credit Insurance: Protecting exporters against the risk of non-payment by buyers or other credit-related risks.

Working Capital Financing: Ensuring businesses have the necessary funds to cover day-to-day operations, production, and the fulfillment of export orders.

Letters of Credit: A financial instrument issued by a bank that guarantees payment to the exporter upon fulfillment of certain conditions, providing security for both parties.

Factoring and Forfaiting: Techniques to accelerate cash flow by selling accounts receivable or future cash flows at a discount.

Foreign Exchange Services: Managing currency risk by providing tools like forward contracts or currency swaps to mitigate the impact of exchange rate fluctuations.

Export finance is essential for businesses looking to engage in cross-border trade by providing the financial infrastructure needed to overcome challenges such as credit risks, currency fluctuations, and payment uncertainties associated with international transactions.

What Does Export Finance Risk Mean?

Export finance risk refers to the potential challenges and uncertainties that exporters face in the process of conducting international trade transactions. These risks can impact the financial aspects of exporting goods and services to foreign markets. Various factors contribute to export finance risk, and understanding and managing these risks are crucial for the success of international business ventures.

Risk Associated With Export Financing in India

Export finance risk in India refers to the potential challenges and uncertainties associated with financing and conducting international trade transactions. These risks can impact both exporters and financial institutions involved in facilitating export-related activities. Several key export finance risks in India include:

Credit Risk

Credit risk in international trade involves the potential that the buyer or importer might not meet payment obligations. This risk is elevated by factors like economic instability, political uncertainties, and the financial health of the importing country. In cross-border transactions, the likelihood of payment default increases due to the complex interplay of these factors.

Economic fluctuations and political instability in the buyer’s country contribute to the heightened vulnerability of exporters to credit risks, emphasizing the importance of thorough risk assessment and mitigation strategies in the dynamic landscape of global trade.

Example: Imagine an Indian textile exporter excitedly clinching a deal to ship a bulk order of fabrics to a buyer in a politically unstable African nation. The buyer’s country, undergoing economic turmoil and uncertain governance, poses a substantial credit risk. As the shipment traverses continents, political tensions escalate, impacting the buyer’s ability to make payments.

The exporter, navigating through a web of geopolitical uncertainties, faces the real possibility of payment default. This vivid scenario illustrates the intricate dance of economic instability and political unpredictability, underscoring the intricate nature of credit risk in international trade and the strategic acumen needed to navigate such challenging terrain.

Exchange Rate Risk

Exporters confront potential losses when exchange rates fluctuate unfavorably between the initiation of the export transaction and the actual payment receipt. Currency volatility introduces a variable that can significantly impact the profitability of exports.

The ever-changing exchange rates create a dynamic landscape where the financial outcome of international trade transactions is subject to the unpredictable nature of currency markets, emphasizing the need for exporters to employ effective risk management strategies to mitigate the adverse effects of exchange rate fluctuations on their export earnings.

Example: Consider an Indian tech company thrilled to secure a contract with a U.S. firm to provide cutting-edge software. As the project unfolds, the exchange rate between the Indian Rupee and the U.S. Dollar takes an unexpected dive. What seemed like a lucrative deal for the Indian company suddenly becomes less profitable due to the unfavorable exchange rate movement.

The software export, initially a financial triumph, now grapples with diminished returns. This real-life plot twist underscores the unpredictable nature of exchange rate risk, turning what appeared as a golden opportunity into a cautionary tale for exporters navigating global financial currents.

Political and Country Risk

Political and country risk in international trade arise from the potential impact of political instability, shifts in government policies, and economic conditions in the importing country. These factors pose considerable risks as they can hinder the buyer’s ability to fulfill payments, disrupt the overall business environment, and even prompt alterations in trade regulations.

Exporters navigating these uncertainties must be adept at assessing and adapting to the geopolitical landscape, implementing resilient strategies to safeguard their interests amid the dynamic and evolving conditions of the importing country.

