Multiple documents are essential for completing an export trade, with the Shipping Bill standing out as one of the most crucial. This document serves as a declaration of goods being exported out of the country and contains vital details such as the exporter’s information, consignee details, description of the goods, quantity, value, port of destination, and mode of shipment.

Additionally, the Shipping Bill facilitates customs clearance and serves as evidence of shipment for the exporter. Its accurate preparation and submission are imperative for smooth and legal export operations, ensuring compliance with international trade regulations.

Let’s understand shipping bill in detail in this article:

What is a Shipping Bill?

A Shipping Bill is a crucial document required for obtaining customs clearance for exports. It functions as an application submitted to customs authorities, essential for shipping goods via air, sea, or road. Without filing the Shipping Bill, exporters are prohibited from loading their export items. Typically submitted electronically, unless granted permission for physical submission by the Commissioner or Principal Commissioner, the Shipping Bill contains vital information such as exporter details, consignee information, description of goods, quantity, value, port of destination, and mode of shipment.

Its accurate completion and submission are vital for ensuring compliance with international trade regulations and facilitating smooth export operations.

Color-Coding of Shipping Bills

Shipping Bills are categorized and color-coded based on the type of export transaction they represent. This classification system helps customs authorities quickly identify and process different types of exports. The color-coding system typically includes distinct colors for various export types, such as:

White: Used for exports under free shipping bill or exports of duty-free goods.

Yellow: Assigned to exports under the Duty Drawback Scheme, where exporters are eligible for a refund of duties paid on imported materials used in manufacturing the exported goods.

Blue: Reserved for exports under the Duty Entitlement Passbook (DEPB) scheme, allowing exporters to claim duty credit on the export of eligible products.

Green: Designated for exports under the Export Promotion Capital Goods (EPCG) scheme, which enables import of capital goods at concessional rates of duty for producing goods for export.

Red: Applied to exports under the Export Oriented Units (EOU) scheme or those claiming benefits under various export promotion schemes.

By assigning specific colors to Shipping Bills, customs authorities streamline the clearance process and ensure proper scrutiny and assessment of each export transaction according to its category and associated benefits or obligations.

