[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”11498″ img_size=”full” css=”.vc_custom_1702356066003{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]Did you know that the global economy relies on the swift and secure movement of goods across borders? In this interconnected world, international trade is the lifeblood of economies, and facilitating it demands cutting-edge solutions. One such pivotal element in the realm of cross-border commerce is ICEGATE, a technological marvel that streamlines and accelerates the customs clearance process.

Let’s understand what ICEGATE is and how it works in detail.

What is ICEGATE?

ICEGATE (Indian Customs and Central Excise Electronic Commerce/Electronic Data Interchange (EC/EDI) Gateway) is a transformative force shaping the future of customs procedures in India. It is an online portal developed by the Central Board of Indirect Taxes and Customs (CBIC) in India. It facilitates the electronic exchange of trade-related information and documents between customs authorities, traders, and other stakeholders involved in international trade.

With a staggering 8,500 registered users, ICEGATE operates as a dynamic online gateway, colloquially referred to as the “ice gate portal.”

According to statistics, ICEGATE plays a pivotal role in supporting more than 6.72 lakh exporters and importers. The platform is intricately connected with 15 types of partners collaborating with Customs EDI to seamlessly transmit messages. This interconnected network significantly expedites the customs clearance process, underscoring ICEGATE’s efficiency in facilitating international trade.

This sophisticated e-commerce platform plays a pivotal role in the nation’s customs landscape, offering a comprehensive suite of services to both cargo and trade carriers. Functioning on the principles of electronic filing, ICEGATE facilitates seamless transactions and communications between stakeholders, leveraging the power of EC/EDI technology. This not only expedites the customs clearance process but also enhances accuracy by minimizing the risk of manual errors associated with traditional paperwork.

Beyond its technological prowess, ICEGATE stands as a cornerstone of the country’s customs department, serving a diverse clientele. Whether you’re a business involved in the intricate web of international trade or a carrier navigating the complexities of cargo logistics, ICEGATE is the digital ally streamlining processes and fostering a more efficient, transparent, and user-friendly customs experience. Welcome to a future where innovation meets international trade, courtesy of ICEGATE’s unwavering commitment to excellence.

How Does ICEGATE Work?

ICEGATE operates as a digital gateway, revolutionizing the traditional customs clearance process through its seamless and efficient functionalities. Leveraging Electronic Data Interchange (EDI) technology, ICEGATE facilitates the secure exchange of information between traders and customs authorities. Users initiate the process by logging onto the ICEGATE portal, where they can access a range of services. The platform streamlines document submission, reducing manual paperwork and minimizing errors.

Upon submission, ICEGATE generates unique identifiers and real-time updates, ensuring transparency in transaction statuses. The system employs two-factor authentication, using One-Time Passwords (OTPs) sent to registered email IDs and mobile numbers, adding an extra layer of security. With its user-friendly interface and technological prowess, ICEGATE simplified customs procedures, expediting the clearance process and contributing to the efficiency of international trade operations.

How to Register for ICEGATE?

Embarking on the ICEGATE registration journey is a straightforward process, composed of user-friendly steps designed for ease. Follow these simple guidelines to successfully register:

Step 1: Log In to the ICEGATE Portal

Begin by accessing the ICEGATE portal through your web browser.

Step 2: Locate the Registration Link

On the homepage, find the registration link to initiate the sign-up process. Click on the ‘Simplified Registration’ link.

Step 3: Input and Verify Information

Enter and verify crucial details such as Importer Exporter Code (IEC), Goods and Services Tax Identification Number (GSTIN), and the temporary password sent by the portal.

