[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11981″ img_size=”full” css=”.vc_custom_1706864233857{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Export Credit Risk Insurance serves as a crucial shield for businesses venturing into the global market, offering a safety net against the uncertainties associated with international trade. Imagine a scenario where a company sells goods or services abroad and faces the risk of non-payment due to various factors like political instability, economic crises, or buyer insolvency.

This is where Export Credit Risk Insurance steps in, providing a financial safeguard against potential losses. It’s like a safety harness for businesses spreading their wings internationally, ensuring that they don’t suffer financially if unforeseen circumstances impact their overseas transactions. This insurance mechanism not only encourages businesses to explore new markets but also fosters confidence by mitigating the uncertainties that often accompany cross-border trade.

Let’s delve into the intricacies of Export Credit Risk Insurance and understand how this financial safety net works to bolster international business endeavors.

What is Export Credit Risk Insurance?

Export credit insurance in India serves as a protective shield for exporters by safeguarding their receivables. This insurance tool offers exporters assurance that they will receive the owed amount from their foreign customers. In situations where the foreign customer or bank is unable to pay due to political, commercial, or other reasons, the insurance steps in, covering a portion of the assured value.

In India, the Export Credit Guarantee Corporation Limited (ECGC) is the key provider of export credit insurance. ECGC, established in 1957 by the Government of India, offers an open cover for credit insurance, making it a mandatory requirement. The primary objective of the ECGC policy is to boost trade in the country by providing credit risk insurance and associated services to exporters.

Operated under the Ministry of Commerce, the Export Credit Guarantee scheme (ECGC) has a board comprising members from the Reserve Bank of India (RBI), the government, and individuals from the banking, export, and insurance sectors. This collaborative effort ensures effective support and risk mitigation for Indian exporters.

How Export Credit Insurance Helps Exporters?

Here’s how export credit insurance helps exporters in multiple ways:

Comprehensive Export Risk Coverage: Export credit insurance provides a robust shield against various risks associated with international trade.

Timely Revenue Recovery: With a credit insurance policy, exporters can confidently rely on the timely recovery of sales revenue, eliminating concerns about non-payment.

Efficient Credit Risk Management: The insurance policy streamlines credit risk management and assessment, saving valuable time for exporters to concentrate on business development and growth.

Flexibility in Credit Terms: Export credit insurance allows exporters the flexibility to adjust credit periods and credit lines as needed, providing adaptability in response to market dynamics.

Enhanced Business Development: By freeing exporters from the burden of credit risk concerns, the insurance empowers them to focus on strategic business development initiatives.

Increased Credit Periods: Exporters can extend credit periods to buyers, encouraging new clients to engage in business and existing buyers to make larger purchases.

Expanded Credit Lines: The flexibility provided by credit insurance enables exporters to increase credit lines when necessary, accommodating the evolving needs of the business.

Sales Boost: Ultimately, export credit insurance contributes to increased sales by fostering a conducive environment for both new and existing buyers, promoting business growth and sustainability.

How does Export Credit Insurance Work?

The process involves obtaining credit insurance to bolster confidence in exploring new markets, mitigating risks, receiving support in debt recovery, and facilitating smoother arrangements for export finance.

Obtaining Export Credit Insurance: As an exporter, securing export credit insurance is crucial for various reasons.

Market Exploration with Confidence: Credit insurance serves as a safety net, enabling exporters to confidently explore opportunities in new markets. With coverage often extending up to 95% of your raised invoices, the insurance provides a cushion for taking calculated risks and venturing into new territories without excessive concerns about potential losses.

Risk Mitigation: Export credit insurance companies not only provide financial backup but also offer additional benefits. These include valuable guidance and information on debts and customers, strengthening your risk management strategy.

Debt Recovery Support: In the event of non-payment, credit insurance companies offer support in debt recovery. This assistance can be instrumental in navigating challenges and ensuring a smoother financial recovery process.

Boosting Export Finance: Having credit insurance enhances your credibility when seeking export finance. Lenders are more inclined to provide financial support when they know your invoices are covered, as this reduces the perceived risk associated with the transaction.

