To maintain a healthy economy, it’s important for a country to export more than it imports. To encourage exports, the government has introduced different schemes. These schemes are outlined in the Foreign Trade Policy (FTP), which focuses on boosting exports and using trade to drive economic growth and job creation.

The current FTP aligns with the ‘Make in India’ initiative and supports exports from Special Economic Zones (SEZs) and Export Oriented Units (EOUs). It includes various schemes that promote exports by either exempting or reducing customs duty. One such scheme is the Advance Authorization Scheme, aimed at facilitating export activities.

What is an Advance Authorisation Scheme (AA)?

The Advance Authorisation Scheme (AA) is a program initiated by the Indian government to facilitate exports by granting duty exemptions to exporters. Administered by the Directorate General of Foreign Trade (DGFT), this scheme encourages the import of essential raw materials and additives needed for the production of export-bound goods. These inputs, which can include fuel, oil, power, or catalysts, are incorporated into the final product intended for exportation.

Through the AA Scheme, importation of these inputs is exempted from duties, and allowances are made for normal wastage during production. The DGFT periodically issues notifications regarding the inclusion or exclusion of products under the AA Scheme through public notices. Sometimes referred to as an ‘Advance License,’ this scheme outlines guidelines for input-output relationships, eligibility criteria, value addition requirements, and other pertinent aspects.

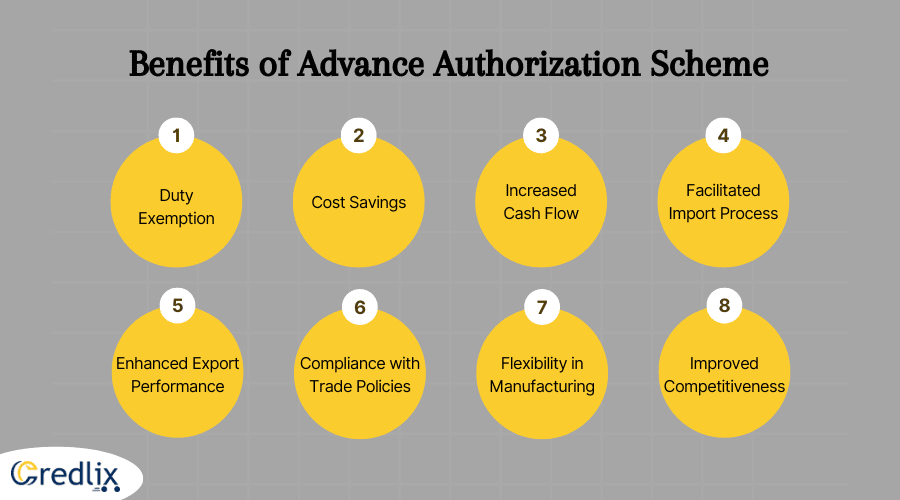

Benefits of Advance Authorization Scheme

Discover the advantages of the Advance Authorization Scheme, including duty exemptions, streamlined import processes, and enhanced competitiveness for exporters.

Duty Exemption: One of the primary benefits of the scheme is the exemption from duties such as Basic Customs Duty, Additional Customs Duty, Education Cess, Anti-dumping duty, and other applicable taxes. This exemption applies to imported inputs that are physically incorporated into export products.

Cost Savings: By eliminating or reducing the burden of customs duties and taxes on imported inputs, the Advance Authorization Scheme helps exporters save significantly on production costs. This cost advantage enhances the competitiveness of Indian goods in the international market.

Increased Cash Flow: With duty exemptions under the scheme, exporters can conserve cash flow that would otherwise be tied up in paying customs duties and taxes. This liquidity can be redirected towards other business expenses or invested in growth initiatives.

Facilitated Import Process: The scheme streamlines the import process for essential raw materials, components, and inputs required for export production. Exporters can obtain authorization in advance, ensuring timely procurement of necessary goods without delays at customs checkpoints.