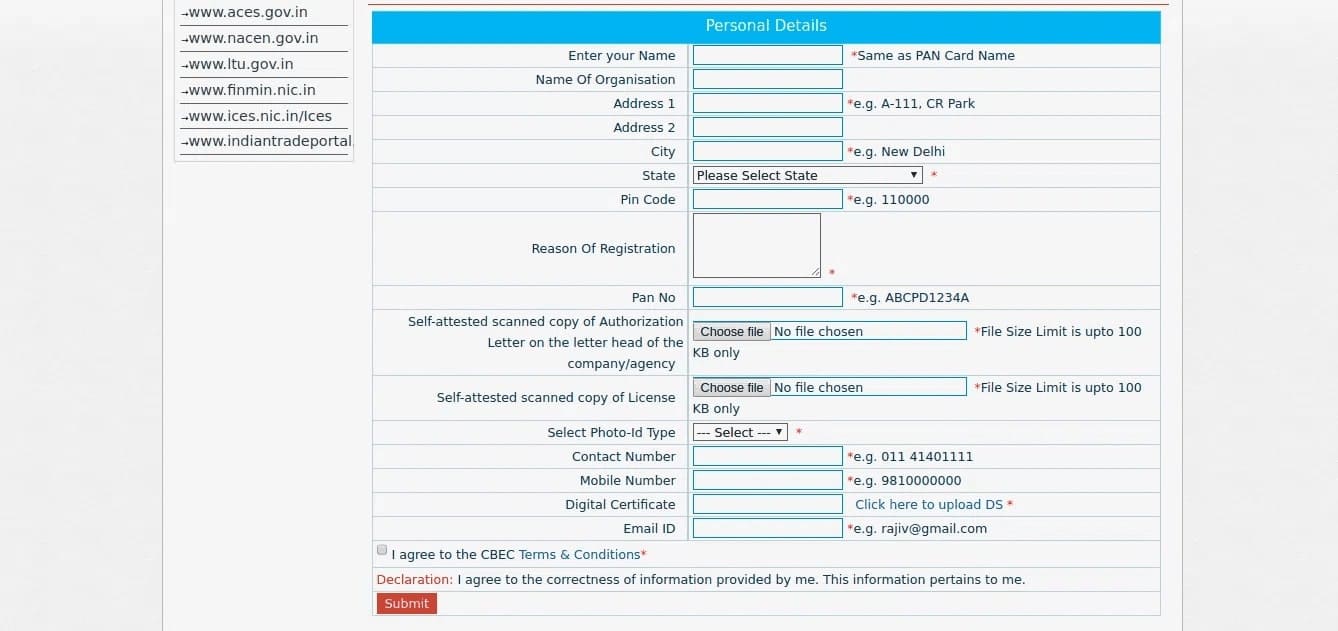

Step 4: Complete the Registration Form

Provide necessary information and fill out the registration form with accuracy.

Step 5: Enter ICEGATE ID and Password

Input the unique ICEGATE ID and password provided during the registration process.

Step 6: Receive and Input OTPs

Two different One-Time Passwords (OTPs) will be generated and sent to the applicant’s registered email ID and mobile number.

Step 7: Verify OTPs

Enter the valid OTPs received to validate and complete the registration process.

Step 8: Review Details and Finish

Carefully review the entered details and click on the ‘Finish’ button to successfully conclude the registration.

Should applicants wish to modify details or the registered email ID, they can utilize the “Click Here” link. Subsequently, an alternative email ID and mobile number can be provided, and an OTP will be sent to the alternative email ID to facilitate the necessary changes.

Completion of the registration process involves the submission of required documents for a comprehensive and seamless experience.

Documents Required for ICEGATE Registration

Here’s a list of documents required for ICEGATE registration:

- Aadhaar Card

- Voter ID Card

- Driving License

- Passport

- Authorisation Letter

- License or Permit

- Authorisation to F Card or G Card

- Authorisation Letter or Order of Commissioner

Reasons to Register with ICEGATE

Registering with ICEGATE isn’t just a formality; it’s a strategic move towards a more streamlined and efficient trade experience. Here’s why you should consider registering:

Online Document Filing

ICEGATE registration opens the door to filing essential documents like the Bill of Entry and shipping bills seamlessly through the online platform.

Comprehensive Transaction Capability

A single ICEGATE registration provides the capability to transact through any Electronic Data Interchange (EDI) customs port, ensuring versatility in trade operations.

Efficient Customs Transactions

Gain access to a centralized platform that streamlines customs transactions, making the process smoother and more efficient.

Notably, registration with ICEGATE is essential for various critical processes, including:

Export General Manifest (EGM)

Facilitating smooth and organized export processes.

Import General Manifest (IGM)

Simplifying and expediting import-related transactions.

Consol Manifest

Ensuring a consolidated and efficient approach to manifest processes.

Export and Import

Covering a spectrum of trade activities, ICEGATE registration becomes the gateway to a comprehensive trade ecosystem.

In essence, ICEGATE registration isn’t just about compliance; it’s a strategic decision that unlocks the full potential of online trade facilitation, offering a seamless and integrated approach to customs processes.

