Initiating the customs clearance process for your goods demands adherence to several essential prerequisites, crucial for navigating the regulatory landscape smoothly. Paramount among these prerequisites is securing an Import Export Code, alongside obtaining an Authorized Foreign Exchange Dealer Code. Additionally, maintaining a current account designated for the credit of duty drawback is imperative, as is procuring a license for export under an export promotion scheme.

When it comes to navigating the intricate maze of customs procedures, the assistance of a freight forwarder or customs broker proves invaluable. These seasoned professionals serve as indispensable allies, adept at navigating the nuances of export transactions. Whether leveraging the logistical expertise of a freight forwarder or the regulatory insight of a customs broker, exporters can surmount obstacles and ensure the seamless movement of their goods.

In the ever-evolving scene of international trade, collaboration between exporters, freight forwarders, and customs brokers emerges as a pivotal factor for success. By harnessing the collective knowledge and experience of these stakeholders, exporters can confidently navigate regulatory complexities, facilitating efficient customs clearance and smooth passage for their goods to global markets.

Also Read: Everything About Export Finance Scheme

What is Custom Clearance?

Customs clearance is the process by which goods entering or leaving a country’s borders are officially inspected and documented to ensure compliance with customs regulations. It involves a series of procedures and documentation requirements, including declaring the contents of shipments, paying any applicable duties or taxes, and obtaining approval from customs authorities for the goods to be imported or exported. Customs clearance is essential for facilitating international trade and preventing illegal or prohibited goods from entering or leaving a country.

Also Read: What is Export Finance in International Marketing?

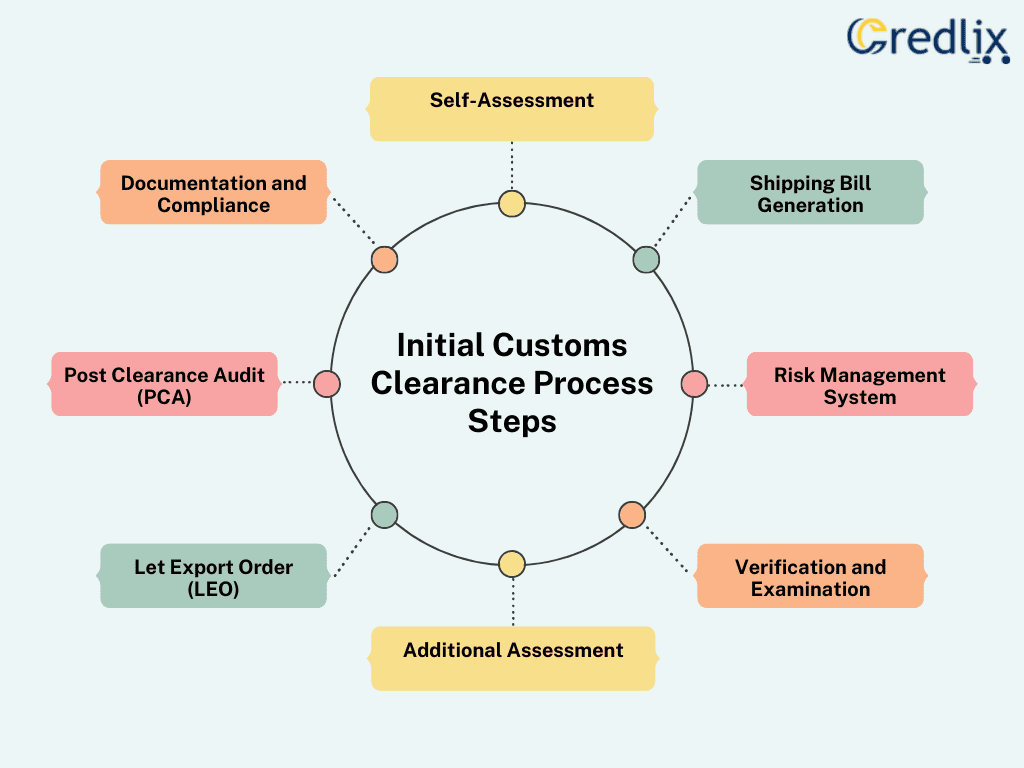

Initial Customs Clearance Process Steps

In the process, there are some initial steps that need to be followed the right way:

Self-Assessment

- As an exporter, you take on the responsibility of evaluating the duty applicable to your export items. This involves accurately declaring the classification, duty rate, value of goods, and claiming any applicable exemptions while preparing the shipping bill.

