[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12123″ img_size=”full” css=”.vc_custom_1708066363846{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Factoring serves as a secure avenue for businesses to secure essential funds for purposes like expansion, diversification, and meeting supply demands. This financing method has gained recent popularity, particularly in India with the Trade Receivables Discounting System (TReDS) regulated by the Reserve Bank of India (RBI). Notably, TReDS witnessed substantial growth, soaring from Rs. 11,165 crore in FY20 to Rs. 34,362 crore in FY22.

Breaking down the concept, factoring involves businesses obtaining funds against their accounts receivable. It has become a preferred choice for companies seeking to address working capital gaps. The appeal of factoring lies in its reliability as a financial tool, supporting businesses in managing their cash flow effectively.

In terms of costs associated with factoring, businesses typically incur charges for the service. These costs vary and may include fees for credit checks, interest rates, and discount fees. Despite the expenses, many businesses find the benefits of improved cash flow and timely access to funds outweighing the associated costs.

There are different types of factoring arrangements available to businesses, allowing them to choose a structure that aligns with their specific needs. Factoring solutions can be recourse or non-recourse, depending on the level of risk a business is willing to assume. Recourse factoring implies that the business retains responsibility for any unpaid invoices, while non-recourse factoring transfers this risk to the factor.

What is Factoring in Finance?

Factoring in finance is a form of funding in which a financial entity, known as a factor, acquires a business or seller’s debt or outstanding invoice. The factor purchases the accounts receivable at a discounted rate, and the buyer then makes the payment directly to the factor, who is responsible for collecting the full invoice amount.

This financing method serves as a valuable resource for small businesses, providing them with access to funds for everyday operations, expansion, and diversification. It simplifies the process for exporters, enabling them to unlock funds trapped in the supply chain and expedite cash flow. Additionally, by selling their accounts receivable, businesses not only gain immediate funds but also transfer the associated debt, ensuring guaranteed payment.

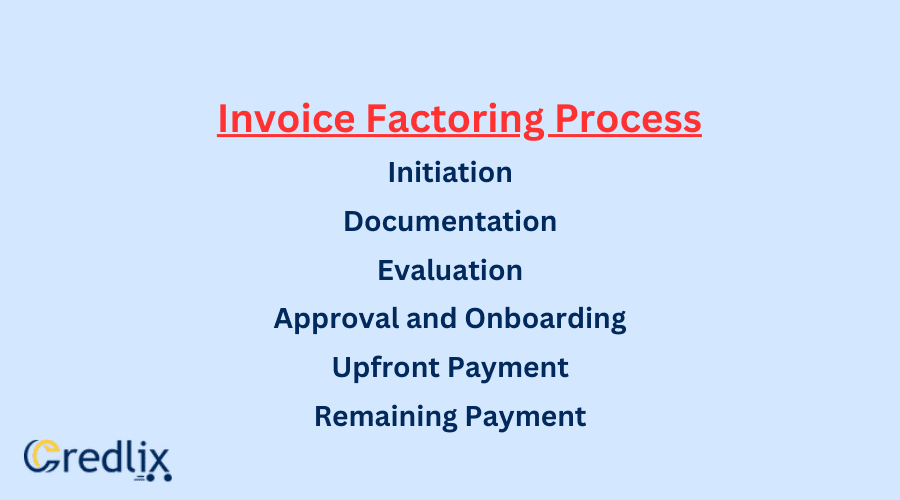

Invoice Factoring Process

A typical procedure of factoring an invoice looks somewhat like this:-

Initiation: The seller or supplier, in need of immediate cash, approaches the factor.

Documentation: The factor requests basic details, typically including KYC information in India, to assess background and company history.

Evaluation: The factor examines the company’s financials, shipment history, and the buyer’s purchasing track record to either approve or disapprove the application.

Approval and Onboarding: Upon approval, the borrowing company may join the factoring platform, entering buyer details and factoring invoices as needed.

Upfront Payment: The factor provides an upfront payment, usually 80%-90% of the invoice value, to the seller.

Remaining Payment: After the financial institution receives the payment, the factor disburses the remaining amount to the seller after deducting necessary charges.

Example of Factoring in Finance

Imagine a small manufacturing business that lands a substantial $100,000 order from a reputable client but grapples with cash flow constraints due to the client’s standard 60-day payment terms. Urgently needing funds for day-to-day operations, raw materials, and efficient order fulfillment, the business turns to factoring for a solution.