Different Services offered by ICEGATE

Discover the array of user-friendly services that ICEGATE brings to the forefront, elevating your international trade experience:

IPR Registration

Seamlessly register online for Intellectual Property Rights (IPR) through the ICEGATE platform.

IE Code Status Verification

Effortlessly verify the status of your Importer Exporter (IE) code, ensuring a smooth trade process.

Document Tracking at Customs EDI

Stay informed in real-time by tracking the status of your documents at Customs EDI through the user-friendly interface.

E-Payment of Customs Duties

Simplify financial transactions with the convenience of an E-payment gateway for custom duties.

IGST Refund Processing

Avail yourself of services for the smooth processing of Integrated Goods and Services Tax (IGST) refunds.

License Verification Online

Verify Duty Entitlement Pass Book (DEPB), Export Promotion Capital Goods (EPCG) licenses, and more through a hassle-free online process.

PAN-based Data Search

Swiftly search and retrieve data using the Permanent Account Number (PAN) feature on ICEGATE.

Customized Website Redirection

Enjoy the convenience of ICEGATE redirecting users to websites relevant to Customs business, creating a centralized hub for information.

Round-the-Clock Services

Access ICEGATE services 24/7, ensuring flexibility and convenience for users navigating the intricacies of international trade.

Experience a world where ICEGATE isn’t just a gateway; it’s a comprehensive suite of services, simplifying and enhancing every aspect of your international trade endeavors.

Click here for information: www.icegate.gov.in

Advantages of ICEGATE

The advantages of utilizing ICEGATE in the realm of international trade are manifold, offering a range of benefits to businesses and stakeholders. Here’s a concise breakdown of the key advantages:

Efficiency Boost

ICEGATE significantly enhances operational efficiency by modernizing and automating customs procedures. The reduction in paperwork and streamlined processes accelerates the entire clearance timeline, saving valuable time and resources for businesses.

Transparency in Transactions

The platform ensures a transparent exchange of information through electronic means, minimizing the chances of errors associated with traditional paperwork. This transparency not only fosters trust among stakeholders but also contributes to the accuracy of data transmission.

Convenient Online Services

ICEGATE’s online services revolutionize the way businesses interact with customs procedures. Document tracking, e-payment of customs duties, and real-time status verification are easily accessible, providing businesses with a user-friendly and convenient experience.

Enhanced Accuracy

Leveraging the power of Electronic Data Interchange (EDI), ICEGATE significantly reduces manual data entry errors. This results in a more precise and error-free customs clearance process, minimizing the potential for discrepancies that could lead to delays or complications.

Comprehensive Information Access

ICEGATE empowers users with comprehensive access to essential information by enabling data searches through PAN. This feature ensures quick and efficient retrieval of crucial data, facilitating informed decision-making for businesses engaged in international trade.

24/7 Accessibility

The round-the-clock availability of ICEGATE services ensures that businesses can engage with customs procedures at any time. This flexibility caters to the diverse needs and timelines of businesses involved in international trade, providing uninterrupted access to critical services.

Wide User Base

With a substantial user base of over 6.72 lakh exporters and importers, ICEGATE has become a cornerstone of the trade community. The widespread adoption of the platform underscores its reliability and effectiveness in meeting the diverse needs of businesses engaged in international trade.

Strategic Partnerships

ICEGATE’s integration with 15 types of partners collaborating with Customs EDI creates a robust network for efficient message transmission. These strategic partnerships contribute to seamless communication and collaboration, enhancing the overall effectiveness of customs processes.

Accelerated Customs Clearance

Perhaps the most crucial advantage, ICEGATE plays a pivotal role in expediting customs clearance. The platform ensures a smoother and faster flow of goods across borders, reducing bottlenecks and facilitating timely deliveries for businesses engaged in international trade.

In essence, ICEGATE emerges as a digital ally, providing a suite of advantages that collectively contribute to a more streamlined, transparent, and efficient international trade experience.

ICEGATE Advantages with Credlix

ICEGATE serves as a valuable resource for traders, cargo carriers, and individuals associated with the Customs Department, offering the ability to track material locations and monitor bill statuses. This valuable information can be leveraged by businesses to their advantage. Utilizing the insights provided by ICEGATE, businesses can consider Credlix’s invoice discounting services to address their working capital needs effectively. By leveraging unpaid invoices, businesses gain access to funds with favorable repayment terms.