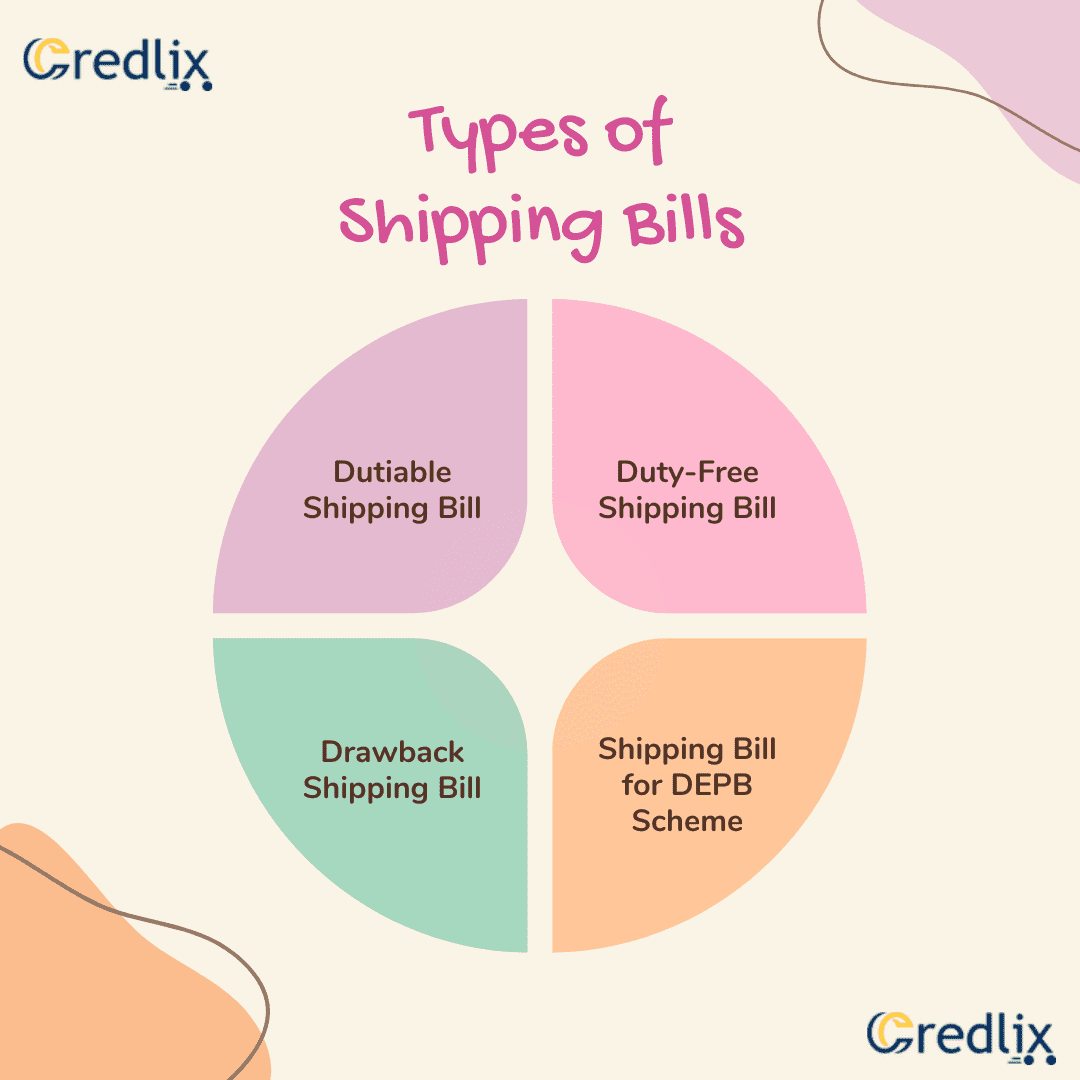

Types of Shipping Bills

Shipping Bills serve as crucial documents for facilitating exports, each tailored to specific export scenarios. There exist four primary types:

Dutiable Shipping Bill: Printed on yellow paper, it applies to goods slated for export with payment of export duty.

Duty-Free Shipping Bill: Printed on white paper, it’s designated for goods to be exported without duty payment, rendering them ineligible for duty drawback benefits.

Drawback Shipping Bill: Initially printed on green paper, it transitions to white paper post-payment of drawback. This bill facilitates claims for refund of duties paid on imported materials used in exported goods.

Shipping Bill for DEPB Scheme: Printed in blue, it’s utilized for exporting goods under the government’s Duty Entitlement Passbook (DEPB) scheme, which offers export incentives.

In March 2019, the Shipping Bill and Bill of Export (Forms) Amendment Regulations, 2019, were issued, delineating the specific forms for these Shipping Bill variants. These regulations streamline export documentation procedures, ensuring clarity and compliance in international trade transactions.

How To Generate Shipping Bill?

The process of generating a Shipping Bill is streamlined through the Indian Customs Electronic Gateway (ICEGATE), a national platform managed by the Central Board of Indirect Taxes and Customs. ICEGATE offers electronic filing services, including the submission of Shipping Bills, facilitating swift customs clearance. Integrated with key entities such as the Reserve Bank of India (RBI), Directorate General of Foreign Trade (DGFT), and various government ministries, ICEGATE ensures seamless coordination for export-related transactions.

The Indian Customs EDI System (ICES) serves as the online interface for customs clearance, operating in real-time through Electronic Data Interchange (EDI). This system not only expedites the process but also enables internal automation of Custom House operations, enhancing efficiency and compliance in export procedures.

The Process of Shipping Bill Generation

Here’s the process of shipping bill generation:

1. Registration with EDI System

Before initiating the Shipping Bill filing process, exporters or Customs House Agents (CHA) must register with the Electronic Data Interchange (EDI) system using their Importer Exporter Code (IEC) code, Authorized Dealer (AD) code, and/or CHA license number.

2. Submission of Shipping Bill

Under the Electronic Data Interchange (EDI) system, the Shipping Bill is meticulously filled out in the prescribed format and submitted at designated Customs service centers, accompanied by copies of the invoice and packing list.

3. Verification Process

Upon submission, a checklist is generated, necessitating verification by either the exporter or the CHA to ensure accuracy and completeness of the provided information.

4. Transmission to EDI System

The verified data is then transmitted to the EDI system by the service center operator.

5. Generation of Shipping Bill Number

The system generates a unique Shipping Bill Number, which is endorsed on the printed copy of the checklist and returned to the exporter or CHA.

6. Automated Processing

In most cases, the system autonomously processes the Shipping Bill without human intervention, relying on the declarations furnished by the exporter.

7. Manual Assessment

Manual assessments are conducted by the Assistant Commissioner of Exports for Shipping Bills with specific criteria, such as exceeding certain value thresholds.

8. Payment of Export Cess

If applicable, the exporter is provided with the requisite challan for payment of export cess, which can be settled at designated banks.

9. Tracking and Query Resolution

Exporters can track the progress of the Shipping Bill and address any queries raised within the service center interface, ensuring seamless communication and resolution.

Correcting or Amending a Shipping Bill

Corrections or amendments to the declaration on a Shipping Bill can be facilitated at the service center, provided that the documents have not yet been submitted in the system and the Shipping Bill has not been generated.

Once the Shipping Bill number is generated or the goods arrive at the Export Dock, but before the granting of ‘Let Export,’ any necessary changes can be made by the Assistant Commissioner of Exports.

In the event that ‘Let Export’ has already been issued, amendments can only be made by the Additional/Joint Commissioner of the Custom House, who oversees the export section. This hierarchical process ensures that any modifications to the Shipping Bill are accurately documented and authorized by the appropriate customs authorities, maintaining the integrity and compliance of export procedures.

