In the intricate landscape of global commerce, the concept of deemed exports stands as a pivotal element, offering unique opportunities and benefits for businesses operating on an international scale. Unlike traditional exports, where goods physically cross borders, deemed exports occur when the benefits of domestically produced goods extend to foreign entities without the items leaving the exporting country. This nuanced arrangement often arises in scenarios where goods manufactured domestically contribute to projects funded by international organizations or are utilized in the production process for goods destined for foreign markets.

Understanding the eligibility criteria and benefits associated with deemed exports is crucial for businesses seeking to maximize their global trade potential. Eligible entities typically include manufacturers, suppliers to Export Oriented Units (EOUs), and those involved in projects backed by international agencies. The allure of deemed exports lies in the array of benefits they offer, ranging from tax incentives and duty exemptions to enhanced access to financing options.

In this blog post, we’ll delve deeper into the intricacies of deemed exports, shedding light on their significance, eligibility requirements, and the myriad advantages they present for businesses navigating the complex terrain of international trade.

What is Deemed Exports?

Deemed exports refer to transactions in which goods supplied do not physically leave the country, but the benefits of such goods accrue to the recipient located abroad. In other words, although the goods are not shipped out of the country, they are considered as exports because they are used in the production of goods and services for foreign markets or consumed by foreign entities.

Deemed exports can include various scenarios such as:

- Supply of goods to Export Oriented Units (EOUs) or units located in Export Processing Zones (EPZs).

- Supply of goods to projects funded by international organizations.

- Supply of goods to diplomatic missions or UN organizations.

- Supply of goods to exporters for packaging or other purposes.

These transactions are typically subject to certain benefits or incentives provided by the government to promote exports, as they contribute to the generation of foreign exchange and boost economic activity.

