- September 30, 2024

- Posted by: admin

- Categories: Invoice discounting, Blog

A proforma invoice is a detailed document used in business transactions to outline the terms and conditions of a sale before the actual delivery of goods. It is like a preliminary bill or quotation that the seller provides to the buyer. This document helps the buyer understand the cost and terms of the sale in advance.

The proforma invoice includes important details such as the items being purchased, their quantities, the estimated delivery date, shipping weight, and any transport or handling fees. Although it provides a comprehensive breakdown of the costs and conditions, it does not request payment. Instead, it serves as a preview or estimate of what the final invoice will include.

Unlike a final invoice, which is issued after the sale is confirmed and payment is due, a proforma invoice does not have an invoice number and is not recorded as an account receivable. It is essentially a way for the buyer to review and agree upon the terms before the goods are shipped. Once the sale is finalized and the goods are delivered, a final invoice is generated, which will include a payment request and a unique invoice number.

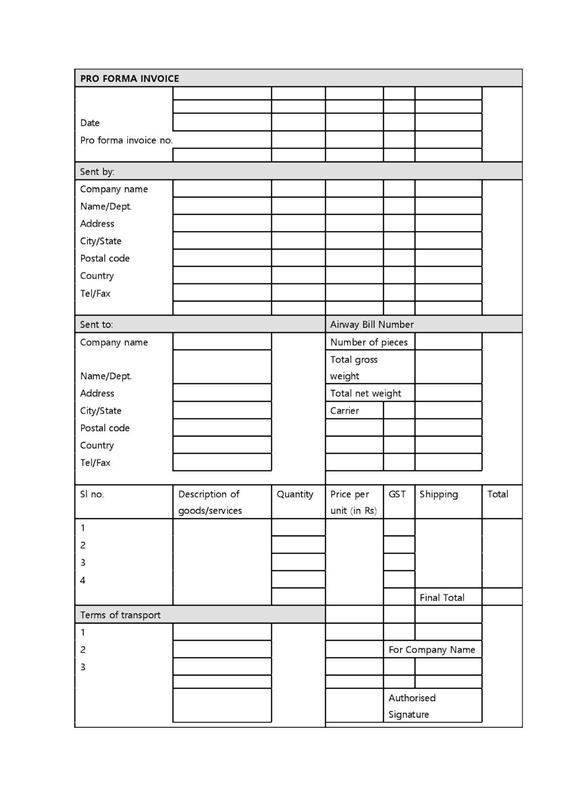

Exporter’s Proforma Invoice Template

Key Details Included in a Proforma Invoice

Here are the key details that are included in a proforma invoice:

- Address of the seller/supplier

- Address of the purchaser/prospective buyer

- A unique invoice number

- Date of issue of the proforma invoice

- Details of the goods (weight, dimensions, total number of units)

- Details of the services (itemised charges/fees)

- Bill of Lading

- Period of validity of the proforma invoice

- Agreed/proposed terms of sale

- Agreed/proposed terms of payment

- Certifications required as per the law

- Permissions required as per the law

- Estimated/proposed timeline of delivery

- Mode of shipment

- Signature by an authorised person from the seller’s/supplier’s company

Why is the Proforma Invoice Important?

The Proforma Invoice plays a crucial role in the early stages of an export transaction. Here’s why it matters:

- First Impression: It’s often the first formal document the buyer receives, so it’s important to make it clear and professional. This helps build trust and sets a positive tone for the business relationship.

- Negotiation Tool: The Proforma Invoice allows both the buyer and seller to negotiate terms before finalizing the deal. It serves as a starting point for discussions on price, delivery, and payment.

- Blueprint for the Final Invoice: If the buyer agrees to the terms, the Proforma Invoice will closely resemble the final Commercial Invoice. This helps ensure that there are no surprises or discrepancies later in the process.

How is the Proforma Invoice Used?

Once the Proforma Invoice is sent to the buyer, several things can happen:

- Approval: If the buyer agrees with the terms and prices outlined, they may proceed with the purchase. This can involve securing payment, such as through a letter of credit, to ensure the transaction goes smoothly.

- Negotiation: The buyer might request changes to the terms, such as a lower price or different delivery conditions. These negotiations help finalize the deal in a way that satisfies both parties.

- No Sale: In some cases, the buyer might decide not to proceed with the purchase. While this can happen, a well-prepared Proforma Invoice increases the chances of moving forward with the sale.

Things to Keep in Mind When Making a Proforma Invoice

When creating a proforma invoice, there are a few important things to remember to make sure it’s clear and useful. First, include all the essential details like the items being sold, their quantities, prices, and any shipping or handling fees.

Even though a proforma invoice looks like a final invoice, it’s crucial to write “PROFORMA INVOICE” at the top to show that it’s an estimate and not a request for payment. This helps keep everything clear and correct.

It’s also a good idea to follow the standard practices for your industry when making a proforma invoice. This will help avoid confusion and ensure that important details such as dates, tax rates, and delivery times are correctly shown.

Make sure the proforma invoice is easy to read and not too crowded with unnecessary designs or logos. A clear and simple proforma invoice helps both the buyer and seller understand the terms of the sale and keeps everything organized.

The Role of the Proforma Invoice in the Export Process

The Exporter’s Proforma Invoice is more than just a quote; it’s a crucial document that sets the stage for a successful export transaction. By providing clear and accurate information, it helps the buyer make an informed decision and prepares both parties for the steps that follow, such as securing payment and arranging shipment.

Difference Between Proforma Invoice and Tax Invoice

A proforma invoice is like a preview or estimate of what the final bill will look like. It shows what items are for sale, how much they cost, and other details like shipping fees and delivery times. It’s just a way for the buyer to see what they might be paying for, but it’s not a final bill.

A tax invoice is the real bill that you get after you buy something. It shows that you need to pay for the goods or services you’ve received. This invoice is a legal document and proves that the buyer and seller have agreed on the sale.

Conclusion

The Exporter’s Proforma Invoice is an essential document that helps start the export process. It serves as a detailed quote that outlines the terms of the sale, giving the buyer all the information they need to make a decision. By ensuring that the Proforma Invoice is clear, accurate, and professional, exporters can make a strong first impression and pave the way for a smooth and successful transaction.