They approach a factoring company, presenting details of the $100,000 invoice. After assessing the business’s financial health, client credibility, and invoice legitimacy, the factoring company approves the application. The manufacturing business is then boarded onto the factoring platform, where they input client and invoice details.

The factor provides an upfront payment, typically around 85% of the $100,000 invoice value ($85,000), allowing the business to address immediate financial needs. The client eventually pays the $100,000 invoice directly to the factoring company within the 60-day period.

After deducting their fees and charges from the remaining 15% of the invoice value ($15,000), the factoring company transfers the balance ($15,000) to the manufacturing business. This practical example showcases how factoring enables businesses to bridge cash flow gaps, access crucial funds, and fulfill significant orders without being constrained by extended payment terms.

Types of Factoring in Finance

Here are some of the types of Factoring in Finance

Recourse Factoring

Recourse factoring involves the selling of invoices to a factor with the business retaining the risk of non-payment. If the client fails to pay, the business must repurchase the debt.

Non-Recourse Factoring

In contrast, non-recourse factoring shifts the risk of non-payment from the business to the factor. If the client defaults, the factor absorbs the loss, providing added security to the business.

Advance Factoring

Advance factoring provides an upfront payment, typically 70-90% of the invoice value, helping businesses access immediate funds for operations and growth.

Disclosed Factoring

In disclosed factoring, the client is aware of the arrangement, and the factor directly collects payments from them, maintaining transparency in the financial transactions.

Undisclosed Factoring

Undisclosed factoring keeps the client unaware of the factoring arrangement, as the factor collects payments in the business’s name, preserving client relationships.

Maturity Factoring

Maturity factoring involves the factor advancing funds based on the maturity date of the invoice, offering flexibility in managing cash flow according to business needs.

Invoice FactoringA broad term encompassing various factoring types, invoice factoring involves selling outstanding invoices to a factor, unlocking immediate cash for the business.

Domestic Factoring

Domestic factoring deals with transactions within a single country, providing financial solutions for businesses operating domestically.

Export Factoring

Export factoring caters to businesses involved in international trade, offering financing solutions for cross-border transactions and mitigating risks associated with global trade.

Reverse Factoring

Reverse factoring, or supply chain financing, involves the factor financing the payables of the business, ensuring smooth operations within the supply chain and facilitating early payments to suppliers.

Also Read: Types of Export Factoring

Pros of Factoring in Finance

Factoring in finance offers several advantages for businesses, making it a popular financing option:

Improved Cash Flow

Factoring provides immediate cash by converting accounts receivable into funds, addressing short-term liquidity needs and ensuring smoother business operations.

Quick Access to Funds

Businesses can access funds swiftly, avoiding the delays associated with traditional financing methods, which is crucial for meeting urgent financial requirements.

Flexible Financing

Factoring is adaptable to the business’s needs, allowing them to factor invoices selectively, providing flexibility in managing cash flow and financing arrangements.

No Additional Debt

Unlike loans, factoring does not create debt on the balance sheet. It’s a transaction based on existing assets (receivables), minimizing the financial risk for the business.

Risk Mitigation

In non-recourse factoring, businesses transfer the risk of non-payment to the factor, providing protection against bad debts and improving financial stability.

Outsourced Credit Management

Factoring companies often handle credit checks and collection services, reducing the administrative burden on businesses and enhancing efficiency.

Enhanced Working Capital

By accelerating the collection of receivables, factoring increases working capital, enabling businesses to invest in growth opportunities, pay suppliers promptly, and cover operational costs.

Business Growth Support

Factoring supports expansion by providing the necessary funds for marketing, inventory purchase, and other growth-related activities, contributing to overall business development.

Maintained Customer Relationships

In disclosed factoring, where customers are aware of the arrangement, the factor’s professionalism in managing collections helps maintain positive client relationships.

Suitable for Small Businesses

Factoring is particularly beneficial for small businesses with limited access to traditional financing, offering them a practical solution to bridge cash flow gaps and facilitate growth.

Cons of Factoring in Finance

While factoring in finance offers several advantages, it also comes with some drawbacks that businesses should consider:

Costs and Fees

Factoring involves fees and discount charges, which can be higher compared to traditional loans. Businesses must carefully assess the cost implications.

Impact on Profit Margins

The fees associated with factoring can eat into the company’s profit margins, affecting overall profitability.