Enhanced Export Performance: By providing duty-free access to imported inputs, the Advance Authorization Scheme encourages exporters to scale up production and expand their export volumes. This, in turn, contributes to the growth of the export sector and strengthens the country’s trade position.

Compliance with Trade Policies: Utilizing the Advance Authorization Scheme enables exporters to align with the Foreign Trade Policy (FTP) objectives of promoting exports and supporting domestic manufacturing. By adhering to the scheme’s guidelines, exporters contribute to the overall trade objectives of the government.

Flexibility in Manufacturing: Exporters have the flexibility to choose their suppliers and source inputs globally under the scheme. This flexibility allows them to access high-quality inputs at competitive prices, supporting efficient and cost-effective manufacturing processes.

Improved Competitiveness: With reduced production costs and streamlined import procedures, exporters under the Advance Authorization Scheme can offer competitive pricing for their goods in international markets. This competitiveness enhances their market share and strengthens India’s position as a global exporter.

Overall, the Advance Authorization Scheme plays a crucial role in facilitating export-led growth, fostering trade competitiveness, and supporting the economic development of the country.

Duties Exempted under the Advance Authorization Scheme

Under the Advance Authorization Scheme, the following duties are exempted for imported inputs, subject to specific conditions:

- Basic Customs Duty

- Additional Customs Duty

- Education Cess

- Anti-dumping duty

- Safeguard Duty

- Transition Product-Specific Safeguard duty

- Integrated tax

- Compensation Cess

Eligibility of the Advance Authorization Scheme

The Advance Authorization Scheme is open to various entities involved in export activities, including manufacturer exporters, merchant exporters with a link to the supporting manufacturer, and subcontractors of projects where their name appears in the contract. Additionally, those supplying to the United Nations or other aid programs are eligible, provided payment is received in freely convertible foreign exchange.

This scheme is specifically designed for facilitating physical exports, which encompass exports to Special Economic Zones (SEZs), intermediate supplies, and the supply of stores onboard vessels/aircraft, among others, subject to specific conditions.

One notable benefit of the DGFT Advance License is the duty-free import of mandatory spares, if required to be provided with the exported item. This benefit is extended up to a maximum of 10% of the CIF value of the authorization.

Eligibility for the Advance Authorization Scheme is contingent upon meeting certain criteria, including compliance with export obligations and adhering to the terms and conditions outlined by the Directorate General of Foreign Trade (DGFT). By availing of this scheme, exporters can streamline their operations, reduce import costs, and enhance their competitiveness in the global market.

Overall, the Advance Authorization Scheme serves as a valuable tool for promoting exports and fostering economic growth by incentivizing export-oriented businesses and streamlining trade processes.

Eligible Imported Inputs and Conditions for Advance License

Learn about the criteria for imported inputs eligible for Advance License and the conditions for obtaining this valuable trade benefit.

- Imported inputs eligible for Advance License are determined by their physical incorporation into exportable products, based on standard input-output norms (SION) or self-declaration.

- In the absence of SION, exporters can apply to the Norms Committee for approval.

- Exporters holding an ‘Authorized Economic Operator’ (AEO) certificate can also apply for advance authorization under the self-ratification scheme.

- Certain inputs, such as vegetable oils, cereals, and fruits, are not admissible for self-declaration under the scheme.

- For biotechnology items, self-declaration is permitted only with a No Objection Certificate (NOC) from the Department of Biotechnology.

- Advance Authorization is not granted for activities like cleaning, grading, or packaging of spices; instead, activities resembling manufacturing, such as crushing or grinding, are required.

Annual Requirement Advance Authorisation: A Brief Guide

The Advance Authorisation Scheme is also available as an annual requirement, with eligibility limited to items notified in the Standard Input Output Norms (SION), except for those listed in Appendix 4J of the Handbook of Procedures 2015-20. To qualify for the Advance Authorisation under the annual requirement, exporters must demonstrate export performance for at least the preceding two financial years. Specifically, the Free On Board (FOB) value of exports should exceed 15% of the Cost, Insurance, and Freight (CIF) value of the inputs covered by the scheme.

