Are you a small business dreaming of expanding globally? Don’t worry, you’re not alone! Did you know that 97% of all exporters are small businesses? That’s right! And guess what? The U.S. Government has your back with various financing programs to help you step into the international market or grow your existing exporting business. Let’s break down these four types of export financing programs:

Also Read: Everything About Export Finance Scheme

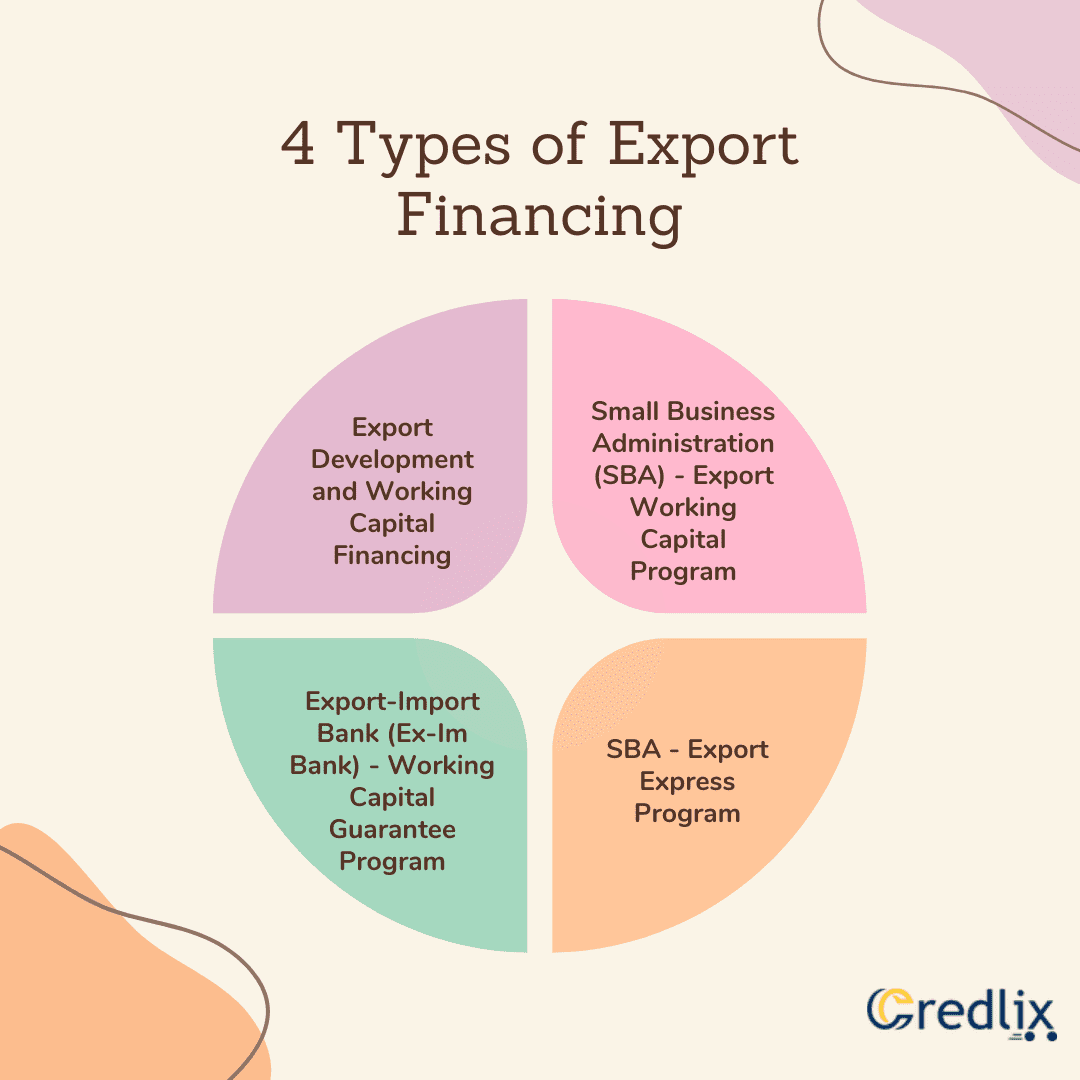

4 Types of Export Financing

Here are the 4 types of export financing:

Export Development and Working Capital Financing

Export Development and Working Capital Financing is a program designed to support U.S. businesses in expanding their exports by providing them with access to loans. This initiative aims to empower businesses with the financial resources necessary to seize new opportunities, increase their international sales, and enhance their competitiveness in the global market.

Through this program, businesses can obtain the funding required to undertake various initiatives aimed at boosting their export activities. Whether it’s investing in new production facilities, expanding distribution networks, or launching marketing campaigns targeted at overseas markets, Export Development and Working Capital Financing offers the financial flexibility needed to pursue these endeavors effectively.

