- October 1, 2024

- Posted by: admin

- Categories: Export Financing, Blog

When goods are imported or exported, they often face tariffs and taxes. In the European Union (EU), these tariffs are managed using a special system called the TARIC code. This system helps customs officials determine how much tax needs to be paid for different goods entering or leaving the EU.

In this guide, we will explain everything about the TARIC code in simple language, including what it is, why it’s important, and how to find the right TARIC code for your product.

Introduction to TARIC Code

The TARIC code stands for TARif Intégré Communautaire, which is French for “Integrated Tariff of the European Communities.” It is a system used by customs authorities in the EU to classify goods and apply the correct taxes and regulations to them. Every product that is imported or exported has a unique TARIC code, which helps determine how much duty or tax will be charged on it.

These codes are important for businesses that import or export goods in the EU, as they need to use the correct TARIC code for customs clearance.

How Does the TARIC Code Work?

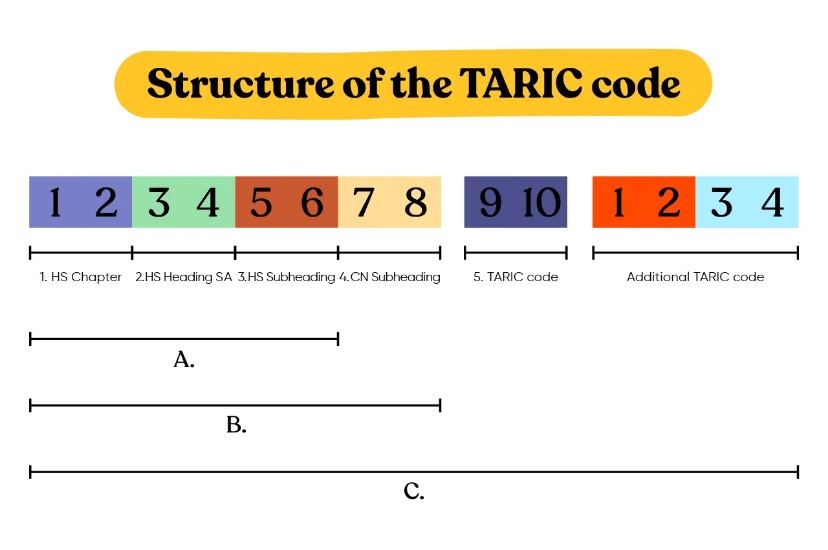

A TARIC code is made up of 10 digits, and it includes information about the product and the specific rules or tariffs that apply to it. The first 6 digits of the TARIC code come from the Harmonized System (HS), which is a global system for classifying goods. The remaining digits provide more specific information about the product, such as additional tariffs or trade rules.

Here is how the 10-digit TARIC code is structured:

- First 6 digits: These come from the Harmonized System (HS) code and represent the general category of the product.

- Digits 7 & 8: These come from the Combined Nomenclature (CN), which adds more specific details about the product.

- Digits 9 & 10: These are known as the TARIC subheading and provide even more details about the product, such as additional tariffs or rules.

Example of a TARIC Code

Let’s take a look at an example:

- 85171200 10 is a TARIC code for certain types of mobile phones.

- The first 6 digits (851712) come from the HS code and represent the product category, which is telecommunications equipment.

- The next 2 digits (00) are the CN code, adding more specific details.

- The final 2 digits (10) are the TARIC subheading, which might refer to additional tariffs or rules for that specific product.

Why Is the TARIC Code Important?

The TARIC code plays a crucial role in the import and export process for the following reasons:

- Customs Duties: It determines how much duty or tax needs to be paid for the product.

- Trade Rules: The TARIC code includes any specific rules or regulations that apply to the product, such as quotas or anti-dumping measures.

- Accurate Classification: Using the correct TARIC code ensures that the goods are classified correctly, which helps avoid any delays, fines, or penalties.

Also Read: A Complete List of Custom Duty in India

How to Find the Correct TARIC Code

If you are importing or exporting goods in the EU, it is important to use the right TARIC code. Here’s how you can find it:

- TARIC Database: The European Commission provides an official online TARIC database, where you can search for the correct code for your product. You can search by entering the name of your product or the material it’s made from.

- Product Description: Make sure you have a detailed description of your product. Even small differences in size, material, or function can result in a different TARIC code, so be as specific as possible.

- Seek Professional Help: If you’re unsure about which code to use, you can always consult a customs broker or a trade expert to help you classify your product accurately.

What Happens if You Use the Wrong TARIC Code?

Using the wrong TARIC code can lead to several issues, including:

- Customs Delays: Your goods could be delayed at customs, causing delivery problems and additional costs.

- Fines or Penalties: Incorrect classification can result in fines or penalties from customs authorities.

- Additional Costs: If you use a code that applies a lower duty rate than is required, you may be required to pay additional taxes or penalties later.

For example, if you classify a product with a 0% duty rate when it should have a 10% duty rate, you could face fines and delays in getting your goods through customs.

Changes to TARIC Codes

TARIC codes are updated regularly, usually at the beginning of each year, to reflect changes in trade policies, tariffs, and product classifications. However, changes can also happen during the year with little or no warning.

It’s essential for businesses to stay updated on the latest changes to avoid any complications during the import or export process.

The Difference Between TARIC Code and HS Code

The HS code is an international system used by countries around the world to classify products. It is made up of 6 digits and is the same for most countries. The TARIC code, however, is specific to the EU and is a 10-digit code. It includes the HS code as its first 6 digits, but then adds more details to classify products more accurately within the EU.

In simple terms, the HS code is a global standard for classifying products, while the TARIC code is a more detailed version used by the EU to apply specific tariffs and trade rules.

The Difference Between TARIC, CN, and HTS Codes

- TARIC Code: The 10-digit code used by the EU to classify goods and apply tariffs.

- CN Code: The Combined Nomenclature code is an 8-digit code used by EU member states to classify products for statistical purposes. The CN code is part of the TARIC code.

- HTS Code: The Harmonized Tariff Schedule is used by the United States for classifying imported goods. Like the TARIC code, it includes the HS code but adds more details specific to the US.

Importance of Using the Correct TARIC Code for Businesses

For businesses that import or export goods in the EU, using the correct TARIC code is essential for smooth operations. Here are a few reasons why:

- Compliance: Ensuring that goods are classified correctly helps businesses comply with EU regulations, avoiding penalties and legal issues.

- Accurate Duty Payments: The correct TARIC code ensures that businesses pay the right amount of duty, preventing overpayment or underpayment.

- Efficient Customs Clearance: Using the correct code helps speed up the customs process, reducing the chances of delays and ensuring timely delivery.

Conclusion

The TARIC code is a vital tool for businesses trading within the European Union. It helps ensure that goods are classified correctly and that the appropriate duties and taxes are applied. Understanding how to use the TARIC code system is important for businesses that want to avoid delays, penalties, and additional costs when importing or exporting goods.

By using the correct TARIC code and staying informed about any changes, businesses can ensure a smoother, more efficient trading process in the EU.

Also Read: Different Types of Customs Duty in India Complete List