[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12997″ img_size=”full” css=”.vc_custom_1717400738319{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]A letter of credit (LC) is an important document in international trade, particularly when unfamiliarity, geographical distance, and differing legal frameworks and trade customs define the buyer-seller relationship. Among different types of LC, the Irrevocable Letter of Credit (ILOC) is also one part, particularly beneficial for sellers.

In global transactions, where trust may be limited due to geographical and legal disparities, an ILOC assures the seller of payment once the agreed-upon terms are met. Unlike a revocable LC, which permits modifications or cancellations by the buyer without prior notice, an ILOC provides sellers with a greater sense of security and reliability. This assurance is especially crucial when dealing with unfamiliar buyers or navigating complex international trade regulations.

Moreover, an ILOC serves as a catalyst for trade facilitation by mitigating risks for sellers. It acts as a financial instrument, guaranteeing payment upon fulfillment of contractual obligations, thus instilling confidence in sellers to engage in cross-border transactions without uncertainties of payments by buyers. Let’s understand more about it in detail.

Understanding an Irrevocable Letter of Credit

An Irrevocable Letter of Credit (ILOC) offers sellers a firm guarantee of receiving the agreed-upon payment amount from the buyer, precisely as scheduled. True to its name, the ILOC cannot be revoked unilaterally; any modifications require mutual consent from all parties involved. This provides sellers with double assurance, supported by dual-bank guarantees from both the buyer’s and seller’s banks.

Understanding Clean Irrevocable Letters of Credit

A Clean Irrevocable Letter of Credit (LC) enables the beneficiary to draw a bill of exchange without supplementary documentation. This LC type remains irrevocable until the review period starts, offering stability and assurance throughout the transaction process. Unlike traditional LCs, clean LCs streamline the process by eliminating the need for additional paperwork, simplifying transactions for both parties involved. The absence of extra documentation reduces administrative burdens and enhances efficiency, making clean LCs an attractive option for international trade transactions.

Also Read: Diverse Types of Export Letters of Credit

Issuers of Irrevocable Letters of Credit

An Irrevocable Letter of Credit (LC) is typically issued by a commercial bank, serving as a guarantee that the seller will receive the correct payment amount punctually. If the buyer fails to fulfill payment obligations, the bank assumes liability to settle the outstanding amount on their behalf. This commitment provides reassurance to sellers, ensuring timely and complete payment for goods or services rendered. As a result, the involvement of a reputable commercial bank enhances trust and security in international trade transactions.

Terms and Conditions of an Irrevocable Letter of Credit (ILOC)

Here are some terms and conditions of Irrevocable letter of Credit:

- The terms and conditions of an Irrevocable Letter of Credit (ILOC) are fixed and cannot be altered without mutual agreement from all parties involved.

- Stakeholders, including the buyer and seller, must agree on all clauses outlined in the letter, covering various scenarios such as misconduct, fraud, insolvency, etc.

- Provisions regarding responsibilities in case of misconduct or fraud, including security measures, blacklisting, and boycotts, are detailed in the letter.

- Authority for disbursements in different scenarios is defined within the terms and conditions.

- The terms also address timely payments, renewals, settlements, and other obligations.

- Special instances requiring prior consent, such as special deposits, are included in the terms.

- Provisions allow for assumptions, estimates, and allocations in good faith when fulfilling certain requirements.

- The terms specify the possession of goods and acknowledgment of documents in accordance with the credit’s terms and conditions.

How to get an Irrevocable Letter of Credit (ILOC)

To get an Irrevocable Letter of Credit (ILOC), follow the following steps:

Step 1: Contact Your Bank

Initiate the process by contacting your bank and requesting assistance in obtaining an ILOC. Your bank will assign a representative with expertise in international trade or a related field to assist you in meeting your requirements.

Step 2: Avoid Self-Drafting

Avoid attempting to draft an LC independently or replicating templates from others. Doing so may result in legal and financial complications, even minor errors could jeopardize your ability to claim purchased goods.

Step 3: Seek Professional Assistance

While drafting your ILOC might seem cost-effective initially, it can lead to costly repercussions and harm your business in the long run. It is strongly recommended to seek guidance and support from your bank to ensure compliance and mitigate risks effectively.

Also Read: LC at Sight: Meaning & Complete Process

How Does an Irrevocable Letter of Credit work?