Format and Content of the Shipping Bill

Form SB I (Regulation 2) encompasses various fields essential for accurately documenting export transactions. These fields cover crucial aspects such as:

Exporter, Buyer, and Customs Broker Details: This section captures information about the exporter, the buyer of the exported goods, and details of the customs broker involved in the transaction. It ensures proper identification of the parties involved in the export process.

Carrier, Port, and Transportation Details: Here, information regarding the carrier responsible for transporting the goods, the port of shipment, and details of the transportation mode are recorded. This section aids in tracking and managing the movement of exported goods.

Invoice-related Information: Essential details from the commercial invoice, such as invoice number, date, and value of the goods, are included in this section. It provides a comprehensive overview of the financial aspects of the export transaction.

Cargo-related Itemized Information: This part entails itemized information about the cargo being exported, including descriptions, quantities, and values of individual items. It ensures accurate declaration of the exported goods for customs and regulatory purposes.

Export Duty and GST-related Information: Details pertaining to export duties, taxes, and GST applicable to the exported goods are documented here. It ensures compliance with taxation and duty regulations governing export transactions.

Export Scheme/Job Work/Re-export Details: This section captures information related to any export schemes, job work arrangements, or re-export scenarios applicable to the exported goods. It helps in identifying special circumstances or incentives associated with the export.

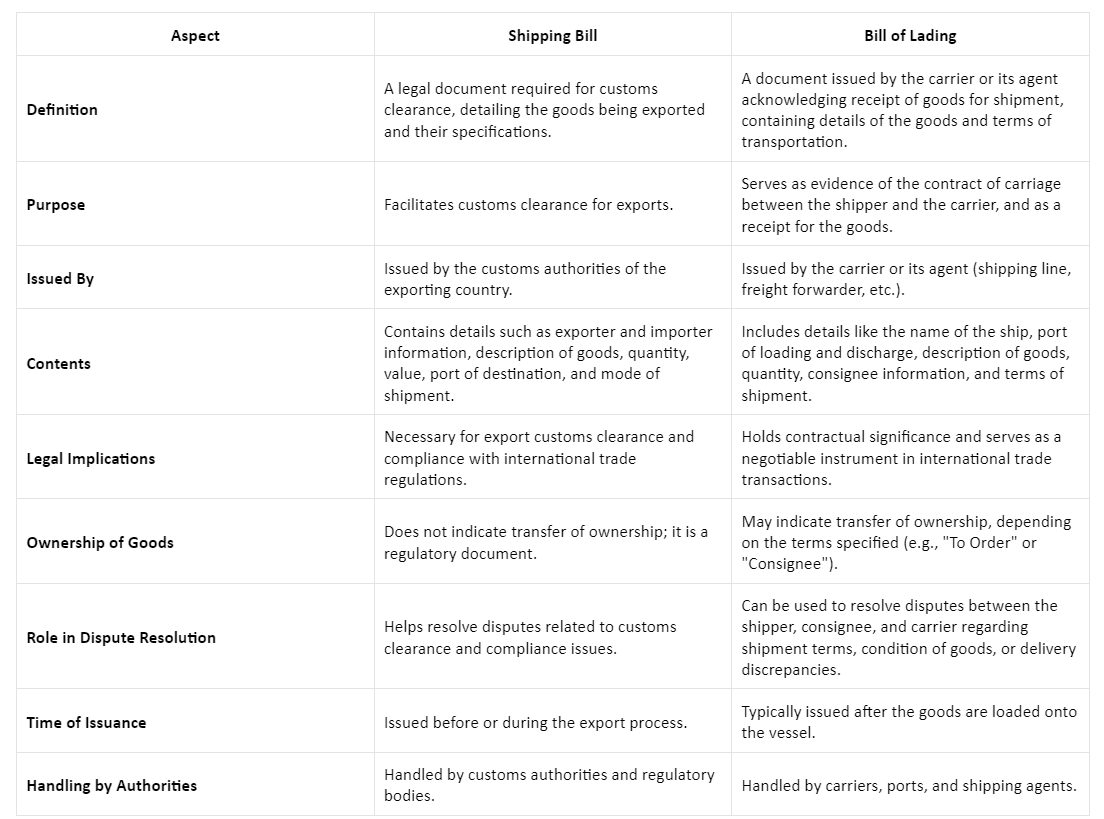

Difference Between Shipping Bill and Bill of Lading

Understand the difference between shipping bill and bill of lading in the table:

In summary, grasping the Shipping Bill’s ins and outs is crucial for smooth export procedures and following global trade rules. Understanding its format, types, and how it’s made helps exporters handle paperwork confidently. Knowing the difference between the Shipping Bill and the Bill of Lading is also important for legal reasons. By sticking to the right steps and paperwork, exports can move smoothly and legally, making global trade easier for everyone involved.

Also Read: How to Download Shipping Bills from ICEGATE?