[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12541″ img_size=”full” css=”.vc_custom_1712214520652{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In global maritime trade, buyers and sellers often face uncertainties like late payments, slow deliveries, and financial complications. With vast distances, diverse regulations, and shifting politics, sellers need assurance of payment when shipping goods internationally.

To tackle this, letters of credit were introduced. These involve a third party, usually a bank, to minimize risks for exporters. So, if there are any hiccups in payment or delivery, the bank steps in to ensure the seller still gets paid. It’s like having a safety net in place for smoother transactions across oceans.

A Letter of Credit (LC)

A Letter of Credit (LC) is a financial instrument used in international trade to provide a guarantee of payment from a buyer’s bank to a seller. Essentially, it’s a promise from the buyer’s bank to pay the seller a specified amount of money once certain conditions are met, typically related to the shipment of goods.

Here’s how it works: When a buyer and seller agree to use a Letter of Credit, the buyer’s bank issues the LC, stating that they will pay the seller once the seller presents documents proving that they’ve fulfilled their end of the deal, such as shipping the goods. The seller ships the goods and provides the required documents to their bank, which forwards them to the buyer’s bank. If everything checks out, the buyer’s bank releases the payment to the seller.

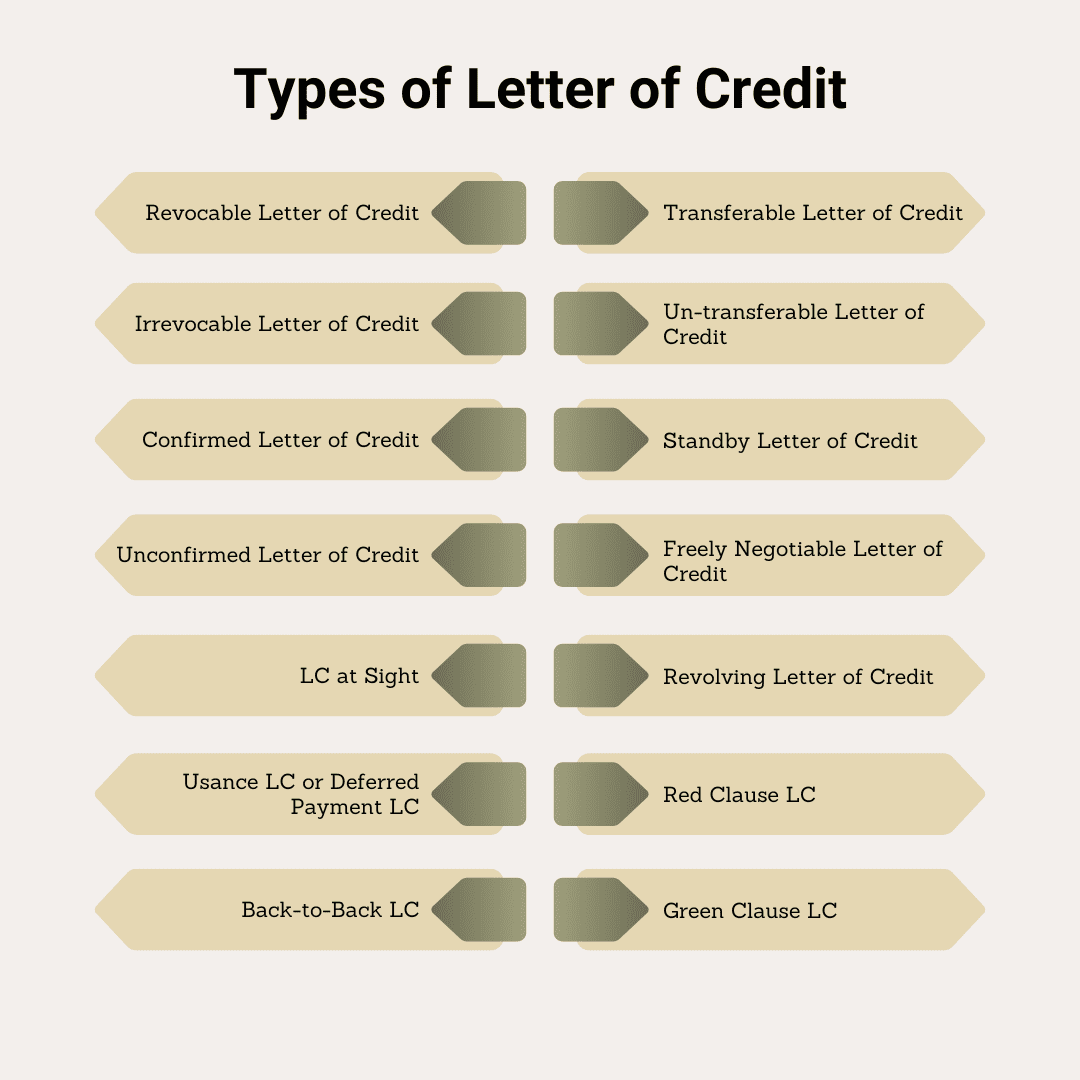

Types of Letter of Credit

Let’s go through each type of Letter of Credit. These are the main types of LCs used in international trade, each offering different benefits and features depending on the needs of the parties involved.

Revocable Letter of Credit: This type of LC can be changed or canceled by the issuing bank without notice to the beneficiary (the seller). It doesn’t offer much security for the seller because the terms can be altered at any time.

Irrevocable Letter of Credit: Unlike a revocable LC, an irrevocable LC cannot be changed or canceled without the consent of all parties involved. It provides more security for the seller, as the terms cannot be altered unilaterally.

Confirmed Letter of Credit: In addition to the issuing bank’s guarantee, a confirmed LC involves a second bank (the confirming bank) adding its confirmation to the LC, providing extra assurance to the beneficiary (seller) that payment will be made.

Unconfirmed Letter of Credit: Unlike a confirmed LC, an unconfirmed LC relies solely on the issuing bank’s guarantee, without the involvement of a confirming bank. It may be seen as less secure for the beneficiary.

LC at Sight: This type of LC requires the issuing bank to make payment to the beneficiary upon presentation of compliant documents. It’s often used for immediate payment upon completion of the transaction.

