A letter of credit (LC) serves as a financial safeguard in trade transactions, with banks acting as intermediaries between buyers and sellers. The buyer requests their bank to issue an LC in favor of the seller. Once the seller’s bank verifies the LC, the seller ships the goods and provides the necessary documents to their bank.

However, there’s a delay between document submission and payment processing, as these documents undergo verification by the buyer’s bank. The buyer then has a grace period, usually 30, 60, or 90 days, to pay their bank as per the LC terms.

This waiting period poses a risk to the seller, as they must wait for payment. To mitigate this risk, sellers can opt for LC at sight or Sight LC, where they receive immediate payment upon presenting compliant documents. This method minimizes payment delays and risks, ensuring smoother and more secure transactions for both parties involved in international trade.

What is the Meaning of LC at Sight?

LC at sight or Letter of Credit at Sight is a document used in trade to ensure payment for goods or services. When a seller wants to ship goods to a buyer, they arrange for a sight letter of credit with their bank. This letter acts as a guarantee that the buyer will pay once they receive the goods.

Once the goods reach the buyer, they must pay the bank that issued the LC. This payment is proof that the transaction has been completed. The process of checking and verifying the documents associated with the LC is called sighting. Once verified, the LC becomes a sight letter of credit.

Banks usually take around 5 to 10 business days to complete this process. LC at sight is a secure way for buyers and sellers to ensure payment and delivery of goods or services in international trade.

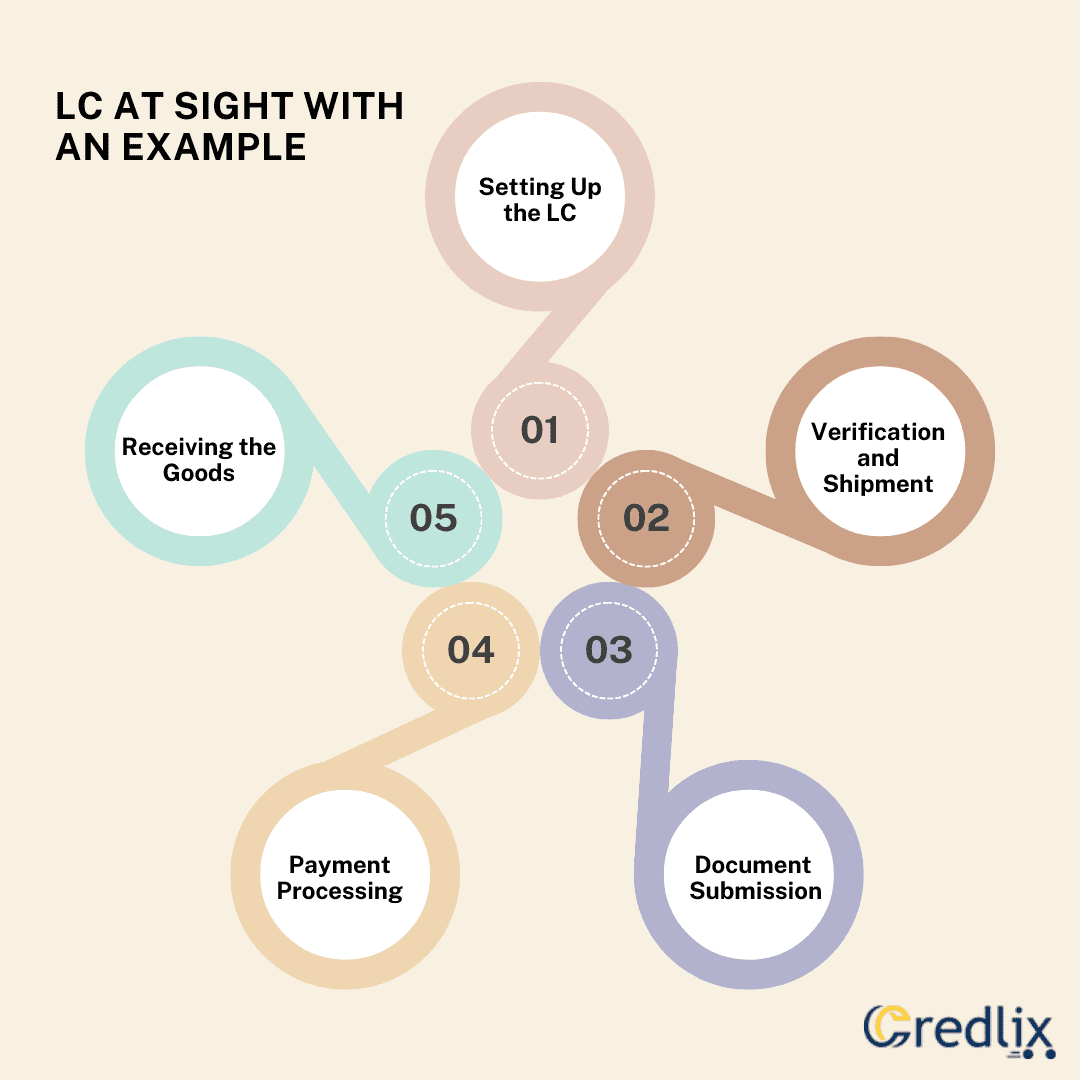

LC at Sight With an Example

Imagine you’re a buyer looking to import goods from a supplier in another country. To ensure a smooth transaction, you decide to use a Letter of Credit (LC) at sight. Here’s how it works:

Setting Up the LC: You approach your bank and request an LC in favor of the supplier. The bank issues the LC, stating that payment will be made to the supplier upon presentation of compliant documents.

Verification and Shipment: The supplier receives the LC from their bank and verifies its authenticity. Once confirmed, they ship the goods to you.

