[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12067″ img_size=”full” css=”.vc_custom_1707723660559{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Global trade is like the backbone of today’s economy. It helps businesses from all over the world work together and grow. But making sure everything goes smoothly when trading across borders often means using some special financial tools. One important tool is export financing, and it plays a big role in making international trade happen.

In this blog, we’re going to talk about how export finance is really important in international trade. We’ll also look at the main options businesses have for export financing and why it’s a good thing for them.

Understanding Export Finance in International Marketing

Export financing in global business means using financial solutions to make it easier for companies to sell their goods and services worldwide. It’s like a helpful toolkit for international trade, including different money tools. Export finance makes it simpler for businesses to trade across borders, helps them grow, makes the economy stronger, and brings the world markets together.

Imagine you’re a company in one country, and you want to sell your products to people in other countries. Export financing is like having special financial tools that make this process smoother. It’s not just about getting paid; it’s a whole set of ways to make sure everything works well when you’re doing business globally. So, when we talk about export finance, we’re talking about the financial help that makes international trade easier, boosts businesses, strengthens the economy, and connects the global market.

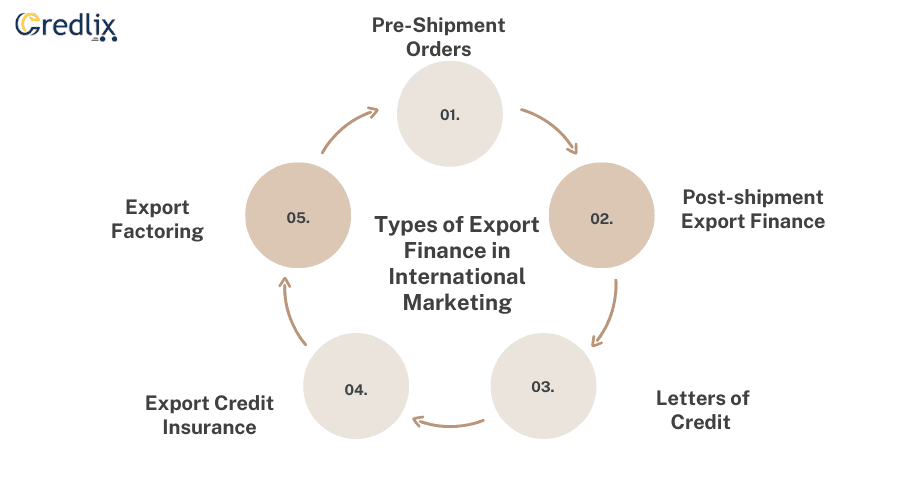

Types of Export Finance in International Marketing

In global trade, having easy access to export financing is super important. These tools help businesses deal with the challenges of international commerce, lower risks, and make the most out of the global marketplace.

There are different options for export financing, like export credit insurance, letters of credit, export factoring, or export financing loans. Businesses can pick the one that fits them best to support their international trade efforts. So, it’s like having a toolbox of financial solutions to make sure businesses can navigate the world of global trade smoothly.

Pre-Shipment Orders

Pre-shipment Export Finance is a valuable support system for exporters, offering funds before they deliver goods to international buyers. This financial assistance is crucial for fulfilling orders, managing day-to-day expenses, and staying competitive in the global market. By providing funds upfront, this tool ensures that exporters have the financial resources required to prepare and ship goods to their international customers.

With Pre-shipment Export Finance, exporters can confidently take on orders, knowing they have the necessary financial backing to cover production and shipping costs. This proactive approach not only helps in meeting customer demands promptly but also strengthens the exporter’s position in the global marketplace. Essentially, it acts as a financial safety net, empowering exporters to navigate the complexities of international trade with confidence and efficiency.

Post-shipment Export Finance

Post-shipment Export Finance plays a crucial role in supporting exporters after they’ve shipped goods to international buyers. This type of financing provides options for exporters to manage their finances effectively in the period between shipping the goods and receiving payment. It serves as a bridge, ensuring a stable cash flow and helping exporters meet their financial responsibilities.

Once the goods have been shipped, exporters often face a waiting period until they receive payment. Post-shipment export finance addresses this gap, offering financial solutions that can include factors like invoice discounting of export bill collection. By leveraging these options, exporters can navigate the time lag between shipment and payment, allowing them to continue their operations smoothly and enhance their financial flexibility in the competitive world of global trade. In essence, post-shipment export finance is a vital tool for exporters to sustain their financial health and stay resilient in the international market.

Letters of Credit

Letters of Credit (LCs) serve as a trusted payment method in international trade, benefiting both exporters and importers. Essentially, an LC is a document issued by a bank, representing the importer and assuring the exporter of a secure payment process. This financial tool outlines specific conditions under which the bank commits to pay a predetermined amount to the exporter.