Usance LC or Deferred Payment LC: With a usance LC, payment to the beneficiary is deferred to a later date, typically after a specified period of time (known as the usance period).

Back-to-Back LC: In this arrangement, a seller (first beneficiary) uses the original LC received from the buyer to open another LC in favor of their supplier (second beneficiary) to fulfill the buyer’s order.

Transferable Letter of Credit: This type of LC allows the beneficiary to transfer all or part of the LC to another party. It’s useful when the beneficiary is a middleman or doesn’t directly supply the goods.

Un-transferable Letter of Credit: In contrast to a transferable LC, an un-transferable LC cannot be transferred to another party. The payment remains solely for the original beneficiary.

Standby Letter of Credit: Unlike a commercial LC used for trade transactions, a standby LC serves as a backup payment method if the buyer fails to fulfill their obligations. It’s often used as a form of guarantee or security.

Freely Negotiable Letter of Credit: This type of LC allows the beneficiary to nominate any bank of their choice to negotiate the LC documents. It offers flexibility in choosing the negotiating bank.

Revolving Letter of Credit: A revolving LC allows for the beneficiary to make multiple draws, up to a specified credit limit, over a certain period of time. It’s useful for ongoing or repetitive transactions.

Red Clause LC: This LC includes a special clause (the red clause) allowing the beneficiary to receive an advance payment before shipping the goods. It’s typically used to provide working capital for the seller.

Green Clause LC: Similar to a red clause LC, a green clause LC allows for advances to be made to the seller, but specifically for storing and/or warehousing the goods before shipment.

Importance of Letter of Credit

The importance of a Letter of Credit (LC) in international trade cannot be overstated. Here are some key reasons why LCs are crucial:

Risk Mitigation: LCs provide a level of security for both buyers and sellers. For sellers, an LC ensures they’ll receive payment as long as they fulfill the terms of the agreement. For buyers, it guarantees that payment will only be made once the seller has met specified conditions, such as shipping the goods.

Trust and Confidence: By involving banks as intermediaries, LCs help establish trust between parties who may be unfamiliar with each other or located in different countries. The involvement of reputable financial institutions adds credibility to the transaction, fostering confidence and reducing the risk of fraud.

Facilitation of Trade: LCs facilitate smoother and more efficient trade transactions by reducing the need for extensive credit checks and negotiations between buyers and sellers. This streamlines the process, allowing parties to focus on the logistics of the transaction rather than financial concerns.