Example: Picture an Indian solar energy company securing a contract to install advanced solar panels in a Southeast Asian nation. Midway through the project, a sudden political upheaval occurs, leading to changes in government policies that impact renewable energy initiatives. The importing country, facing economic challenges, alters regulations affecting the contract terms and jeopardizing the project’s viability.

The Indian company, once optimistic about the venture, grapples with unexpected obstacles due to the intersection of political instability, policy shifts, and economic conditions—an illustrative tale highlighting the intricate dance of political and country risk in international business ventures.

Regulatory and Compliance Risk

Exporters face regulatory and compliance risk in international trade, mandated to adhere to diverse international trade regulations, customs prerequisites, and sanctions. Non-compliance with these stipulations can lead to severe legal and financial repercussions.

Navigating the intricate web of global trade regulations requires exporters to maintain a meticulous understanding of the evolving landscape, ensuring stringent adherence to guidelines. The consequences of overlooking these regulations underscore the critical importance of robust compliance frameworks to safeguard against potential legal challenges and financial setbacks.

Example: Imagine an Indian electronics company eager to export state-of-the-art devices to a European market. In their haste, they overlook updated customs regulations governing electronic imports. As a result, the shipment faces unexpected delays and incurs hefty fines at the European customs border.

To make matters worse, the oversight triggers a temporary suspension of the company’s trading privileges, disrupting their established market presence. This cautionary tale vividly illustrates the high-stakes consequences of regulatory and compliance risks, emphasizing the need for exporters to stay vigilant amidst the ever-evolving landscape of international trade regulations.

Market Risk

Market risk in international trade stems from the susceptibility of exported goods to fluctuations in market conditions, demand shifts, and competitive dynamics. Exporters may encounter challenges if there is an abrupt downturn in global demand for their products.

The success of export ventures hinges on the ability to navigate the dynamic nature of international markets, where unforeseen changes can swiftly influence the fate of goods in transit. Exporters must remain agile and responsive to market trends to mitigate the potential adverse impacts of evolving global economic conditions.

Example: Imagine an Indian luxury watch manufacturer aiming to penetrate the North American market with a new collection. Just as the watches make their debut, a sudden shift in consumer preferences towards smartwatches and digital accessories occurs.

The unexpected surge in demand for tech-savvy alternatives leaves the traditional timepieces languishing on shelves. Despite the watches’ exquisite craftsmanship, the exporter grapples with market risk, underscoring the volatile nature of consumer trends and the imperative for exporters to anticipate and adapt swiftly to ever-evolving global market dynamics.

Operational Risk

Operational risk in international trade encompasses challenges linked to the logistics, transportation, and delivery of goods. Potential delays, damage to merchandise during transit, or other operational hiccups can significantly impede the seamless execution of an export transaction.

Exporters grapple with the intricate task of managing the operational intricacies inherent in transporting goods across borders, emphasizing the critical need for meticulous planning, robust logistics solutions, and contingency measures to ensure the successful and timely delivery of products to their intended destination.

Example: Consider an Indian spice exporter gearing up to ship a premium spice blend to a Middle Eastern market renowned for its culinary diversity. As the shipment embarks on its journey, unexpected weather conditions lead to a delay in the scheduled arrival. Upon reaching the destination, the spice containers, exposed to prolonged humidity, suffer quality degradation, jeopardizing the integrity of the export.

This unforeseen operational hiccup not only tests the exporter’s logistical resilience but also highlights the inherent challenges of safeguarding product quality throughout the intricate process of international goods transportation.

Interest Rate Risk

Interest rate risk in export financing arises from the potential impact of fluctuations in interest rates on the cost of financing for exporters. Variations in interest rates have the capacity to influence the overall cost structure of export financing, introducing a dynamic element that exporters must navigate.

As interest rates fluctuate, exporters need to carefully assess and adapt their financing strategies to mitigate the impact on the cost-effectiveness of their export transactions.

Example: Imagine an Indian automobile manufacturer securing a significant contract to export a fleet of electric vehicles to a European buyer. In the midst of production, a sudden spike in global interest rates increases the cost of the financing facility arranged for the export.

