[vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row el_class=”padding-sm-bottom-40″][vc_column offset=”vc_col-lg-8 vc_col-md-8″ el_class=”post-details-sec”][vc_single_image image=”12362″ img_size=”full” css=”.vc_custom_1710496075719{margin-bottom: 44px !important;}”][vc_row_inner css=”.vc_custom_1608297138483{margin-bottom: 0px !important;}”][vc_column_inner][vc_column_text]In the world of business finance, two important tools help companies manage their money flow: export factoring and invoice discounting. Both let businesses get money quickly by using their unpaid invoices, but they work differently and suit different situations.

Export factoring involves three players: the seller (exporter), the financing company (factor), and the buyer (importer). It’s great for businesses selling goods internationally because it shifts the risk of not getting paid onto the financing company. Invoice discounting, on the other hand, lets businesses borrow money against their unpaid invoices without involving a third party. This means businesses keep control over their sales records.

Understanding how these tools work can help businesses make smart decisions about their finances. Let’s explore the differences between export factoring and invoice discounting to see how each can help businesses thrive.

What is Export Factoring?

Export factoring is a financial service that helps businesses involved in international trade manage their cash flow by providing immediate access to funds tied up in unpaid invoices. In export factoring, a financing institution, known as the factor, purchases the accounts receivable (unpaid invoices) of the exporter at a discounted rate. This allows the exporter to receive a portion of the invoice amount upfront, typically around 70-90%, while the factor assumes the responsibility of collecting payment from the importer (buyer).

The process involves three parties: the exporter (seller), the factor (financing institution), and the importer (buyer). Once the goods or services are delivered and the invoice is issued, the exporter sells the invoice to the factor, who then advances the agreed-upon percentage of the invoice value to the exporter. The factor then collects the full invoice amount from the importer when it becomes due, deducts its fees and charges, and remits the remaining balance to the exporter.

Export factoring provides several benefits to exporters, including improved cash flow, reduced credit risk, and outsourcing of collections and credit management tasks. It is particularly beneficial for businesses engaged in cross-border transactions, as it helps mitigate the risks associated with international trade, such as currency fluctuations, payment delays, and non-payment by foreign buyers.

Also Read: How Does Export Factoring Work

What is Invoice Discounting?

Invoice discounting is a financial arrangement where a business can borrow money against its outstanding invoices. Unlike traditional loans, invoice discounting allows businesses to access funds tied up in unpaid invoices without having to wait for their customers to pay.

Here’s how it typically works: Once a business delivers goods or services to a customer and issues an invoice, it can approach a finance provider, such as a bank or a specialized invoice discounting company. The finance provider evaluates the creditworthiness of the business and its customers and offers to advance a percentage (usually around 70-90%) of the total invoice value, minus a discount fee.

The business retains control over its sales ledger and continues to chase payments from its customers. When the customer eventually pays the invoice, the business repays the advance along with any fees or interest charged by the finance provider.

Invoice discounting offers several advantages to businesses, including improved cash flow, flexibility, and confidentiality. Since the arrangement is typically confidential, customers may not be aware that the business is using invoice discounting. This can be advantageous for maintaining relationships with customers.

Overall, invoice discounting is a valuable tool for businesses looking to manage their cash flow effectively and access working capital to support growth and operations.