At Credlix, we specialize in providing businesses with comprehensive cash flow solutions, strategically designed to bridge working capital gaps. Explore the possibilities of our invoice discounting services to optimize your financial strategy and propel your business forward. Discover more about how Credlix can be the catalyst for your financial success and empower your business with agile working capital solutions.

Final Words

In conclusion, ICEGATE stands as a beacon of efficiency and innovation in the dynamic landscape of international trade. By simplifying customs procedures, reducing paperwork, and offering a user-friendly online platform, ICEGATE has become the go-to solution for businesses and stakeholders. Its advantages, ranging from enhanced accuracy to 24/7 accessibility, underscore its pivotal role in expediting customs clearance and fostering a seamless flow of goods across borders.

As we navigate the interconnected world of global trade, ICEGATE proves to be more than just a gateway; it’s a transformative force shaping the future of cross-border commerce in India. With a commitment to excellence, strategic partnerships, and a robust user base, ICEGATE embodies the digital evolution that ensures businesses can thrive in the ever-evolving landscape of international transactions. Welcome to a future where trade is efficient, transparent, and accessible to all, thanks to the power of ICEGATE.

FAQs

Q: What is Icegate?

Icegate refers to the Indian Customs Electronic Data Interchange (EDI) Gateway, an online platform developed by the Central Board of Indirect Taxes and Customs (CBIC) in India. It facilitates the electronic exchange of trade-related information between traders and customs authorities.

Q: Is it mandatory to file an Icegate Bill of Entry and Shipping Bill through the registered email ID?

No, it is not mandatory to file an Icegate Bill of Entry and Shipping Bill through the registered email ID. However, businesses will receive the status of their queries exclusively on their registered email.

Q: Why was ICEGATE launched?

ICEGATE was launched to streamline trade processes by enabling electronic filing of business forms. It provides traders, cargo carriers, and other partners with a convenient platform for efficient and paperless transactions. As of now, there are approximately 43,542 registered users benefiting from the digitalized services of ICEGATE.

Q: What are the differences between Bill of Entry and Bill of Lading?

Importers or exporters generate a Bill of Entry, outlining the contents of the shipment. In contrast, a Bill of Lading is issued by shippers, specifying the items they agree to transport. While the Bill of Entry is related to customs clearance, the Bill of Lading focuses on the transportation agreement between the shipper and the carrier.

Q: What are the types of Bill of Entry procedures?

In India, Icegate facilitates three main types of Bill of Entry procedures. These include Bill of Entry for home consumption, which involves customs clearance for goods intended for domestic use; Warehousing Bill of Entry, for goods stored in a customs warehouse; and Ex-bond Bill of Entry, applicable when goods are to be moved out of the bonded warehouse.

Q: What is a basic Customs duty?

Basic Customs duty is a tax levied on exported and imported goods and services in accordance with the Customs Act of 1962. This duty, ranging from 5% to 40%, plays a crucial role in regulating international trade by influencing the cost of goods entering or leaving a country and contributing to government revenue.

Q: What is the purpose of the Bill of Entry?

The Bill of Entry, completed by importers or their customs house agents, serves as a vital legal document. Its primary purpose is to facilitate the smooth clearance of imported goods through customs. This document plays a crucial role in ensuring that importers can receive their cargo after successfully navigating the import customs clearance process.

Q: What is the customs clearance process?

The customs clearance process encompasses several steps, including the preparation and submission of necessary documents for both exports and imports. This process also involves the representation of a client, assessment of duties, payment of applicable duties, and the ultimate receipt of cargo.

Q: How to download the Bill of Entry from ICEGATE?

To download the Bill of Entry from ICEGATE, log in to the platform, enter the relevant bill of entry number, and proceed to the download option. The user-friendly interface allows for a straightforward process, ensuring quick and convenient access to the necessary documents for importers and other stakeholders involved in customs clearance.

Q: How much does it cost for ICEGATE registration?

Registration with ICEGATE is free of charge. However, users should be aware of associated expenses, including transaction charges, digital signature certificate (DSC) charges, and internet connection costs. While the initial registration is cost-free, these additional charges may apply based on the specific services and features utilized on the ICEGATE portal.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]