Compliance with Regulations: LCs ensure compliance with international trade regulations and contractual agreements. Banks carefully review and verify the documents presented by the seller to ensure they meet the terms specified in the LC, thereby ensuring legal and regulatory compliance.

Financing Options: LCs can also be used as a financing tool, allowing sellers to obtain financing from their banks based on the creditworthiness of the buyer and the terms of the LC. This can be particularly beneficial for sellers who require upfront payment or need working capital to fulfill large orders.

Overall, the importance of Letters of Credit lies in their role as a trusted and secure mechanism for facilitating international trade, mitigating risks, and ensuring that transactions are conducted smoothly and reliably across borders.

Features Of Letter of Credit

Here are the major features of Letter of Credit:

Negotiability: A letter of credit is like a flexible agreement between parties. They can tweak the terms if everyone agrees. To be negotiable, it must promise payment without any conditions.

Revocability: Think of it like this: a letter of credit can be either “revocable” or “irrevocable.” If it’s revocable, the issuing bank can change its mind about paying anytime. But with an irrevocable one, once it’s set, it stays that way unless everyone involved says otherwise.

Transfer and Assignment: Here’s the deal – the beneficiary (the person getting paid) can pass on or assign the letter of credit to someone else if they want. And no matter how many times it changes hands, it still stays valid.

Sight & Time Drafts: Picture this: the beneficiary only gets paid when they present all the necessary documents and drafts to the bank. It’s like a wait-and-see game; they have to wait until everything’s sorted before they get their money.

Documents Required for a Letter of Credit

- Shipping Bill of Lading

- Airway Bill

- Commercial Invoice

- Insurance Certificate

- Certificate of Origin

- Packing List

- Certificate of Inspection

Fees and Charges With a Letter of Credit (LC)

Let’s break down the fees and charges you might encounter with a Letter of Credit (LC):

Opening Charges: Think of this as the cost of getting the LC set up. There are commitment fees, which you pay upfront just to secure the LC. Then there’s the usance fee, which is like a rental fee for the agreed period of the LC.

Retirement Charges: These are the fees you’ll deal with at the end of the LC period. They include things like the advising fee, which is what you pay to the bank that advises you on the LC. There might also be reimbursements you owe the bank for taking care of any legal stuff related to foreign laws. Plus, there could be fees from the confirming bank and charges you pay to the issuing bank.

In short, LC fees cover a bunch of stuff like setup costs, advisory fees, and reimbursements, all to make sure the LC runs smoothly from start to finish.

Parties Involved in an LC

Let’s talk about the key players in a Letter of Credit (LC) transaction:

Applicant: This is the person or entity who initiates the LC. They’re usually the buyer or importer, and they request the LC from their bank to ensure payment to the seller.

Beneficiary: The beneficiary is the seller or exporter who will receive payment under the LC. They’re the one who will present the required documents to the bank to get paid.

Issuing Bank: The issuing bank is the buyer’s bank that issues the LC on behalf of the applicant. They’re responsible for making the payment to the beneficiary once the terms of the LC are met.

Advising Bank: This is the bank located in the seller’s country that advises the beneficiary about the LC’s existence and terms. They ensure that the beneficiary is aware of the LC and can fulfill its requirements.

Confirming Bank (Optional): Sometimes, the beneficiary may request that their own bank (the advising bank) confirms the LC to add an extra layer of security. This confirming bank guarantees payment to the beneficiary, adding more credibility to the LC.

Negotiating Bank: If the beneficiary wants to get paid immediately upon presenting the documents, they can use a negotiating bank. This bank pays the beneficiary on behalf of the issuing bank and then collects the funds from the issuing bank later.

Paying Bank: This is the bank nominated in the LC to make the payment to the beneficiary. It can be either the issuing bank or a bank nominated by the issuing bank in the LC.

Each of these parties plays a crucial role in ensuring that the LC transaction proceeds smoothly and that both the buyer and seller are protected throughout the process.

Process of Getting an LC

The process of getting an LC consists of four primary steps, which are enlisted here:

Step 1 – Applying for the LC

Once the buyer and seller agree on the terms of their trade deal, the buyer (importer) applies to their bank (the issuing bank) to issue an LC in favor of the seller (exporter). This LC is then sent to the seller’s bank (the advising bank), which confirms its authenticity and passes it on to the seller.