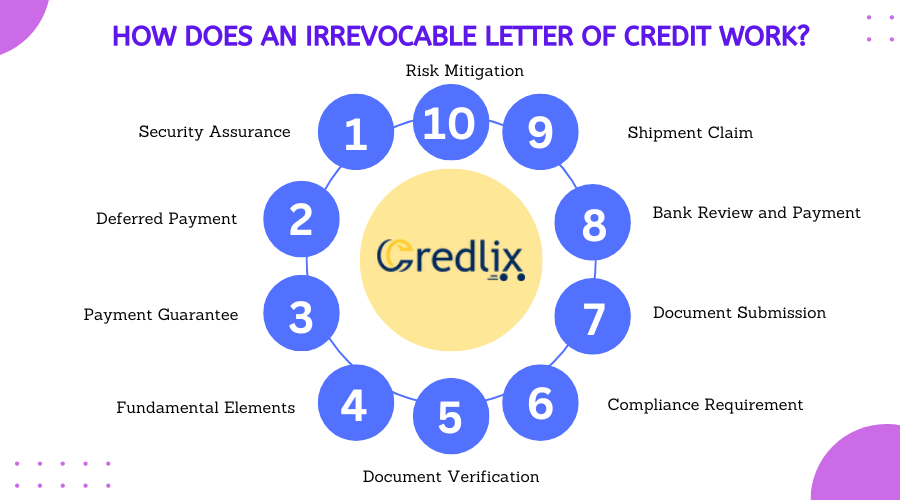

Here’s how an irrevocable letter of credit work:

Security Assurance: An ILOC acts as a safeguard for both buyers and sellers, leveraging the support of their respective banks to ensure the transaction’s integrity and completion.

Deferred Payment: Buyers are not obligated to make payment until the cargo has been shipped, providing assurance that funds are released only when goods are en route or received.

Payment Guarantee: Sellers are guaranteed payment by the bank as long as the conditions outlined in the LC are met, offering financial security for their services or goods.

Fundamental Elements: While the specific terms may vary, the core components of an LC typically include the bank’s assurance of payment, the buyer’s commitment to pay the seller, and the documentation requirements to validate the transaction.

Document Verification: A predefined set of documents is mandated to validate the supply of goods or services, encompassing crucial details such as shipment dates, locations, and the agreed-upon transaction methods.

Compliance Requirement: All documents attached to the LC must adhere strictly to the terms and conditions specified within the letter, ensuring alignment with the agreed-upon transaction terms.

Document Submission: Following the shipment of goods, comprehensive documents detailing the specifics of the shipment are transmitted to the buyer’s bank for thorough review and subsequent payment processing.

Bank Review and Payment: Upon receipt of the shipment documents, the buyer’s bank meticulously evaluates their contents to confirm compliance with LC terms, subsequently facilitating the release of payment to the seller’s bank.

Shipment Claim: Upon successful review and verification of the shipment documents, the seller receives the LC along with any requisite paperwork, enabling them to claim payment upon the arrival of the shipment.

Risk Mitigation: While an LC offers a layer of security for both parties involved, it does not entirely eliminate risks. Both the buyer and seller must diligently ensure compliance with the LC terms to mitigate any potential complications and uphold the guarantee of payment.

Cost of Irrevocable Letters of Credit

Irrevocable Letters of Credit (ILOCs) typically incur costs ranging from 1% to 2% of the contract amount. The exact cost varies based on factors such as the type of ILOC, customer credit history, tenure, safeguarding clauses, and the selected bank’s margin.

For instance, if a seller requests a $100,000 credit with the buyer covering 10%, the ILOC amount would be $10,000. Assuming a 2% cost rate, the ILOC cost would amount to $200.

Also Read: The Intricacies of Back-to-Back Letters of Credit: A Comprehensive Overview

Conclusion

Irrevocable Letters of Credit (ILOCs) play a pivotal role in international trade, offering security and assurance to both buyers and sellers. With stringent terms and conditions, professional assistance, and adherence to compliance requirements, ILOCs facilitate seamless transactions while mitigating risks. Despite associated costs, the peace of mind and financial security provided make ILOCs indispensable tools for global commerce, ensuring smooth operations and fostering trust among trading partners.

Also Read: Standby Letter of Credit (SBLC): Grasping Its Meaning, Varieties, and Operational Mechanism[/vc_column_text][vc_column_text]In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]