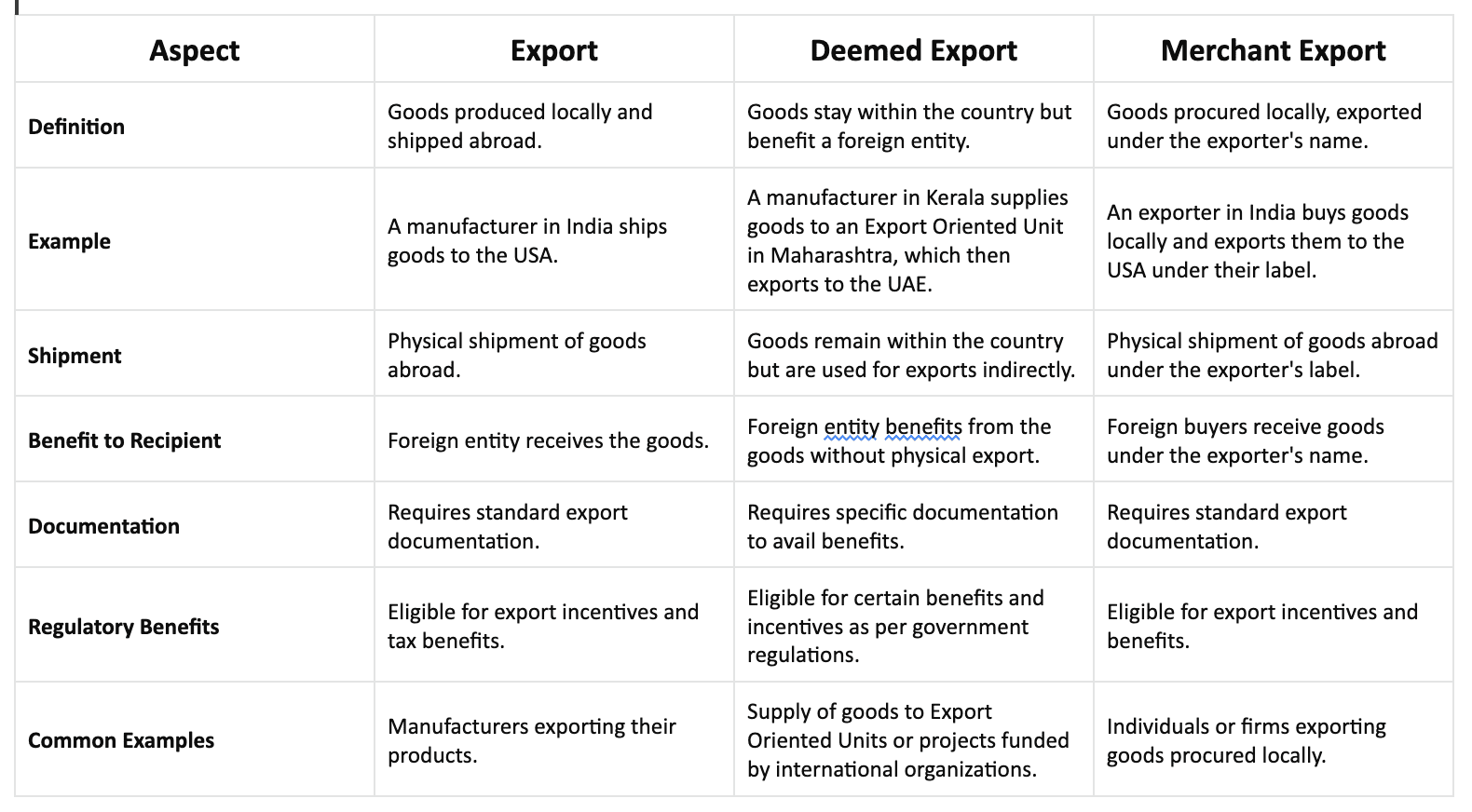

Difference Between Export, Deemed Export, and Merchant Export

Here’s a comparison of Export, Deemed Export, and Merchant Export in a table format. This table provides a comprehensive comparison of Export, Deemed Export, and Merchant Export, outlining their definitions, examples, processes, regulatory considerations, and common scenarios.

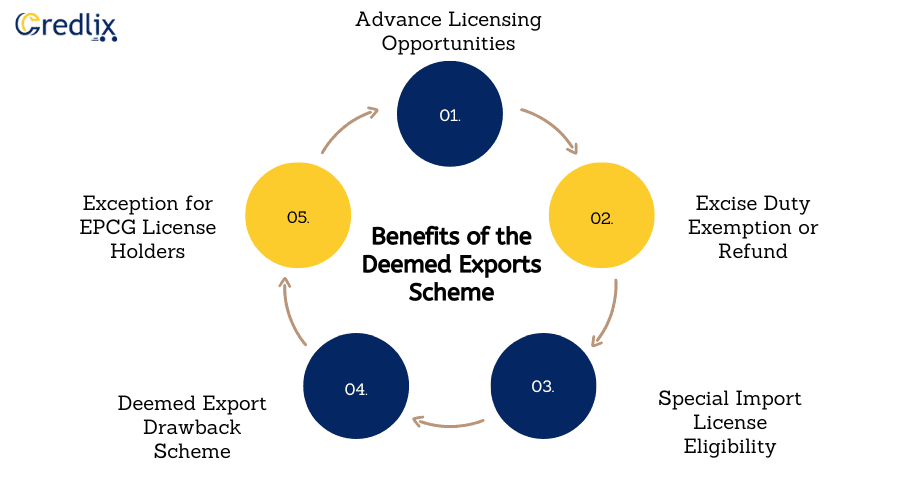

Benefits of the Deemed Exports Scheme

These benefits collectively contribute to fostering a conducive environment for deemed exports, encouraging businesses to actively engage in international trade and capitalize on emerging opportunities in the global marketplace.

Advance Licensing Opportunities

Suppliers of goods eligible for deemed exports can obtain Advance Licenses for various purposes such as intermediate supply, deemed export, Duty-Free Replenishment Certificate (DFRC), or DFRC for intermediate supplies. These licenses facilitate smoother trade operations and help in managing costs effectively.

Excise Duty Exemption or Refund

Deemed exports are either exempted from terminal excise duty or qualify for a full refund of the duty paid. This relieves the supplier from additional financial burdens, enhancing competitiveness and profitability in the global market.

Special Import License Eligibility

Manufacturers engaging in deemed exports may qualify for a Special Import License, typically at a rate of 6 percent of the Freight On Board (FOB) value. This enables them to procure necessary inputs or raw materials for production, thereby supporting business continuity and expansion.