Also Read: How The Indian Economy Benefits From Digital Invoice Discounting

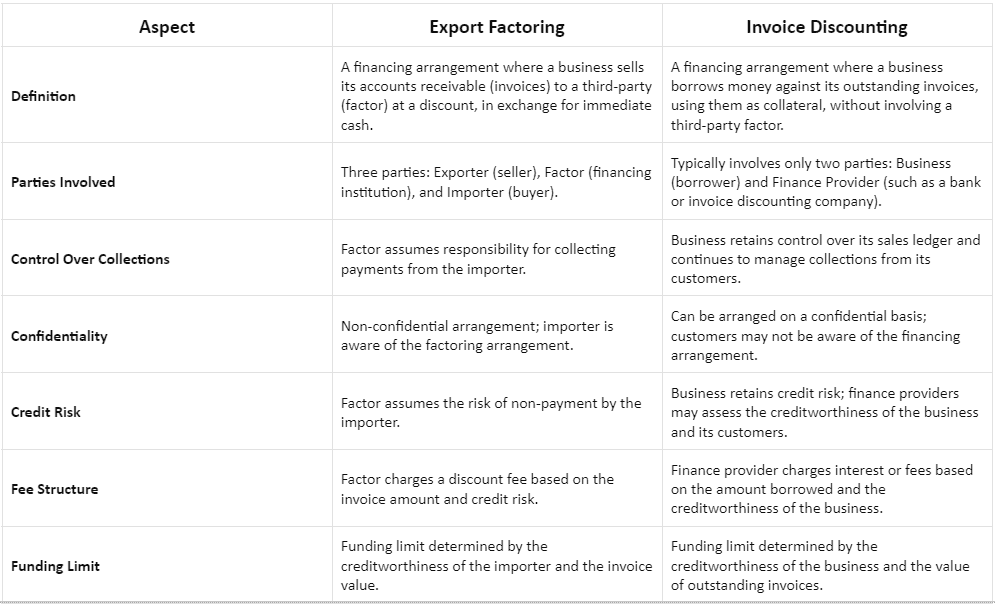

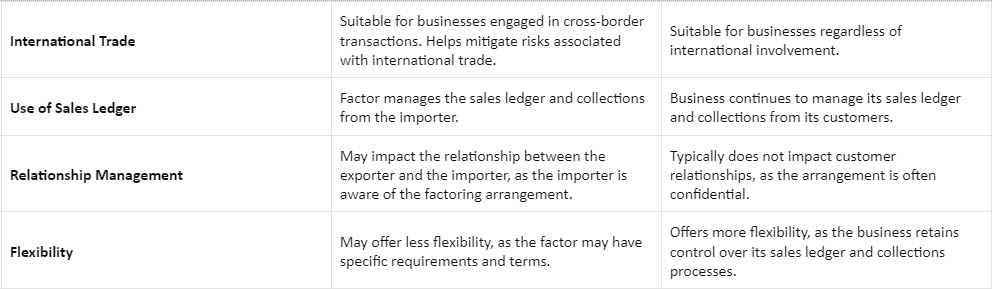

D/B Export Factoring and Invoice Discounting

Here’s a comprehensive comparison between Export Factoring and Invoice Discounting presented in a table format:

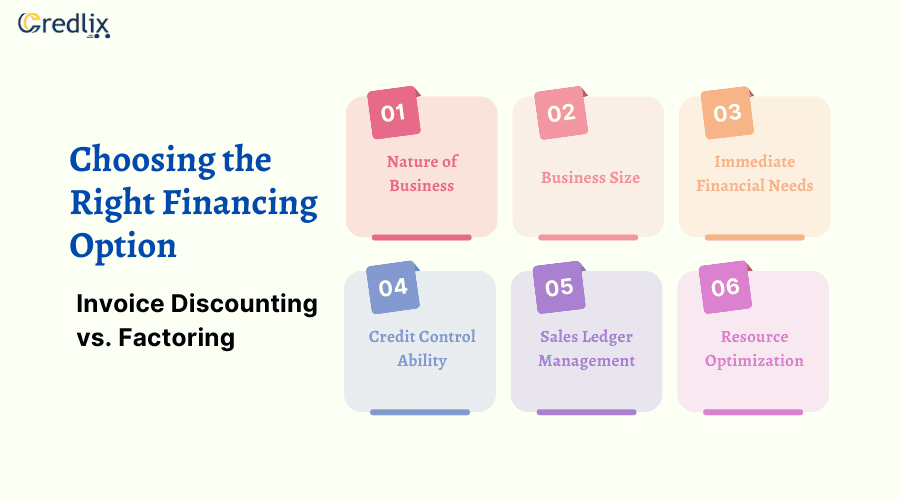

Choosing the Right Financing Option: Invoice Discounting vs. Factoring

Determining whether to opt for invoice discounting or factoring hinges on several critical factors tailored to your business’s unique circumstances:

Nature of Business: Consider the specific operations and industry requirements. Certain industries may benefit more from one option over the other based on their invoicing processes and cash flow needs.