Limited Funding Amount

The amount a business can receive through factoring is tied to its accounts receivable, potentially limiting the availability of funds compared to other financing options.

Dependency on Customer Creditworthiness

In recourse factoring, where the business retains the risk, the financial stability of customers becomes crucial. If clients default, the business must buy back the debt.

Loss of Control

Factoring involves third-party intervention in the collection process, potentially affecting the relationship between the business and its customers.

Reputation Concerns

In undisclosed factoring, where the client is unaware, customers might view the involvement of a third party negatively, leading to concerns about the financial health of the business.

Not Suitable for All Industries

Factoring may not be the best fit for businesses in industries where long payment cycles are standard practice, as the costs may outweigh the benefits.

Complex Contracts

Factoring agreements can be complex, and businesses must carefully review and understand the terms and conditions to avoid any unforeseen complications.

Risk of Non-Payment in Recourse Factoring

In recourse factoring, if customers do not pay, the business assumes the risk and may face financial challenges.

Alternative Financing Availability

Depending solely on factoring might limit the exploration of other potentially more cost-effective financing options. Businesses should evaluate all available avenues before committing to factoring.

Factoring Transactions: An Insight into Accounting Treatment

When considering a factoring solution from an accounting standpoint, companies follow a structured approach. Initially, the seller records the initial sale of receivables in their annual balance sheet. This involves accounting for the factoring costs and sales discounts associated with the transaction.

To illustrate, let’s take the example of company ‘A,’ which has Rs. 1 crore in outstanding accounts receivable and seeks funds through factoring. The approved financier agrees to factor in the receivables with the following charges:

A 3% finance charge

A 20% reserve on the gross accounts receivable

Rs. 1 lakh for collected cash + Rs. 50,000 as other fees.

While the business manages allowances, resolves disputes, and prepares product shipments, the factor identifies sales discounts and charges the costs associated with them. The business receives Rs. 70 lakhs in cash and records a loss on sale, reflecting the 3% financing fee.

From an accounting perspective, the factor now owns the receivable accounts. The accountant adjusts the entries, shifting the receivables from the entry for the gross receivable amount to the factor. The business then records ‘Due from factor’ as an asset, representing the reserve amount. This meticulous accounting treatment ensures transparency and accuracy in reflecting the financial impact of the factoring solution.

Costs Associated With Factoring in Finance

Factoring in finance comes with various costs that businesses should carefully consider:

Discount Fees: Factoring companies charge discount fees, typically a percentage of the total invoice value, as compensation for advancing funds before the actual payment is received.

Finance Charges: Businesses may incur finance charges, representing the cost of borrowing against the accounts receivable. These charges are usually a percentage of the invoice amount.

Service Fees: Factoring companies may impose service fees for managing the receivables, handling collections, and providing ongoing financial services.

Due Diligence Fees: Some factors charge due diligence fees for assessing the creditworthiness of the business, its clients, and the overall risk associated with factoring.

Reserve Amount: In recourse factoring, a portion of the invoice value is held as a reserve. This reserve amount, typically a percentage of the total invoice, is not advanced upfront and is released after the client pays.

Collections Costs: Businesses might be responsible for covering collections costs if the factor does not fully handle the collection process.

Termination Fees: Contracts with factoring companies may include termination fees if the business decides to end the factoring arrangement before the agreed-upon period.

Administrative Costs: There can be administrative costs associated with managing the factoring process, including paperwork, documentation, and communication between the business and the factor.

Sales Discounts: Businesses may offer sales discounts to their clients as an incentive for early payment. The cost of these discounts is a consideration when factoring.

Interest on Advances: If the factor provides an advance on the invoice value, there might be interest charges on the borrowed amount until the client pays.

Understanding these costs is crucial for businesses evaluating the feasibility of factoring as a financing option. Each cost should be carefully examined to assess its impact on the overall financial health and profitability of the business.

Final Note

Factoring in finance emerges as a dynamic solution for businesses seeking quick access to funds. Despite its advantages, careful consideration of associated costs, potential impact on profit margins, and industry suitability is essential. The intricate accounting treatment underscores the need for transparency in reflecting financial transactions.

As businesses navigate this financing avenue, a balanced evaluation of alternatives and a strategic approach to factoring can optimize its benefits, ensuring a tailored fit for unique financial needs. Ultimately, factoring remains a valuable tool for enhancing cash flow, supporting growth, and addressing short-term financial challenges.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]