Deemed Export Drawback Scheme

Suppliers fulfilling orders against an Advance Release Order or Back to Back Letter of Credit can avail benefits under the Deemed Export Drawback Scheme. This includes refunds of terminal excise duty and the opportunity to obtain a Special Imprest License, further incentivizing participation in deemed export transactions.

Exception for EPCG License Holders

In cases where goods are supplied to recipients holding an Export Promotion Capital Goods (EPCG) license with zero duty obligations, suppliers can still benefit from several aspects of the Deemed Exports Scheme. However, the eligibility for a Special Imprest License or participation in the Deemed Export Drawback Scheme may be excluded.

This exception ensures that suppliers can leverage deemed exports to support various trade arrangements while aligning with specific regulatory requirements.

Eligibility Criteria for Qualifying Under the Deemed Exports

Here’s the eligibility criteria for qualifying under the Deemed Exports scheme, structured for clarity and understanding:

Eligibility Criteria for Deemed Exports:

1.Goods Only: Deemed exports pertain strictly to goods; services are not considered eligible under this scheme.

2.Production in India: The goods must be manufactured or produced within the boundaries of India to qualify for deemed export status.

3.Goods Remain in India: The goods involved in the transaction must not physically leave the territory of India.

4.Notification by Government: The goods in question must be officially recognized as deemed exports under Section 147 of the Central Goods and Services Tax Act, 2017 (CGST Act) by the Central Government.

5.Currency and Tax Payment: Transactions under the deemed export category can be conducted in Indian Rupees or any other convertible foreign exchange. Additionally, Goods and Services Tax (GST) levied on the goods must be paid at the time of supply, with the provision for a full refund of this tax.

6.Bond Exclusion: Goods supplied under the deemed export scheme cannot be processed under a Letter of Undertaking (LUT) or a bond.

Specific Transactions Considered as Deemed Exports Include:

a. Supply to parties holding Advance Authorisation (AA)/Advance License.

b. Supply to Export Oriented Units (EOU), Electronic Hardware Technology Park Units (EHTP), Software Technology Park Units (STP), or Bio-Technology Park Units (BTP) by GST-registered individuals or entities.

c. Transactions made against Duty-Free Import Authorisation (DFIA).

d. Supply of capital goods to recipients holding Export Promotion Capital Goods Authorisation (EPCG scheme).

e. Supply of goods for UN projects, nuclear power projects, and projects funded by bilateral or multilateral agencies.

These criteria outline the various conditions and transactions that qualify under the Deemed Exports scheme, providing a comprehensive understanding of the eligibility requirements for businesses and stakeholders.

Understanding Deemed Exports under GST

Under the Goods and Services Tax (GST) regime in India, exports—where goods are physically transported out of the country—are zero-rated, meaning no GST is levied on such transactions. However, the scenario differs for deemed exports. Deemed exports, referring to transactions where the benefits accrue to a foreign entity without the goods leaving the country, do not fall under the zero-rated category. Hence, GST is applicable to goods qualifying as deemed exports. However, the supplier is entitled to claim a full refund of the GST paid on these transactions.

The Central Government, through Notification No. 48/2017-Central Tax, has delineated a broad spectrum of transactions that qualify as deemed exports under GST. While GST is indeed levied on deemed exports, both the supplier and the recipient have the opportunity to claim a refund of the tax paid. This mechanism ensures that the taxation of deemed exports does not burden businesses engaged in international trade, fostering a conducive environment for such transactions while aligning with GST principles.

Final Words

In conclusion, deemed exports emerge as a crucial facet of international trade, offering a nuanced avenue for businesses to engage in global commerce. Despite their distinction from traditional exports, deemed exports bring forth a plethora of benefits and opportunities for manufacturers, suppliers, and exporters alike. From tax incentives and duty exemptions to enhanced access to licensing and financing, the advantages associated with deemed exports serve to bolster economic growth and foster robust trade relations.

Moreover, under the GST framework, the provision for tax refund mechanisms ensures that the taxation of deemed exports does not impede the fluidity of cross-border transactions. As businesses navigate the complexities of global trade, understanding and harnessing the potential of deemed exports can prove instrumental in unlocking new avenues for growth and expansion in the dynamic landscape of international commerce.