[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11970″ img_size=”full” css=”.vc_custom_1706770417938{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In India, small businesses have many ways to get money for their work. One good choice for these companies is something called “debt factoring.” Debt factoring helps new businesses by changing the money they will get in the future into cash they can use right away.

Here’s how it works: A company sells its invoices (which are like bills for its services) to another company at a lower price. This other company is called a “factor.” The selling company gets quick cash, and the factor gets the money from the invoices later. This trick helps small businesses keep their money flowing and handle money challenges.

In our discussion, we’ll explore more about debt factoring and how it can be a useful tool for these growing businesses.

What is Debt Factoring?

Starting a new business brings excitement, but it also comes with the challenge of managing money wisely. Thankfully, there are helpful tools for entrepreneurs, and one such tool is “debt factoring” or “invoice factoring.” Let’s break it down in simpler terms.

Imagine you’re a new business owner, and you’ve done some work for a client. Great! They owe you money, but here’s the thing – you need that money now to keep your business running smoothly. This is where debt factoring comes to the rescue.

Debt factoring is like a financial superhero for businesses. Here’s how it swoops in to help: When you send an invoice to your client, instead of waiting for them to pay you later, a debt factoring company steps in. They buy your invoice from you, giving you some money upfront. It’s not the full amount, but it’s quick cash that you can use right away. Now, the debt factoring company takes on the responsibility of collecting the full payment from your client.

In simple terms, it’s a bit like getting a friend to cover you when you urgently need some money. They help you out by giving you part of the cash you’re waiting for, and they deal with collecting the rest from your client. This way, your business keeps moving, and you don’t have to worry about waiting for payments.

For young businesses, managing working capital (the money needed for day-to-day operations), ensuring the business keeps running, and making sure the balance sheets (financial statements) and cash flows stay positive are big priorities. Debt factoring steps in as a reliable ally, ensuring that businesses can quickly access the money tied up in their unpaid invoices and continue their journey towards success.

Do Businesses Need Debt Factoring? If Yes, Why?

Here are some of the reasons why Businesses need debt factoring:

- Debt factoring relieves businesses from the burden of chasing clients for timely payments.

- The process involves an approval stage, leading to a formal debt factoring agreement upon verification.

- Companies receive 80–90% of the invoice value from the debt factoring company.

- This upfront payment helps businesses address pressing financial needs without waiting for full client payments.

- The debt factoring company disburses the remaining 10-20% (minus any fee) once the customer settles the full amount.

- The acquired cash offers flexibility for various crucial business expenses.

- It can be used to purchase additional stock, ensuring a steady supply of goods.

- Meeting utility bills, such as electricity, becomes manageable with the cash acquired through debt factoring.

- Employee salaries can be promptly covered, contributing to a positive work environment.

- Businesses can invest in necessary equipment, enhancing operational efficiency.

- The process minimizes the impact of delayed payments on overall cash flow.

- Debt factoring serves as a financial tool, empowering businesses to navigate daily operations seamlessly.

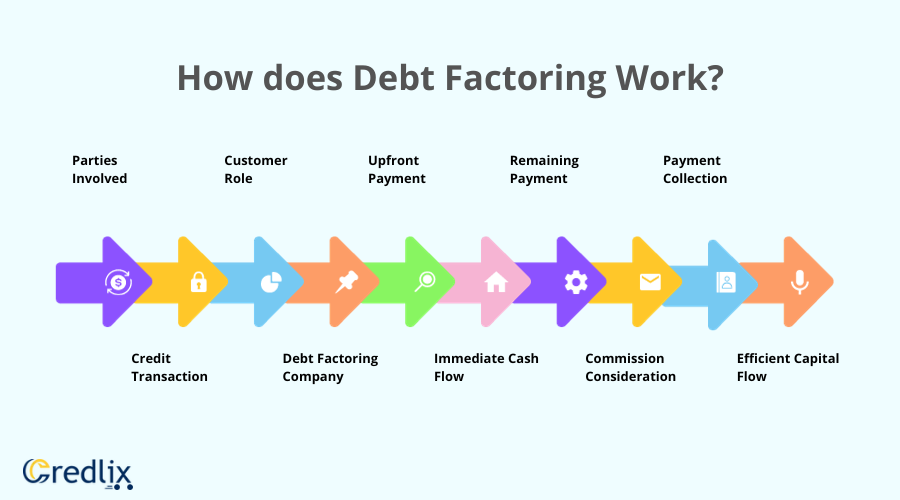

How does Debt Factoring Work?

Understand how debt factoring works:

Parties Involved: Debt factoring includes a business (seller), a customer (buyer), and a debt factoring company (third party).

Credit Transaction: The business sells its products or services on credit, allowing customers to pay at a later agreed-upon date.

Customer Role: The customer, who bought the goods or services, becomes responsible for making the payment.

Debt Factoring Company: This third party steps in, collecting payment from the customer and purchasing the original invoice from the business.

