- May 2, 2024

- Posted by: admin

- Categories: HSN code, Blog

GST, or Goods and Services Tax, is a levy imposed indirectly on the sale of goods and services at each stage of their production. Batteries, being goods, fall under this taxation system. Whether it’s car batteries, mobile batteries, or laptop batteries, all are subject to GST. Each type of battery has its own specified GST rate.

Importantly, businesses can often claim back the GST they pay on battery purchases through what’s known as input tax credit. This means if a business pays GST when buying batteries for their products, they can later reclaim this amount as a credit against the GST they charge their customers. Therefore, while GST applies to batteries, businesses can offset this tax through the input tax credit mechanism, making it an integral part of their financial transactions.

Understanding GST for Batteries

GST, or Goods and Services Tax, is applicable to various types of batteries, such as lead-acid and lithium-ion, depending on their use and type. Let’s understand more:

Applicability of GST on Batteries

The imposition of GST on batteries hinges on several factors such as the battery type, its usage, and the place of supply. Currently, GST is applicable to a wide array of batteries including lead-acid and lithium-ion variants. The GST rate is determined by both the intended use of the battery and its specific type.

E-way Bills for Battery Transportation

To curb tax evasion, the government mandates the issuance of e-way bills for the movement of goods within India. If the total value of a battery consignment exceeds Rs. 50,000 in a single invoice, bill, or delivery challan, it is obligatory for the taxpayer to generate an e-way bill. This requirement is applicable for both intra-state and inter-state battery supply transactions and can be conveniently generated online.

Place of Supply Consideration

The concept of “place of supply” refers to the location where goods or services are delivered or consumed. In the context of battery sales, if a transaction occurs within the same state, the applicable GST rate comprises both State GST (SGST) and Central GST (CGST). Conversely, if a battery is sold to a customer in a different state, Integrated GST (IGST) is levied. Determining the type of GST applied to batteries involves factors such as the supplier’s location, the recipient’s location, and the type of battery involved.

Invoicing Requirements for Battery Transactions

Invoices pertaining to battery transactions must encompass crucial details for compliance. These include the GST registration numbers of both the supplier and the recipient, along with specifics like battery type, quantity, and value. Additionally, the invoice should feature the Harmonized System of Nomenclature (HSN) code assigned to batteries for standardized classification and ease of identification.