- Key documents generated during this stage include the commercial invoice, packing list, consular invoice, certificate of origin, and insurance certificate.

Shipping Bill Generation

- The Shipping Bill is created either through the Indian Customs EDI System (ICES) or non-EDI mode for ports without EDI facilities.

- It must be filed in the specified format with all supporting documents. The process of generating the shipping bill is explained in detail separately.

Risk Management System (RMS)

- Self-assessed shipping bills are processed by the Risk Management System (RMS) of the customs department.

- RMS verifies the accuracy of classification, value, duty rate, exemptions, etc.

- Based on RMS evaluation, shipping bills are either selected for verification, examination, or issued a Let Export Order (LEO).

Verification and Examination

- Selected shipping bills undergo verification and examination to ensure compliance with customs regulations.

- Proper officers may examine and test the goods to validate the accuracy of the declared information.

Additional Assessment

- Customs officers may conduct additional assessments even without RMS flags, with prior approval from the jurisdictional Commissioner of Customs or an officer of equivalent rank.

Let Export Order (LEO)

- Shipping bills that pass through RMS without any issues are granted a Let Export Order (LEO), indicating clearance for export.

Post Clearance Audit (PCA)

- Post Clearance Audit (PCA) is introduced after RMS implementation to enhance compliance and reduce export cargo dwell time.

- PCA aims to audit shipping bills retrospectively to ensure adherence to customs regulations and improve overall compliance levels.

Documentation and Compliance

- Throughout the customs clearance process, exporters must maintain accurate documentation and comply with all regulatory requirements.

- This ensures smooth processing and minimizes the risk of delays or penalties associated with non-compliance.

Final Steps in Customs Clearance Process

Here are the final steps that need to be followed during the custom clearance process:

Checklist Endorsement

- Upon arrival of goods at the dock, the custodian endorses the quantity of goods on the reverse of the checklist./li>

- The endorsed checklist, along with original copies of the invoice, packing list, and other relevant documents, is presented to the customs officer by the exporter or Customs House Agent (CHA).

Verification

- The customs officer verifies the received goods and updates the information in the system.

- An electronic copy of the shipping bill is marked by the customs officer and handed over to the dock appraiser along with the original documents.

Examination

- The dock appraiser assigns the examination task to a customs officer.

- Customs may bypass examination norms and the Risk Management System (RMS) based on credible intelligence, even examining up to 100% of the export consignment.

Sampling

- Upon orders from the proper officer, a representative sample from the shipment may be drawn and tested or verified for visual inspection, description, and valuation.

Let Export Order (LEO)

- LEO is granted by customs once they are satisfied with the verification and examination of the shipment, indicating clearance for export.

Loading Supervision

- Customs preventive officers ensure preventive supervision during the stuffing or loading of container cargo.

- They endorse the exporter’s copy of the shipping bill with a ‘Shipped on Board’ endorsement.

Export General Manifest (EGM)

- Shipping lines or agents must submit a shipping bill-wise Export General Manifest (EGM) to customs before departure.

- EGM is lodged electronically and manually to provide details of the cargo being exported.

Duty Drawback

- Duty drawback primarily covers the incidence of customs duties on inputs used.

- It is claimed by filing the prescribed format of the shipping bill along with prescribed documents as defined in the Drawback Rules 2017.

- In case of any deficiency in the claim, it may be returned, but the shipment is not stopped for this reason.

The customs clearance process is a vital aspect of international trade, ensuring the smooth movement of goods across borders while adhering to regulatory requirements. From initiating the process by securing necessary codes and licenses to navigating the complexities of customs procedures with the assistance of freight forwarders and customs brokers, exporters must follow a meticulous approach.

The collaboration between exporters, logistics professionals, and customs authorities is paramount for success in navigating regulatory intricacies and facilitating efficient customs clearance. By embracing best practices and maintaining compliance throughout the process, exporters can streamline operations and expand their presence in global markets with confidence.

Also Read: What are Export Finance Risks in India?