Easier Financing: The assurance provided by credit insurance makes arranging export finance more straightforward. Lenders are more willing to extend financial support, recognizing the reduced risk when your business is backed by credit insurance.

Advantages of Export Credit Insurance

Here are some of the benefits of export credit insurance:

Expand to New Markets: Export credit insurance provides a safety net that allows businesses to confidently expand into new markets. The assurance of payment protection encourages exploration of diverse markets, fostering international business growth.

Protect Accounts: With credit insurance in place, exporters safeguard their accounts from the risk of non-payment. This protection ensures that businesses receive payment for their goods or services even if the foreign buyer faces financial difficulties or other unforeseen circumstances.

Security of Cash Flow: Export credit insurance contributes to a steady and secure cash flow by mitigating the impact of payment defaults. This financial stability is crucial for businesses to operate smoothly and meet their ongoing operational expenses.

Tax Benefits: In many jurisdictions, premiums paid for export credit insurance may be eligible for tax benefits. This financial incentive encourages businesses to invest in credit insurance, providing an additional layer of protection against potential losses.

Minimize Bad Debts: Export credit insurance minimizes the risk of bad debts by covering a significant portion of the insured value. This minimization is vital for maintaining financial health and avoiding substantial losses due to non-payment or insolvency of foreign buyers.

Disadvantages of Export Credit Insurance

Here are some of the disadvantages of export credit insurance:

Limits Certain Actions: Some export credit insurance policies may impose restrictions or limitations on certain business actions. These could include specific credit terms, trade practices, or market choices, limiting the flexibility of exporters in their operations.

Not Available for High-Risk Accounts: Export credit insurance may not be readily available or cost-effective for high-risk accounts or markets. Insurers might be hesitant to provide coverage in situations where the risk of non-payment is deemed too high, leaving exporters exposed in certain scenarios.

Possibility of Default and Bad Faith: Despite having export credit insurance, there is still a possibility of default by the insurer in cases of bad faith or insolvency. Businesses must carefully review the terms and conditions of their policy to understand the extent of coverage and potential limitations.

Does Not Cover Non-Payment Situations: Export credit insurance may not cover all non-payment situations, particularly if they are not explicitly outlined in the policy. It’s essential for exporters to be aware of the specific terms and conditions to avoid misunderstandings regarding the scope of coverage.

Understanding ECGC’s Export Credit Insurance Scheme and Its Significance in International Trade

Explore ECGC’s Export Credit Insurance, a crucial safeguard enhancing confidence and mitigating risks in global trade.

Multifaceted Functions: ECGC, or Export Credit Guarantee Corporation, has various roles within the realm of export credit risk management.

Risk Insurance Products: ECGC’s main job is to provide different insurance products that protect exporters from losses and bad debts that might occur during exports.

Coverage for Banks and Institutions: ECGC extends export credit insurance cover to banks and financial institutions, allowing them to offer trade-risk coverage to exporters.

Overseas Investment Insurance: The Corporation supports Indian companies venturing into international joint ventures, providing insurance for equity or loans through its overseas investment insurance.

Guidance to Exporters: ECGC offers guidance to exporters, including credit rating-based information about different countries, aiding them in making informed decisions.

Facilitating Export Finance: ECGC’s coverage can help exporters secure export finance from banks and financial institutions, such as Bank Export Credit.

Debt Recovery Assistance: ECGC assists exporters in recovering debts, helping navigate the complexities of international trade transactions.

Checking Creditworthiness: The Corporation plays a role in assessing the creditworthiness of overseas customers, ensuring exporters engage in secure transactions.

Comprehensive Support: ECGC’s support spans various aspects of export activities, providing a comprehensive safety net for businesses.

Risk Management: Its primary focus is on managing and mitigating risks associated with export credit, safeguarding businesses from financial uncertainties.

Encouraging International Ventures: By offering overseas investment insurance, ECGC encourages Indian companies to explore and engage in international collaborations.