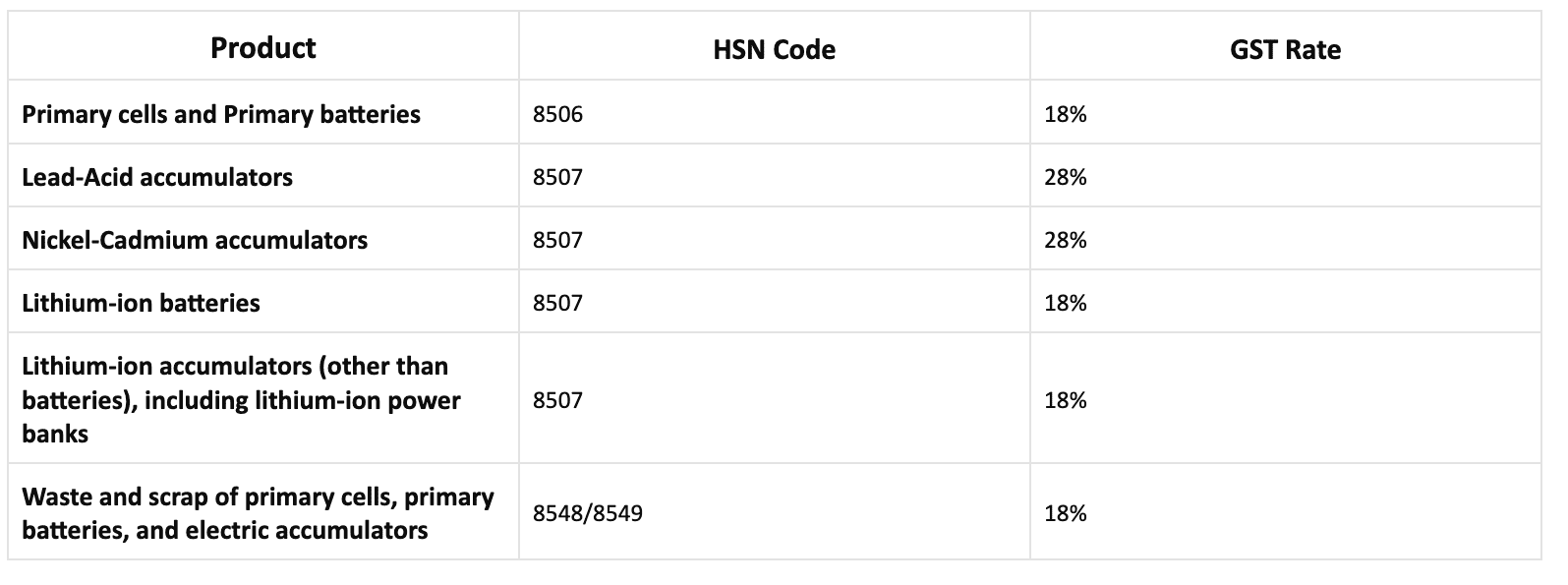

GST Rate and HSN Code for Batteries in India

The GST rates on batteries are subject to change and manufacturers should regularly verify and stay updated with the latest applicable rates.

Input Tax Credit (ITC) Availability on Batteries in India

Input Tax Credit (ITC) can be availed on batteries in India, provided certain conditions are met. Businesses are eligible to claim ITC on the GST paid for batteries procured for their operational use. However, ITC cannot be claimed for batteries utilized in the manufacturing process of exempt goods or for personal consumption.

Moreover, to claim ITC, batteries must be purchased from a supplier registered under GST, and the transaction must be supported by a valid invoice containing the supplier’s GST registration number.

Understanding the GST implications on batteries, including the applicable rates, HSN codes, input tax credit availability, and invoicing requirements, is crucial for businesses operating in the battery industry. Regular monitoring of GST updates ensures compliance and maximizes benefits like input tax credit. With proper understanding and adherence to GST regulations, businesses can effectively manage their financial transactions related to battery sales and purchases, contributing to smoother operations and regulatory compliance.

FAQs

What is the GST rate for inverter batteries in India?

In India, the Goods and Services Tax (GST) rate for inverter batteries, along with UPS batteries (static converters), is set at 28%. This tax rate is applicable on the purchase of these batteries for both residential and commercial purposes.

What is the GST rate for laptop batteries and mobile batteries in India?

The GST rate for batteries commonly found in laptops, personal computers, mobile phones, and tablets—specifically lithium-ion batteries—is set at 18% in India. This tax rate applies to the purchase of these batteries for various electronic devices, ensuring uniformity in taxation across these categories.

How much GST is applicable to bike batteries and car batteries in India?

In India, the GST rate for bike batteries and car batteries varies depending on the battery type. Specifically, lithium-ion batteries, commonly used in some vehicles, are taxed at 18%. On the other hand, other secondary batteries and electric accumulators attract a higher GST rate of 28%.

Do I need to generate an e-way bill when transporting batteries?

Yes, an e-way bill is mandatory for battery transportation if the total value of the consignment exceeds Rs. 50,000.

Can I claim Input Tax Credit (ITC) for batteries used in exempt supplies?

No, it’s not permissible to claim Input Tax Credit (ITC) for batteries utilized in exempt supplies. This means that businesses cannot offset the GST paid on batteries against their tax liability if those batteries are used in the production or supply of goods or services that are exempt from GST. Therefore, businesses need to carefully assess the usage of batteries and ensure compliance with GST regulations regarding Input Tax Credit.

Does GST apply to the sale of batteries to end users?

Yes, GST is applicable to the sale of batteries to end users at the prevailing rates set by the government.

Also Read: What are the differences between HSN and SAC code in GST?