Under this scheme, the entitlement for importing raw materials is calculated based on a percentage of the FOB value of physical exports or the Free On Rail (FOR) value of deemed exports. Alternatively, the entitlement is set at a minimum threshold of Rs. 1 crore, whichever amount is higher. Specifically, the amount entitled for raw material imports under the annual requirement is 300% of the FOB value of physical exports or FOR value of deemed exports, or Rs. 1 crore, whichever is greater.

This scheme aims to streamline import procedures for raw materials required for export-oriented production, thereby facilitating smoother trade operations and promoting export growth. By aligning eligibility criteria with past export performance, the scheme encourages consistent export efforts and ensures that benefits are directed towards exporters with a proven track record. Additionally, the provision for a minimum entitlement threshold provides a safety net for exporters, guaranteeing a certain level of support regardless of export volume fluctuations. Overall, the Advance Authorisation for annual requirement serves as a valuable tool in incentivizing and supporting export-oriented businesses in India.

Applying for Advance Authorisation Scheme: A Step-by-Step Guide

Learn how to apply for Advance Authorisation online and understand the validity period, procurement options, and necessary notifications.

- The application process for the Advance Authorisation (AA) Scheme is entirely online through the DGFT portal at www.dgft.gov.in.

- The validity period for import under Advance Authorisation is typically 12 months from the date of issue.

- For deemed exports, the validity extends to either the project execution period or 12 months, whichever is longer.

- Exporters with an AA can opt to procure goods domestically instead of importing them, or in addition to importing.

- Sale proceeds from exports must be received in freely convertible foreign exchange, unless specified otherwise.

- In the event of re-importing exported goods, exporters must notify the regional authority within one month of re-importation.

Understanding Minimum Value Addition in Duty-Free Import Authorisation

The Duty-Free Import Authorisation under the Advance License comes with specific rules regarding the minimum value addition expected from the products. For most goods, this value addition is set at 15%, but for tea, it’s higher at 50%.

Appendix 4D lists products where the value addition can be less than 15%, while Appendix 4C outlines the requirements for products where payments aren’t received in freely convertible foreign exchange. In the gems and jewelry segment, the Handbook of Procedures specifies the minimum value addition needed.

Value addition is calculated by finding the difference between the export/supply value and the import value, as a percentage of the latter. If goods are received for free from the foreign buyer, their value is also considered in this calculation.

Navigating Export Obligations in the Advance Authorisation Scheme

- Explore the essential aspects of export obligations under the Advance Authorisation Scheme, including requirements, timeframes, penalties, and compliance guidelines.

- Export obligation (EO) is a requirement for beneficiaries of Advance Authorisation.

- EO specifies the value of exports to be fulfilled within a specified timeframe.

- Failure to meet the EO within the set timeframe can result in penalties.

- The EO is indicated in the authorization document itself.

- Evidence of meeting the EO must be retained and provided upon request.

- The standard period to fulfill the EO is 18 months from the date of issue of the authorization.

- However, this timeframe may vary for certain inputs such as supplies to turnkey projects or defense sectors.

- Meeting the EO is essential for maintaining compliance with the Advance Authorisation Scheme.

- Exporters must ensure timely fulfillment of the EO to avoid penalties or complications.

- Adhering to the specified export obligations is crucial for benefiting from the incentives offered under the scheme.

Final Note

The Advance Authorization Scheme stands as a pivotal mechanism in India’s export ecosystem, offering a range of benefits to exporters while facilitating smoother trade operations. From duty exemptions to streamlined import processes and enhanced competitiveness, the scheme empowers exporters to thrive in the global market. By adhering to eligibility criteria, meeting export obligations, and navigating the scheme’s guidelines, exporters can leverage its advantages to bolster their businesses and contribute to the country’s economic growth. As India continues to pursue its vision of becoming a manufacturing powerhouse and a leading player in global trade, the Advance Authorization Scheme remains a cornerstone in realizing this ambition, fostering innovation, competitiveness, and sustainable export-led development.