Business Size: The size of your business operation plays a role in determining which financing option aligns best with your capacity and scalability requirements.

Immediate Financial Needs: Evaluate the urgency of your financial requirements. If you need immediate access to cash flow tied up in invoices, invoice discounting might be the better choice.

Credit Control Ability: Assess your ability to manage credit control effectively. If you prefer to retain control over customer relationships and collections, invoice discounting may be preferable.

Sales Ledger Management: Determine whether you want to maintain control over your sales ledger or delegate this responsibility to a third party. This factor could influence your decision between the two options.

Resource Optimization: Consider your ability to optimize resources within your business. Each financing option may impact resource allocation and efficiency differently.

Industries such as manufacturing, security, transport, construction, printing, wholesale, logistics, and recruitment commonly favor invoice financing to raise funds. However, the decision ultimately rests with individual businesses, who must carefully weigh the advantages and disadvantages of each option based on their specific needs and circumstances. Conducting a thorough comparison of the pros and cons is essential in making an informed choice that best serves your business objectives.

Also Read: Advantages of Export Factoring

Final Note

Whether to choose export factoring or invoice discounting boils down to understanding your business’s unique needs. If you’re involved in international trade and prefer to offload the risks and responsibilities of collecting payments to a third party, export factoring could be the right fit. On the other hand, if you value maintaining control over your sales ledger and want a flexible financing solution that keeps your customer relationships confidential, invoice discounting might be more suitable.

Ultimately, the decision rests on factors like your industry, business size, immediate financial requirements, and ability to manage credit control. By carefully weighing these considerations and comparing the pros and cons of each option, you can make an informed choice that optimizes your cash flow and supports your business growth.

Also Read: Types of Export Factoring

FAQs

Who benefits from this financing option?

This financing option works well for businesses in need of immediate capital, especially those with creditworthy customers and the capability to cover processing charges.

How do export factoring and invoice discounting contribute to businesses’ cash flow management?

Both export factoring and invoice discounting are components of invoice financing, crucial for managing cash flow in businesses. They facilitate swift access to funds, enabling companies to maintain financial stability. These financing options are particularly valuable for businesses facing cash flow challenges or seeking to optimize their working capital. Whether through selling accounts receivable at a discount or borrowing against unpaid invoices, both methods provide vital support for businesses in need of quick liquidity.

What is Reverse Factoring?

Reverse Factoring, also referred to as supply chain financing, is a funding solution initiated by the customer to assist suppliers in financing their accounts receivables at favorable terms.

How do bill discounting and factoring contrast in handling outstanding invoices?

In bill discounting, clients settle their outstanding invoices before the due date, receiving a discounted amount. Conversely, factoring involves companies selling their unpaid invoices to a third party, also at a discounted rate. While both methods expedite cash flow, bill discounting relies on clients’ early payments, whereas factoring transfers invoice ownership to a financing entity, which assumes responsibility for collection. Each approach offers distinct benefits, with bill discounting leveraging existing client relationships and factoring outsourcing credit control and collection tasks to enhance liquidity management for businesses.

Also Read: Export Factoring Advantages and Disadvantages[/vc_column_text][vc_empty_space height=””][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/3″ offset=”vc_hidden-sm vc_hidden-xs” el_class=”post-col” css=”.vc_custom_1638872146414{padding-left: 50px !important;}”][vc_widget_sidebar sidebar_id=”consulting-right-sidebar” el_id=”single-right-siebar”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1638349264629{padding-top: 100px !important;padding-bottom: 80px !important;}”][vc_column][vc_custom_heading text=”Related Post” font_container=”tag:h2|font_size:25px|text_align:center|color:%233c3c3c” google_fonts=”font_family:Poppins%3A300%2Cregular%2C500%2C600%2C700|font_style:600%20semi-bold%3A600%3Anormal” css=”.vc_custom_1638774169659{margin-bottom: 30px !important;}”][vc_raw_html]JTVCc21hcnRfcG9zdF9zaG93JTIwaWQlM0QlMjIxMDAwNSUyMiU1RA==[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]