By facilitating access to capital, this program enables businesses to overcome financial barriers that may otherwise hinder their export growth aspirations. It allows companies to leverage their strengths and seize emerging opportunities in international markets, thereby contributing to their overall business expansion and success.

Moreover, Export Development and Working Capital Financing play a crucial role in fostering economic growth and job creation by supporting the export-driven activities of U.S. businesses. By facilitating the expansion of exports, this program not only benefits individual companies but also strengthens the nation’s economy as a whole, driving innovation, productivity, and prosperity across various sectors.

Small Business Administration (SBA) – Export Working Capital Program

The Small Business Administration (SBA) – Export Working Capital Program is a valuable resource tailored specifically for small business exporters aiming to expand their international operations. This program extends short-term loans of up to $5 million to eligible small businesses, providing them with essential financial support to navigate the complexities of global trade.

One of the key benefits of the Export Working Capital Program is its flexibility in financing various aspects of the export process. Small business exporters can utilize the funds for a wide range of purposes, including covering pre-export expenses such as production costs, packaging, and transportation, as well as managing post-shipment expenses like invoicing, inventory management, and working capital needs.

Moreover, the program’s short-term loan structure offers small businesses the agility and responsiveness required to seize time-sensitive opportunities in the global marketplace. Whether it’s fulfilling urgent orders, capitalizing on emerging market trends, or adapting to shifting customer demands, the Export Working Capital Program empowers small business exporters to act swiftly and decisively, thereby enhancing their competitiveness and market presence.

By providing vital financial assistance tailored to the unique needs of small business exporters, the SBA’s Export Working Capital Program plays a pivotal role in driving economic growth, fostering job creation, and promoting entrepreneurship. It serves as a valuable tool for small businesses looking to expand their reach, capitalize on international trade opportunities, and achieve sustainable success in the global arena.

Export-Import Bank (Ex-Im Bank) – Working Capital Guarantee Program

The Export-Import Bank (Ex-Im Bank) – Working Capital Guarantee Program offers crucial support to U.S. exporters by providing a safety net for working capital loans extended by commercial lenders. This program acts as a guarantor, instilling confidence in lenders to finance small and medium-sized enterprises (SMEs) engaging in international trade.

Through the Working Capital Guarantee Program, exporters gain access to much-needed funding that can be utilized for various purposes essential to their export activities. Whether it’s procuring raw materials, covering production expenses, or financing overseas sales transactions, the program’s backing enables exporters to effectively manage their cash flow and operational needs.

By mitigating the risks associated with lending to exporters, the Ex-Im Bank encourages commercial lenders to offer favorable terms and conditions, making it easier for SMEs to secure the financing they require to thrive in the global market. This, in turn, fosters greater competitiveness and resilience among U.S. exporters, allowing them to seize opportunities for growth and expansion on the international stage.

Furthermore, the Working Capital Guarantee Program plays a pivotal role in supporting job creation, economic development, and the overall competitiveness of the U.S. export sector. By facilitating access to working capital financing, the program empowers exporters to innovate, invest, and capitalize on emerging market opportunities, driving sustained growth and prosperity for businesses and communities across the nation.

SBA – Export Express Program

The Small Business Administration (SBA) – Export Express Program is a valuable initiative tailored to support small businesses with the potential to expand into international markets. With funding options of up to $500,000, this program provides essential financial assistance to eligible small businesses, empowering them to seize opportunities for growth and success in the global arena.

One of the standout features of the Export Express Program is its versatility in catering to a wide range of business needs. Whether you’re looking to invest in new equipment, bolster your working capital, or embark on an expansion initiative, this program offers flexible financing solutions tailored to your specific requirements.

By offering accessible financing options, the Export Express Program aims to remove barriers and facilitate the expansion of small businesses into international markets. Whether you’re a manufacturer looking to export your products overseas or a service provider seeking to tap into global demand, this program offers the financial support needed to turn your export aspirations into reality.

Also Read: Export Pricing Strategy for Your Export Business

Moreover, the Export Express Program plays a crucial role in driving economic growth, job creation, and competitiveness in the small business sector. By providing small businesses with the resources they need to thrive in the global marketplace, the program contributes to the overall vibrancy and resilience of the U.S. economy, fostering innovation, entrepreneurship, and prosperity for years to come.

And that’s not all! There are also financing options available for your international buyers:

- Export-Import Bank offers loan guarantee programs and direct loans to creditworthy international buyers.

- The U.S. Department of Agriculture (USDA) provides credit guarantees for food and agricultural products sold to foreign buyers.

Lastly, if you’re planning big projects like infrastructure or telecommunications, there’s Investment Project Financing available through the Overseas Private Investment Corporation (OPIC) to support your ventures in developing countries and emerging markets.

So, if you’re ready to take your business global, these financing programs can be your ticket to success!

Also Read: Why Do Exporters Need Financing?