For an exporter to receive payment through an LC, they must fulfill the precise terms and conditions stipulated in the document. This ensures that the transaction proceeds smoothly and both parties are protected. The use of letters of credit adds a layer of security to international transactions, reducing the risks associated with cross-border trade. In essence, LCs provide a reliable framework for financial transactions, fostering trust and facilitating smoother exchanges in the complex landscape of global commerce.

Export Credit Insurance

Export Credit Insurance stands as a robust defense for businesses, shielding them from the uncertainties associated with non-payment risks during international trade. When businesses export goods, they encounter potential challenges tied to the creditworthiness of foreign buyers or political instability in the buyer’s country. In such scenarios, Export Credit Insurance acts as a crucial safeguard, offering protection against financial losses.

The primary function of Export Credit Insurance is to provide assurance to exporters that they will receive payment, even if the foreign buyer faces difficulties and defaults on their payment. This insurance coverage acts as a financial safety net, allowing businesses to explore global markets with confidence, knowing they are protected against unforeseen risks. By mitigating the impact of non-payment, Export Credit Insurance contributes to the stability and resilience of businesses engaged in international trade.

Export Factoring

Export Factoring provides a practical financing solution for businesses engaged in international trade. In this arrangement, a business sells its accounts receivable, which are the amounts owed by customers, to a factoring company at a discount. In return, the business receives immediate cash, facilitating a quicker and more predictable cash flow.

This financing option is particularly advantageous for exporters who often engage in credit sales, where customers are allowed to pay at a later date. Export Factoring enables businesses to convert their accounts receivable into readily available cash, providing them with the financial flexibility to cover immediate expenses, invest in growth, or navigate unforeseen challenges. By accelerating the conversion of receivables into liquid assets, export factoring becomes a valuable tool for exporters seeking to enhance their financial agility in the dynamic landscape of global trade.

Benefits of Export Finance in International Marketing

Here are some of the benefits of export financing in international marketing:

Working Capital Boost

Export finance provides crucial Working Capital Support for international trade, offering solutions like export factoring and finance loans. These tools help businesses bridge the gap between production and payment, ensuring smooth operations by meeting financial needs at key stages.

Risk Mitigation in Export

Export finance tools address payment default, currency fluctuations, political instability, and logistical challenges associated with international trade. By minimizing risks, these tools instill confidence in exporters, fostering exploration of global markets.

Export Finance for Market Expansion

Businesses aiming to broaden their market reach find export finance essential. Venturing into foreign markets demands substantial investments, and export finance becomes a valuable resource, offering the financial support required to explore new territories.

This not only facilitates market diversification but also reduces dependency on a single market. By embracing export finance, businesses enhance their resilience to economic fluctuations and market-specific risks, fostering a more robust and sustainable approach to global market expansion.

Regulatory Compliance in International Trade

With various regulations and compliance requirements in international trade, from customs procedures to export controls, businesses face a complex landscape. Export finance experts, knowledgeable in these regulations, play a crucial role in guiding businesses.

Their expertise ensures that transactions align with legal and regulatory standards, minimizing the risk of legal complications and potential fines. By seeking guidance from export finance experts, businesses can confidently navigate the intricate web of international trade regulations, fostering smoother transactions and avoiding legal pitfalls.

Export Finance in Foreign Exchange Management

Effectively managing foreign exchange risk is pivotal in international trade, where exchange rate fluctuations can impact export transaction profitability. Export finance tools, including forward contracts and currency hedging, empower businesses to shield themselves from unfavorable exchange rates. By utilizing these tools, businesses enhance stability, ensuring predictability in financial outcomes and safeguarding profit margins.

This strategic approach to foreign exchange management through export finance becomes a valuable asset for businesses engaged in global trade, providing a shield against the uncertainties of currency fluctuations and contributing to overall financial resilience.

Expand Globally with Credlix

Empower your global expansion with Credlix, experts in facilitating cross-border transactions. Whether it’s sales on open accounts, letters of credit, or documentary collections, we specialize in streamlining the process. Overcoming short-term cash flow hurdles is seamless with Credlix—we offer a solution by purchasing your company’s account receivables and providing an advance of up to 95% of the total invoice value. Fuel your international growth confidently with Credlix at your side.

Final Words

Export finance emerges as a cornerstone in the realm of international marketing, playing a pivotal role in facilitating seamless global trade. The diverse array of financial tools, including pre-shipment and post-shipment financing, letters of credit, export credit insurance, and export factoring, collectively empowers businesses to navigate the complexities of cross-border transactions. These tools not only mitigate risks associated with payment default, currency fluctuations, and political instability but also provide a robust financial infrastructure for market expansion and regulatory compliance.

The benefits of export finance extend beyond immediate financial support, offering a strategic approach to working capital management, risk mitigation, market diversification, and foreign exchange stability. As businesses increasingly strive to explore new territories and diversify their markets, export finance stands as an indispensable ally, fostering resilience and sustainability in the dynamic landscape of international trade. By embracing export finance, businesses can confidently expand their global footprint, strengthen their financial health, and contribute to the interconnected and thriving world of global commerce.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]