[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12499″ img_size=”full” css=”.vc_custom_1711950161220{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]If you’re in the world of exporting garments and made-ups, this scheme could be a game-changer for you. So, let’s understand what RoSCTL is all about, its benefits, how to apply, and more!

Imagine you’re an exporter, sending out batches of stylish garments or cozy made-ups to customers worldwide. You’re facing the usual hurdles of high logistics costs and fierce global competition. That’s where RoSCTL steps in like a helpful friend, offering you a way to cut costs, stay competitive, and grow your business.

But wait, what exactly is RoSCTL? How does it benefit exporters like you? And how do you go about applying for it? Don’t worry, we’ve got you covered.

In this blog, we’ll break down everything you need to know about RoSCTL in simple, everyday language. So, grab a cup of coffee, get comfy, and let’s embark on this journey together to uncover the ins and outs of the RoSCTL scheme!

What is RoSCTL Scheme?

The RoSCTL Scheme, or Rebate of State & Central Taxes and Levies Scheme, serves as a crucial export incentive framework offered in the form of transferable and sellable duty credit scrips. These scrips are granted based on the Free on Board (FOB) value of exports. This scheme has replaced the Rebate of State Levies (RoSL) program, wherein Customs would directly deposit rebates into exporters’ bank accounts.

Introduced by the Ministry of Textiles in March 2019, the RoSCTL Scheme was accompanied by the release of a rate list and notifications by the Central Board of Indirect Taxes & Customs (CBIC).

The introduction of RoSCTL was prompted by growing international pressure on India’s export incentives. Particularly, the United States has been vocal in urging the discontinuation of schemes like the Merchandise Exports from India Scheme (MEIS), citing violations of the WTO Agreement on Subsidies and Countervailing Measures. Additionally, objections were raised against other schemes such as Export Oriented Units (EOU), Electronics Hardware Technology Park (EHTP), Export Promotion Capital Goods (EPCG), Special Economic Zones (SEZ), and Duty-Free Import Authorization (DFIA) at various points in 2019.

Despite WTO objections, the MEIS is expected to continue until the introduction of the new Foreign Trade Policy in April 2020. However, in the long term, the MEIS is deemed unsustainable as an export incentive, thus prompting the introduction of the RoSCTL Scheme.

Benefits of RoSCTL

The Rebate of State Levies (RoSCTL) scheme offers several benefits for exporters of readymade garments and made-ups:

Cost Reduction

The RoSCTL scheme serves as a pivotal tool for exporters, addressing the longstanding challenge of high logistics and other operational costs. By providing rebates on state levies, the scheme significantly reduces the financial burden on exporters, enabling them to offer their products at more competitive prices in the global market. This cost reduction isn’t merely a short-term benefit; it fosters long-term sustainability by improving profit margins and ensuring exporters can remain competitive in the face of global competition.

Global Competitiveness

The RoSCTL scheme doesn’t just offer financial relief; it acts as a catalyst for enhancing the global competitiveness of exporters. In an increasingly interconnected world, where consumers have a plethora of choices, being able to offer products at competitive prices is paramount. By alleviating financial pressures, the scheme empowers exporters to invest in product quality, innovation, and market expansion strategies, thus amplifying their global competitiveness. This not only benefits individual exporters but also contributes to the overall growth and dynamism of the export sector.

Financial Incentives For Growth

At its core, the RoSCTL scheme provides exporters with tangible financial incentives that drive growth and expansion. These incentives can take various forms, including rebates, which directly impact exporters’ bottom lines. The availability of such incentives encourages exporters to explore new markets, invest in technology and infrastructure, and innovate their product offerings. Consequently, exporters are better positioned to capitalize on emerging opportunities and navigate challenges, fostering sustainable growth and development within the export ecosystem.

