[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12925″ img_size=”full” css=”.vc_custom_1715928571651{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In the world of shipping, just like international traders have to deal with many charges, shippers also have their own expenses. One of these is the Bunker Adjustment Factor (BAF), an extra cost to cover the ups and downs of fuel prices. Depending on the deal between the shipper and carrier, BAF might be included in the freight charge or added separately.

Also called the Fuel Adjustment Factor, BAF considers how fuel prices change and the costs of running the ship. By taking these factors into account, BAF helps work out a more accurate shipping cost, making things clearer for both shippers and carriers in the complex world of shipping.

What is BAF?

BAF, or the Bunker Adjustment Factor, is a component of shipping costs calculated per twenty-foot equivalent unit (TEU), varying depending on the trade route. It reflects the fluctuating expenses attributed to fuel costs in shipping operations.

The starting of the International Maritime Organization’s (IMO) 2020 regulations prompted the adoption of eco-friendly technologies to mitigate pollution from large container ships. Measures like the global sulfur cap, limiting sulfur emissions to 0.5% from the previous 3.5%, were introduced to address environmental concerns.

To comply with these regulations, shipping companies incur higher expenses, either through technology upgrades or cleaner fuel procurement. BAF is the mechanism through which these additional costs are passed on to shippers.

While the implementation of IMO regulations has stirred curiosity and raised questions within the shipping industry, BAF remains a critical aspect of shipping operations, reflecting the impact of regulatory changes on fuel-related costs.

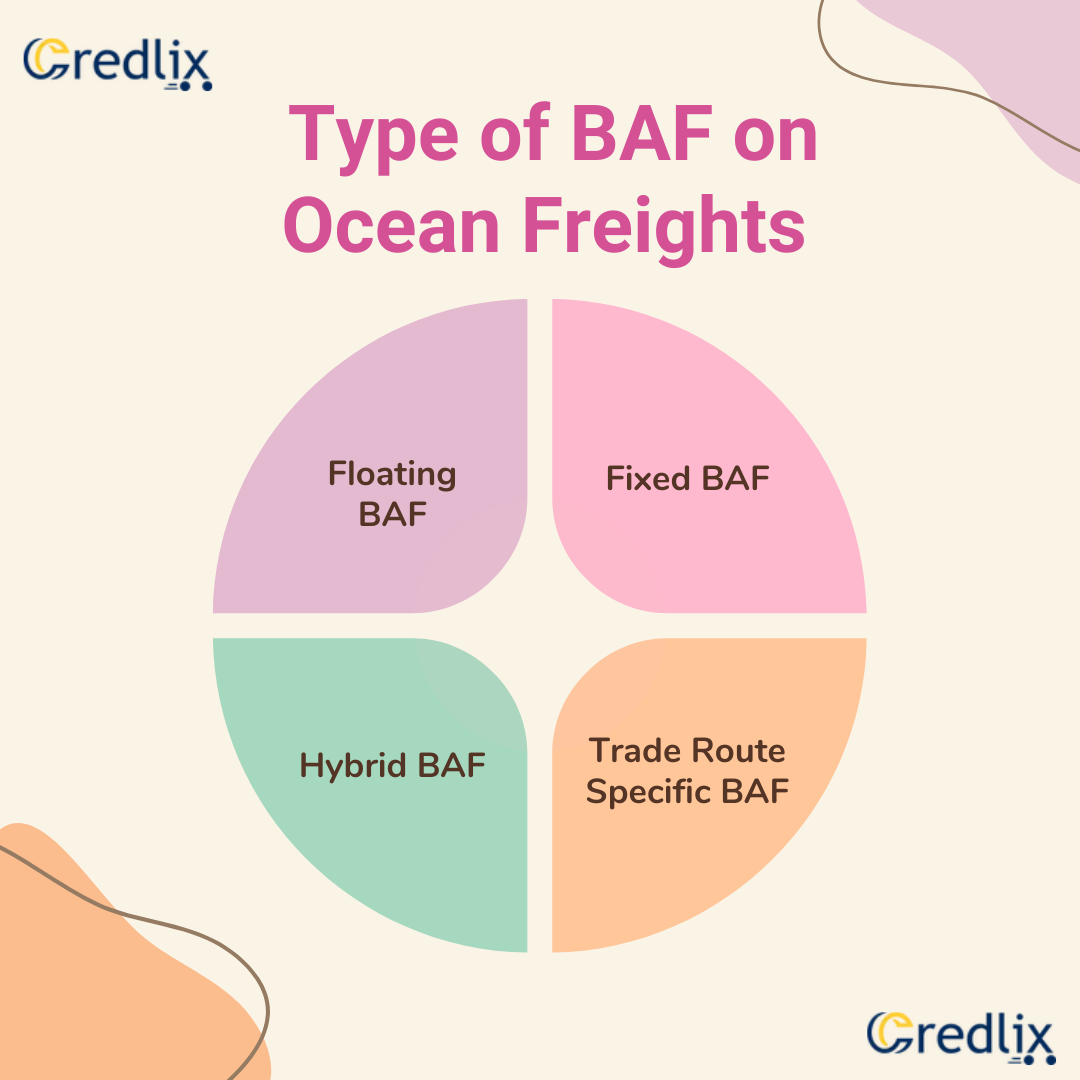

Type of BAF on Ocean Freights

Bunker Adjustment Factor (BAF) is a component of ocean freight charges that accounts for the fluctuating costs of fuel used by vessels. There are several types of BAF mechanisms used in the shipping industry, each with its own method of calculation and application. Let’s explore some common types:

Floating BAF

- Floating BAF is directly tied to the current market prices of fuel. This means that the BAF rate changes periodically in line with fluctuations in fuel prices.

- For example, if the market price of fuel increases, the BAF rate applied to a shipment will also increase. Conversely, if fuel prices decrease, the BAF rate will decrease accordingly.

- This type of BAF offers flexibility but can result in uncertainty for shippers as they may not know the exact BAF rate until closer to the shipment date.

Fixed BAF

- Fixed BAF, also known as a bunker surcharge, is a predetermined rate that remains constant for a specific period, regardless of changes in fuel prices.

- For instance, a shipping company may announce a fixed BAF rate for a quarter or a year, providing stability and predictability for shippers.

Fixed BAF rates are often based on average fuel prices over a certain period, allowing shipping lines to hedge against fuel price volatility.

Hybrid BAF

- Hybrid BAF combines elements of both floating and fixed BAF. It typically consists of a base rate that remains fixed for a set period, with adjustments made periodically based on changes in fuel prices.

- For example, a shipping line may set a fixed BAF rate for six months, with adjustments every month or quarter to account for fluctuations in fuel prices.

- Hybrid BAF offers a balance between stability and responsiveness to fuel price changes, providing some predictability while still reflecting market conditions.

Trade Route Specific BAF

- Some shipping lines apply BAF rates that vary depending on the specific trade route or geographic region.

- For instance, routes with longer distances or higher fuel consumption may have higher BAF rates compared to shorter routes.

- Trade route-specific BAF allows shipping lines to align BAF charges more closely with the actual fuel consumption and costs incurred on different routes.

Each type of BAF has its advantages and considerations for both shipping lines and shippers. Understanding the nuances of BAF mechanisms can help shippers anticipate and manage freight costs effectively in the dynamic environment of international shipping.

Who Issues the Bunker Adjustment Factor?

Bunker Adjustment Factor (BAF) rates are determined autonomously by individual shipping companies. However, the European Commission maintains vigilant oversight, closely monitoring these rates in relation to fuel prices to ensure fair and transparent pricing within the industry.

How to Calculate BAF?

Bunker Adjustment Factor (BAF) calculation in shipping is diverse, with each shipping line employing its unique formula, typically subject to monthly or bimonthly adjustments. To tackle concerns regarding transparency, many carriers have opted to disclose their calculation methodologies. For instance, Maersk Line, Limited, simplifies its BAF calculation using a formula that incorporates total fuel consumption, transit time, ship capacity, and a utilization factor.

Conversely, Hapag-Lloyd calculates BAF based on fuel price per tonne and fuel consumption relative to carried TEUs. Both approaches ensure flexibility and price security for carriers while addressing criticisms of opacity in BAF determination.

BAF = (Total fuel consumption x transit time) / (ship’s total capacity) x utilization factor

On the other hand, Hapag-Lloyd uses the following formula to calculate BAF:-

BAF = Fuel price per tonne x Fuel consumption in tonne/ Carried TEU

Note: Both these methods are based on flexible BAF and provide specific price security to the carriers.

The Impact of IMO 2020 on BAF and Shipping Operations

IMO 2020 signifies a landmark regulation aimed at mitigating global pollution by reducing emissions. Enacted on January 1, 2020, this directive mandates stringent controls on emissions through the compulsory implementation of the Data Collection System (DCS) by the International Maritime Organization (IMO).

In compliance, shipping lines globally are compelled to invest in technologies to minimize sulfur emissions, incurring additional costs. Consequently, shipping costs have surged either through logistical tariffs or the adoption of low sulfur fuel, prompted by the necessity to adhere to the new regulations.

Furthermore, it’s necessary to adjust BAF charges to match the new fuel prices if shipping companies choose low sulfur fuel. This means that IMO 2020 directly affects BAF rates worldwide, requiring changes to adapt to the changing rules.

Conclusion

The Bunker Adjustment Factor (BAF) is a crucial component in the realm of shipping, reflecting the dynamic nature of fuel costs and regulatory changes. The introduction of IMO 2020 has significantly impacted BAF rates globally, necessitating adjustments to align with the new regulations. Understanding BAF mechanisms and the influence of regulatory mandates is essential for navigating the complexities of international shipping operations effectively.

Also Read: LCL Shipments in Logistics and Shipping : Meaning, Costs and More[/vc_column_text][vc_column_text]In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]