Document Submission: After shipping the goods, the supplier submits the necessary documents, such as the bill of lading and invoice, to their bank.

Payment Processing: The supplier’s bank forwards the documents to your bank for verification. Your bank checks the documents and, if compliant, makes immediate payment to the supplier.

Receiving the Goods: With payment secured, the goods are released for delivery to you. You receive the products without delay, knowing that payment has been made.

In this scenario, LC at sight provides assurance to both parties. The supplier is guaranteed prompt payment upon fulfilling their obligations, while you, as the buyer, receive the goods with confidence, knowing that payment has been processed swiftly. This example illustrates how LC at sight simplifies international trade, reducing risks and ensuring smoother transactions for all involved.

How Does a Sight LC Work?

Here’s how a Sight Letter of Credit (LC) works:

Buyer-Supplier Agreement: The process begins when a buyer identifies certain goods they need and negotiates a deal with a supplier. Once the terms are agreed upon, the buyer confirms the transaction.

Request for LC Issuance: The buyer approaches their bank, typically one that has already provided them with a line of credit, and requests the issuance of a Sight LC in favor of the supplier. The bank evaluates the buyer’s creditworthiness before issuing the LC.

Issuance and Transmission: Upon verifying the buyer’s creditworthiness, the bank issues the Sight LC and sends it to a bank in the supplier’s country. This serves as a guarantee of payment to the supplier.

Receipt and Review by Supplier: The supplier’s bank informs the supplier about the received LC and provides them with all the terms and conditions outlined in the LC.

Shipment and Document Submission: With the LC in hand, the supplier ships the products to the buyer and submits the shipping documents to their bank.

Document Processing by Supplier’s Bank: The supplier’s bank reviews the submitted documents for compliance with the terms of the LC. Once verified, they forward the documents to the buyer’s bank.

Notification to Buyer: The buyer’s bank alerts them about the arrival of the documents and informs them that they need to make full payment to collect the documents. These documents are crucial for taking delivery of the products.

Payment and Document Collection: Upon receiving notification from their bank, the buyer inspects the documents and makes the full payment for the LC. The buyer’s bank then transfers the payment to the seller’s bank, ensuring that the seller receives payment well before the goods reach the buyer.

Letters of Credit (LC) in Trade Transactions

A letter of credit (LC) serves as a financial safeguard in trade transactions, with banks acting as intermediaries between buyers and sellers. Here’s how it typically unfolds: The buyer requests their bank to issue an LC in favor of the seller. Once the seller’s bank verifies the LC, the seller ships the goods and provides the necessary documents to their bank. However, there’s a delay between document submission and payment processing, as these documents undergo verification by the buyer’s bank. The buyer then has a grace period, usually 30, 60, or 90 days, to pay their bank as per the LC terms.

This waiting period poses a risk to the seller, as they must wait for payment. To mitigate this risk, sellers can opt for LC at sight or Sight LC, where they receive immediate payment upon presenting compliant documents. This method minimizes payment delays and risks, ensuring smoother and more secure transactions for both parties involved in international trade.

What is Usance LC?

A Usance Letter of Credit (LC), also known as a Deferred Payment LC, is a type of LC where payment is made at a future date specified in the LC terms. Unlike a Sight LC, where payment is immediate upon presentation of compliant documents, Usance LC allows for a credit period before payment is due.

This credit period can range from 30 days to several months, depending on the terms negotiated between the buyer and the seller. Usance LCs are often used in international trade transactions where the buyer requires time to inspect the goods or secure financing before making payment.

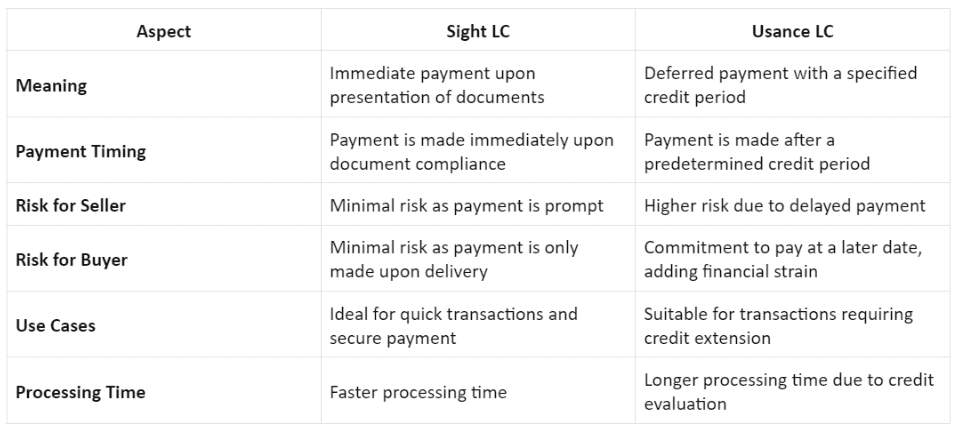

Difference between Sight LC and Usance LC

Here’s a comparison between Sight LC and Usance LC in a table format:

In conclusion, letters of credit (LCs) play a crucial role in facilitating secure and efficient international trade transactions. Whether opting for LC at sight or Usance LC, buyers and sellers can choose the payment method that best suits their needs and risk preferences. LC at sight ensures prompt payment upon document compliance, minimizing delays and uncertainties, while Usance LC offers flexibility with deferred payment options. By understanding the workings of LCs and their variations, businesses can mitigate risks, streamline transactions, and foster trust and reliability in their trade relationships across borders.

Also Read: Diverse Types of Export Letters of Credit: Clauses, Payment Terms, and More