Easy Application Process

One of the hallmarks of the RoSCTL scheme is its user-friendly and streamlined application process. Exporters are required to submit the ANF 4R form along with digital signatures to the DGFT, simplifying administrative procedures. This ease of application not only saves exporters valuable time and resources but also ensures that the benefits of the scheme are accessible to a wide range of exporters, regardless of their size or operational capacity.

Flexibility without Penalty

Unlike certain schemes that penalize late submissions with cut fees, the RoSCTL scheme offers exporters much-needed flexibility without punitive measures. This flexibility acknowledges the dynamic nature of international trade and allows exporters to adapt to changing market conditions without fear of financial repercussions. As a result, exporters can focus on maximizing their export potential without being unduly burdened by administrative constraints.

Bulk Processing Efficiency

The RoSCTL scheme recognizes the volume of exports handled by exporters and accommodates bulk processing to enhance efficiency. Allowing up to 50 shipping bills to be attached to a single application streamlines the process for exporters managing multiple shipments. This efficiency not only reduces administrative burdens but also ensures that exporters can access rebates in a timely manner, further bolstering their financial stability and operational resilience.

Inclusive Support for All Regions

An important aspect of the RoSCTL scheme is its inclusivity, which ensures that exporters from all regions can benefit from its provisions. By accommodating exports from non-EDI ports, the scheme promotes equitable access to incentives and opportunities, irrespective of geographical location. This inclusive approach not only fosters regional economic development but also strengthens the overall resilience and diversity of the export sector.

Efficient Online Processing

Leveraging technology for efficient online processing, the DGFT expedites the approval and disbursement processes under the RoSCTL scheme. This digital infrastructure minimizes bureaucratic delays and enhances transparency, providing exporters with greater confidence in the efficacy of the scheme. By embracing digitalization, the scheme demonstrates a commitment to modernization and responsiveness to the evolving needs of exporters in an increasingly digital world.

Convenient Delivery Options

Recognizing the diverse preferences and logistical constraints of exporters, the RoSCTL scheme offers tailored delivery options for scrips. Exporters have the flexibility to choose between physical delivery or postal dispatch based on their individual requirements. This customization enhances convenience and ensures that exporters can access benefits in a manner that best aligns with their operational workflows, further facilitating their participation in the scheme.

Timely Participation for Maximum Benefits

While the RoSCTL scheme offers substantial advantages, its limited duration underscores the importance of timely participation. Exporters are encouraged to capitalize on the scheme’s benefits before the deadline of 31st March 2020 to maximize their gains. By proactively engaging with the scheme, exporters can optimize their financial outcomes and position themselves for sustained success in the global marketplace.

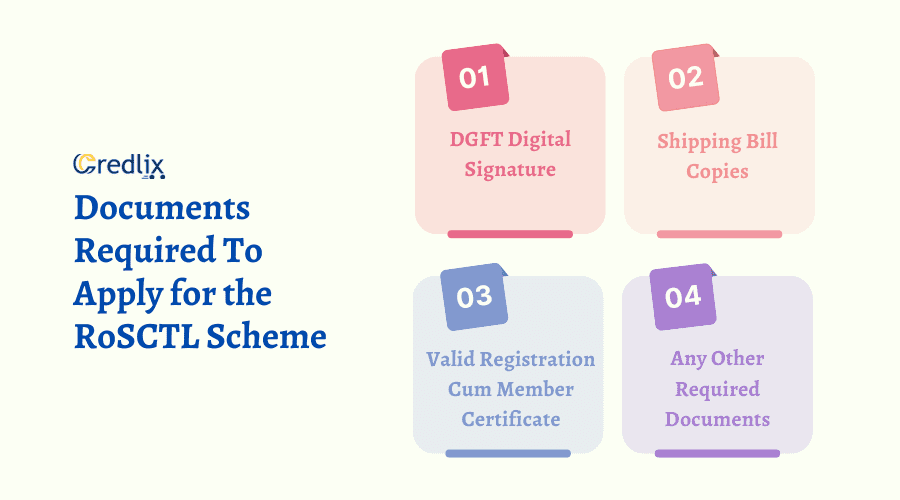

Documents Required To Apply for the RoSCTL Scheme

Here are the documents required for applying for the RoSCTL scheme, listed in points:

DGFT Digital Signature: This serves as your digital stamp of approval, verifying the authenticity of your application.