The unexpected financial burden places strain on the exporter’s profit margins, challenging the feasibility of the entire venture. This scenario vividly illustrates how interest rate fluctuations can unexpectedly alter the cost dynamics of export financing, emphasizing the importance of financial foresight in global trade endeavors.

Counterparty Risk

Counterparty risk in international transactions emerges when the other party, be it a financial institution or intermediary, faces the potential of defaulting on its obligations. This risk underscores the vulnerability inherent in relying on external entities for the smooth execution of transactions.

Exporters must meticulously evaluate and manage counterparty risk to safeguard against potential financial losses and disruptions in their business dealings, highlighting the importance of due diligence and prudent risk mitigation strategies in international trade.

Example: Picture an Indian tech startup securing a crucial partnership with a European investor to fund their innovative project. Midway through the collaboration, economic challenges in the investor’s country prompt their financial institution to face difficulties.

The unforeseen consequence is the investor defaulting on the agreed funding commitment, leaving the Indian startup in a financial lurch. This real-life example accentuates the tangible impact of counterparty risk, demonstrating how external factors beyond an exporter’s control can unexpectedly disrupt and complicate business agreements in the global arena.

To mitigate these export finance risks, exporters often use various financial instruments, such as letters of credit, export credit insurance, and other trade finance solutions. Additionally, thorough market research, due diligence, and a comprehensive risk management strategy are essential for exporters operating in the international trade environment.

How To Tackle Export Financing Risks in India?

Tackling export financing risks in India involves a comprehensive approach that considers various aspects of international trade. Here are some strategies to mitigate and manage export financing risks effectively:

Diversify Markets: Expand your customer base across different countries to reduce dependence on a single market. Diversification can help balance risks associated with economic and political conditions in specific regions.

Thorough Market Research: Stay informed about the economic, political, and regulatory conditions of target markets. A deep understanding of the business environment in different countries can help anticipate and mitigate potential risks.

Credit Insurance: Invest in export credit insurance to protect against the risk of non-payment by buyers. This provides a safety net in case customers face financial difficulties or political instability affects their ability to pay.

Use Letters of Credit: Request letters of credit from buyers to secure payment. This financial instrument, issued by a bank, ensures that you receive payment upon meeting specified conditions, reducing the risk of non-payment.

Also Read: The Intricacies of Back-to-Back Letters of Credit: A Comprehensive Overview

Currency Hedging: Implement currency hedging strategies to mitigate the impact of exchange rate fluctuations. Forward contracts and currency swaps can help stabilize costs and protect profit margins.

Compliance Management: Stay compliant with international trade regulations and customs requirements. A robust compliance management system reduces the risk of legal and financial consequences associated with regulatory non-compliance.

Due Diligence on Counterparties: Conduct thorough due diligence on your trading partners, including financial institutions and intermediaries. Understanding their financial health and reliability can help assess and mitigate counterparty risks.

Risk-Sharing Agreements: Consider entering into risk-sharing agreements with financial institutions or partners. These agreements can help distribute certain risks and responsibilities, providing a shared approach to managing challenges.

Working Capital Management: Efficiently manage working capital to ensure you have the necessary funds for day-to-day operations and to fulfill export orders. Proper working capital management enhances financial stability.

Engage with Export Promotion Agencies: Leverage the services of export promotion agencies and trade associations that provide support, information, and financial assistance to exporters. These organizations can offer valuable resources and guidance.

By adopting a proactive and multifaceted approach, exporters in India can navigate export financing risks more effectively. It’s essential to continuously monitor and reassess risk factors, adapting strategies to the evolving dynamics of international trade.

Conclusion

In the intricate world of global trade, Indian exporters face a maze of challenges, known as export finance risks. From credit uncertainties to currency roller coasters, navigating these hurdles requires strategic acumen. As we wrap up our exploration, remember that thorough research, diversification, and risk management strategies are your compass. By staying informed, embracing innovation, and building resilient partnerships, Indian exporters can not only weather the storm of export finance risks but also thrive in the dynamic global marketplace.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]