Step 2 – Shipping the Goods

Once the seller receives the LC, they make sure everything checks out and then start the process of shipping the goods to the buyer.

Step 3 – Presenting Documents

After the goods are shipped, the seller (either directly or through their freight forwarder) gathers all the necessary documents, like the bill of lading and commercial invoice, and presents them to their bank (the advising/confirming bank).

Step 4 – Payment and Goods Possession

The advising/confirming bank reviews the documents and forwards them to the issuing bank. The issuing bank then verifies the documents and arranges for payment from the buyer. Once payment is sorted, the issuing bank sends the documents to the buyer, who uses them to claim possession of the goods from the shipping company.

An example of an LC

Let’s consider a hypothetical example of how a Letter of Credit (LC) might be used in an international trade transaction:

Scenario:

Imagine a company called ABC Electronics based in the United States wants to purchase computer chips from XYZ Semiconductors located in Taiwan. Since this is an international transaction involving significant sums of money and distance, both parties agree to use an LC to ensure a smooth and secure transaction.

Step 1 – Issuance of LC:

ABC Electronics, the buyer (importer), approaches their bank, First Bank of USA, to issue an LC in favor of XYZ Semiconductors, the seller (exporter), for the purchase of computer chips. The LC, with all the agreed-upon terms, is issued by First Bank of USA and sent to XYZ Semiconductors’ bank, Taiwan Bank.

Step 2 – Shipping of Goods:

Upon receiving the LC, XYZ Semiconductors verifies its authenticity and starts preparing the computer chips for shipment to ABC Electronics.

Step 3 – Providing Documents to the Confirming Bank:

Once the computer chips are shipped, XYZ Semiconductors gathers all the required documents, including the bill of lading, commercial invoice, and certificate of origin, and presents them to Taiwan Bank, their advising/confirming bank.

Step 4 – Settlement of Payment from Importer and Possession of Goods:

Taiwan Bank reviews the documents and forwards them to the First Bank of the USA. First Bank of USA verifies the documents and arranges for payment to XYZ Semiconductors. Upon receiving confirmation of payment, XYZ Semiconductors releases the documents to ABC Electronics, allowing them to claim possession of the computer chips from the shipping company.

In this example, the LC serves as a secure and reliable method of payment, ensuring that both parties fulfill their obligations and that the transaction proceeds smoothly.

Process of Applying For a Letter of Credit (LC)

Let’s break down the process of applying for a Letter of Credit (LC) in a simple and easy way:

Agreement and Application

Once the importer and exporter agree on the terms of their transaction, the importer applies to their bank for an LC in favor of the exporter.

Letter of Credit Creation

The importer’s bank, known as the issuing bank, creates the LC according to the terms agreed upon in the sales agreement. This LC is then sent to the exporter’s bank.

Evaluation and Approval

The exporter and their bank assess the creditworthiness of the issuing bank and review the LC to ensure it matches the sales agreement. Once approved, the exporter’s bank sends the LC to the importer.

Manufacturing and Shipping

With the LC in place, the exporter proceeds to manufacture and ship the goods according to the agreed timeline, often with the assistance of a shipping line or freight forwarder.

Document Submission

Alongside the goods, the exporter provides documents to their bank to ensure compliance with the sales agreement. These documents are crucial for proving that the transaction has been completed as per the agreed terms.

Review and Payment

The exporter’s bank verifies the submitted documents to ensure they meet the requirements of the sales agreement. Once approved, these documents are forwarded to the issuing bank.

Payment Release and Document Transfer

Upon reviewing the documents, the issuing bank releases the payment to the exporter. Simultaneously, they send the approved documents to the importer, who can then collect the shipment.

Letters of Credit (LCs) play a vital role in international trade by providing a secure and reliable method of payment for buyers and sellers. By involving banks as intermediaries, LCs help mitigate risks, foster trust and confidence between parties, and ensure compliance with regulations. The various types of LCs offer flexibility and cater to different needs, while the application process and fees associated with LCs are manageable with careful planning. Overall, LCs serve as a trusted mechanism for facilitating smooth and efficient transactions across borders, contributing to the growth and success of businesses engaged in global commerce.

Also Read: Standby Letter of Credit (SBLC): Grasping Its Meaning, Varieties, and Operational Mechanism[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]