Upfront Payment: After verifying the invoice, the debt factoring company pays the business a substantial portion, often around 80% of the initial amount owed by the customer.

Immediate Cash Flow: This upfront payment provides immediate cash to the business, enhancing working capital without waiting for the full payment.

Remaining Payment: Once the debt factoring company collects the full payment from the customer, it releases the remaining 20% to the business, minus any factoring commission or fee.

Commission Consideration: The debt factoring company deducts a fee for its services, ensuring it covers its costs.

Payment Collection: The debt factoring company takes on the responsibility of following up with customers to ensure timely payment, freeing the business from this task.

Efficient Capital Flow: By avoiding the typical delay of waiting for two to three months for full payment, debt factoring facilitates a smoother and more efficient working capital flow for businesses.

Debt Factoring With an Example

Let’s understand debt factoring with a simple example:

Business Transaction: Imagine you own a small business that sells electronic gadgets. You have a client, XYZ Electronics, who regularly buys gadgets from you on credit.

Invoice Issued: After delivering a batch of gadgets to XYZ Electronics, you issue an invoice for $10,000, specifying the payment terms as 60 days.

Decision to Factor: Instead of waiting for 60 days to receive the full payment, you decide to use debt factoring. You approach a debt factoring company to help speed up your cash flow.

Verification Process: The debt factoring company reviews the invoice, checks the creditworthiness of XYZ Electronics, and approves the debt factoring arrangement.

Upfront Payment: The debt factoring company pays your business a significant portion upfront, let’s say 80% of the $10,000 invoice value. So, you receive $8,000 immediately.

Responsibility Shift: The debt factoring company now takes on the responsibility of collecting the full $10,000 from XYZ Electronics when the payment is due in 60 days.

Remaining Payment: After collecting the full amount from XYZ Electronics, the debt factoring company deducts its fee, let’s say 2%, and pays you the remaining $2,000.

Benefits for Your Business: Your business gains immediate access to $8,000, helping you cover operational expenses, purchase new stock, or address any pressing financial needs.

Efficiency and Risk Mitigation: Debt factoring not only accelerates your cash flow but also transfers the risk of delayed payments to the debt factoring company, allowing you to focus on your business without worrying about collection issues.

Debt factoring is a financial strategy that enables businesses to convert their outstanding invoices into immediate cash, facilitating smoother operations and mitigating the challenges associated with delayed payments.

Who Can Use Debt Factoring?

Small and medium-sized businesses use debt factoring as a smart way to manage their money flow. It’s like a tool to get quick cash when they need it. Debt factoring is especially helpful for these businesses if they want to grow and deal with short-term money challenges.

But, before businesses go to a debt factoring company to get fast cash, it’s crucial for them to know everything about how debt factoring works and what it can do for them. Understanding these details helps businesses make the right decisions for their financial needs.

Factors Affecting Debt Factoring Value

Know about some factors that affect debt factoring value:

Bill Amount: The value of debt factoring is influenced by the total amount of bills involved in the process.

Client Credit Standing: The creditworthiness of the business’s clients plays a significant role in determining the value of debt factoring.

Business Sector: The industry or sector in which the business operates can impact the value of debt factoring.

Overall Business Health: The general financial health of the company is a crucial factor affecting the value derived from debt factoring.

Fees Associated with Debt Factoring

Wondering how much fees are attached to debt factoring? Here’s a brief explanation:

Advance Fee: This is a percentage of the upfront cash that the company receives. It is a crucial factor in debt factoring.

Financing Cost (Rate): Ranging between 1.5% and 4% monthly, this cost is associated with the financing provided through debt factoring.

Average Rates and Advances

Rates: Typically falling between 1.5% and 4% per month.

Advances: Averaging between 75% and 85% of the total invoice amount, providing an immediate injection of cash for the business.

Advantages of Debt Factoring

Here are some of the major advantages of Debt Factoring:

Improved Cash Flow: Debt factoring provides an immediate infusion of cash by converting outstanding invoices into readily available funds, enhancing the business’s cash flow.

Quick Access to Funds: Unlike traditional financing methods, debt factoring offers a swift and efficient way to access working capital, helping businesses address immediate financial needs.

Reduced Bad Debt Risk: By transferring the responsibility of collecting payments to the factoring company, businesses mitigate the risk of bad debts and late payments, improving overall financial stability.

Flexible Financing: Debt factoring is a flexible financing option that grows with the business. As sales increase, the amount available through factoring also increases, supporting business expansion.

Focus on Core Operations: Outsourcing receivables management to the factoring company allows businesses to concentrate on core operations without the distraction of chasing outstanding payments.

Credit Protection: Factoring companies often offer credit protection services, safeguarding businesses from losses due to customer insolvency or non-payment.

No Additional Debt: Debt factoring doesn’t create additional debt on the balance sheet, making it an attractive option for businesses looking to avoid traditional loans.