Shipping Bill Copies: These official documents outline the details of your shipments, including destination and logistics information.

Valid Registration Cum Member Certificate: This certificate confirms your registration and eligibility to participate in the RoSCTL scheme.

Any Other Required Documents: Depending on your specific circumstances, additional documents may be requested to support your application. These could include certifications, compliance records, or other relevant paperwork.

Having these documents ready ensures a smooth and efficient application process, allowing you to access the benefits of the RoSCTL scheme without delay.

Step-by-Step Guide to How Exporters can Apply for RoSCTL

Below is a step by side to understanding how one can apply for RoSCTL. By following these steps, exporters can navigate the RoSCTL application process smoothly and access the benefits provided by the scheme.

Understand the Scheme: Get familiar with the Rebate of State Levies (RoSCTL) scheme, which is designed to benefit exporters of garments and made-ups by providing duty credit scrips based on specified rates.

Check Notification: Keep an eye out for notifications from the Ministry of Textiles, as they specify the rates under the RoSCTL scheme in different schedules.

Identify Applicable Rates: Look up the schedules to find out the Central and State taxes and levies applicable to your particular export items.

Determine Eligibility: Ensure that your exports meet the criteria outlined in the schedules to qualify for RoSCTL benefits.

Prepare Documentation: Gather necessary documents such as shipping bills and valid registration certificates to support your application.

File Application: Fill out the RoSCTL application within a year from the date your shipping bill(s) is uploaded from ICEGATE to the DGFT server.

Select Port of Registration: If your exports are made from multiple EDI ports, you can include all the details in a single application. Choose one port of registration from the shipping bills included.

Submit Application: Submit your application through the designated channels, ensuring that all required information and documents are included.

Await Issuance: Wait for the issuance of duty credit scrips based on the rates specified in the schedules for your exports.

Retain Documents: Keep the shipping bills and other related documents for at least three years from the date of scrip issuance.

Comply with Authorities: Be prepared to produce the documents upon request by relevant authorities. Non-compliance could result in penalties under the Foreign Trade (Development and Regulation) Act.

Risk Factors to Keep in Mind Of RoSCTL

With all the positive sides, take care of the negative sides of RoSCTL too.

Keep Proof of Sale Proceeds: Make sure to hold onto documents proving that you’ve received payment in foreign currency. This is super important because it’s directly linked to receiving your rebate.

Be Prepared for Scrutiny: Regional authorities might double-check your records electronically to verify the value of your scrips. So, it’s best to have everything in order to avoid any hiccups.

Look for Excessive Claims: If it turns out that you’ve claimed too much rebate, you’ll need to pay back the extra amount to the DGFT. Plus, you’ll have to pay interest at a rate of 15% per year from the date you got the scrip to the repayment date.

Avoid Penalties: Not declaring excess receipts or engaging in fraudulent activities could land you in hot water. So, it’s wise to play by the rules and keep everything transparent.

Act Responsibly: Remember, legal action can be taken under the Foreign Trade (Development and Regulation) Act if you don’t repay the excess rebate or respond to the regional authority’s notice within 30 days of getting it.

Conclusion

It’s clear that the RoSCTL scheme holds immense potential for exporters in the garments and made-ups industry. By grasping the ins and outs of the scheme, its perks, and the application process, exporters can truly tap into RoSCTL to propel their businesses forward and reach new heights globally. But remember, staying vigilant and playing by the rules is key to avoiding any bumps in the road. With a little attention and proactive effort, exporters can make the most of RoSCTL, contributing to the vibrancy and growth of India’s export landscape.

[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]