Trade Facilitation: ECGC’s insurance cover facilitates smoother trade by reducing the impact of potential losses, fostering confidence in the export business.

Export Finance Facilitation: The Corporation’s involvement in export credit insurance eases the process of securing finance, supporting the financial needs of exporters.

No GST on Premiums: Importantly, there is no Goods and Services Tax (GST) payable on insurance premiums, providing a cost benefit for businesses utilizing ECGC’s services.

What is the Cost of Export Credit Insurance?

The cost of export credit insurance is usually a percentage of your total invoices or accounts receivable. This percentage varies depending on transaction terms and the country of operation. It’s a flexible and crucial investment to safeguard your international trade transactions, ensuring financial protection against potential losses.

ECGC’s Export Credit Insurance for Indian Exporters

Understand ECGCs export credit insurance for Indian exporters:

Additional Services:

- Export factoring facilities for MSMEs

- Insurance cover for buyer’s credit and line of credit

- Overseas investment insurance

- Customer-specific covers

- Setting up of a national export insurance account for medium- and long-term exports

ECGC offers a diverse range of credit risk insurance products to support exporters and their banks.

Also Read: Understanding ECGC Insurance: Protection for International Trade

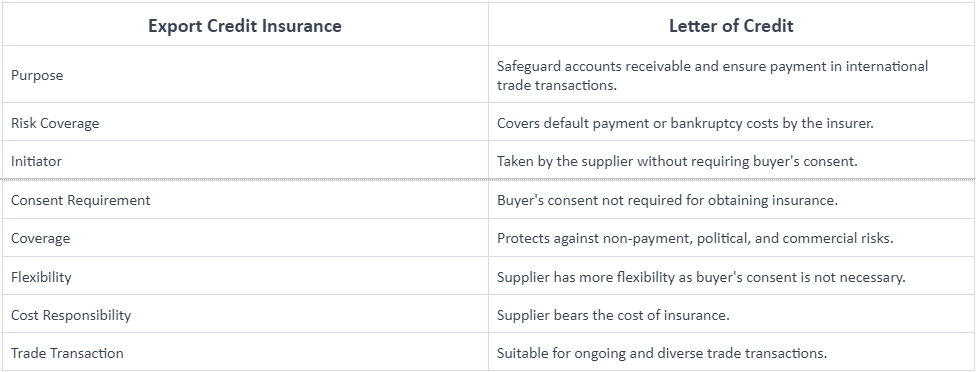

Export Credit Insurance vs Letter of Credit

If you want to know the difference between credit insurance and letter of credit, here’s a brief comparison for you:

Export credit insurance is chosen by suppliers to protect against payment risks without requiring buyer consent, while a letter of credit is opted for by buyers to secure transactions, involving buyer’s consent for each trade proceeding.

Conclusion & Pro-Tips on Export Credit Risk Insurance

Some pro-tips for a more informed choice:

Maintain Adequate ECGC Account Balance: Always ensure sufficient funds in your ECGC account to cover shipments for the upcoming month/quarter.

Leverage ECGC Database for Background Checks: Utilize the ECGC database to conduct background checks on potential buyers. Check for any adverse experiences exporters or ECGC may have had with them.

Assess Maximum Policy Liability: Ensure that the maximum liability of your policy is substantial enough to cover all outstanding dues at any given time. Notably, no GST is applicable on EPCG premium.

Proactive Premium Management: Proactively manage your ECGC premium to guarantee a practitioner’s guide for export payments, promoting financial stability in your transactions.

Financial Prudence in Coverage: Exercise financial prudence in determining the extent of coverage needed, aligning it with your business’s ongoing and future financial commitments.

Adapt to Changing Business Needs: Regularly reassess and adjust your ECGC account and coverage based on changing business dynamics and evolving trade scenarios.

Stay Informed for Informed Decisions: Stay informed about your ECGC premium, policy limits, and the database insights to make well-informed decisions, ensuring a secure and risk-mitigated approach to international trade.

Also Read: ECGC – Export Credit Guarantee Corporation of India: Safeguarding Exporters` Interests[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]