Enhanced Negotiating Power: With improved cash flow and financial stability, businesses may negotiate better terms with suppliers, potentially securing discounts for early payments.

Facilitates Growth: The immediate availability of funds through debt factoring facilitates business growth by supporting investments in inventory, equipment, and other expansion initiatives.

Efficient Receivables Management: Debt factoring streamlines the receivables process, reducing the administrative burden on businesses and ensuring timely payments for improved financial planning.

Disadvantages of Debt Factoring

With advantages, understand some disadvantages of Debt Factoring to make a wiser choice:

Costly Financing: Debt factoring often comes with higher costs compared to traditional forms of financing, with fees and discount charges reducing the overall value of the invoices.

Impact on ProfitMargins: The fees associated with debt factoring can eat into the company’s profit margins, affecting the overall financial performance.

Loss of Control: Businesses relinquish control over the collection process as the factoring company takes charge, potentially impacting customer relationships and communication.

Potential Customer Perception: Customers may view businesses that use debt factoring as financially unstable, potentially affecting their trust and long-term relationships.

Limited Eligibility: Not all invoices may be eligible for factoring, limiting the flexibility of this financing method and requiring businesses to carefully choose which invoices to factor.

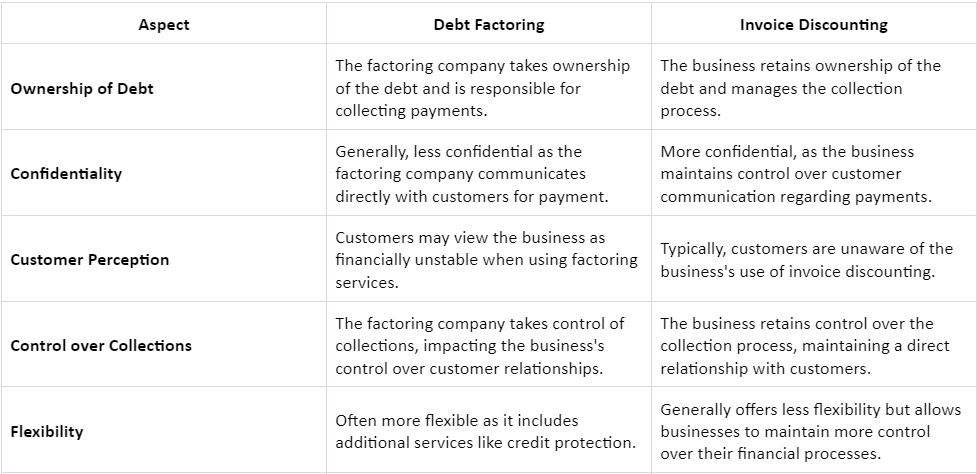

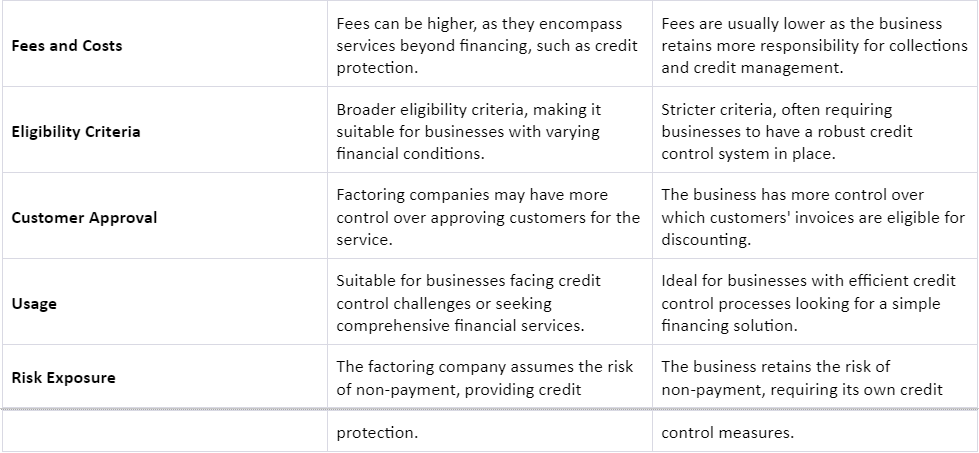

Difference Between Debt Factoring & Invoice Discounting

For those of you who are unaware of the difference between debt factoring and invoice discounting, here’s an understanding of it.

Should You Opt For Debt Factoring?

Small and medium-sized businesses often turn to debt factoring to quickly improve their cash flow when facing short-term financial challenges. If your business aims to grow rapidly and needs a solution for temporary cash flow issues, debt factoring could be a helpful choice.

Still, it’s essential to weigh the advantages and disadvantages of debt factoring. Before seeking quick cash from a debt factoring company, make sure to understand all the details and services they provide to ensure it aligns with your business needs.

Also Read: The Role of Export Factoring in Improving Cash Flow for Exporters[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]