In the world of business, think of invoices like the superheroes of money matters. They’re not just papers or digital files; they’re the heartbeat of how businesses handle cash. Today, let’s talk about two important invoice heroes: Commercial Invoices and Tax Invoices.

Commercial Invoices are like friendly guides in a trade journey, showing what’s bought or sold. Now, Tax Invoices are a bit like financial superheroes, especially for taxes. They prove we’ve paid our dues.

These documents aren’t just boring papers – they’re like business superheroes, making sure everything is clear and legal. So, if you’re a business owner, an accountant, or someone dealing with a company’s money matters, get ready to understand these money superheroes!

Key Takeaways!

- Commercial Invoices document the sale of goods or services, fostering clarity between buyer and seller.

- Tax Invoices go beyond transactions, serving as proof of tax payments and aiding in tax compliance.

- The key components of both invoices include buyer and seller details, a description of goods or services, and payment terms.

- Commercial Invoices play a crucial role in international trade, facilitating the movement of goods across borders.

- Tax Invoices are essential for businesses to fulfill their tax obligations and maintain transparent financial records.

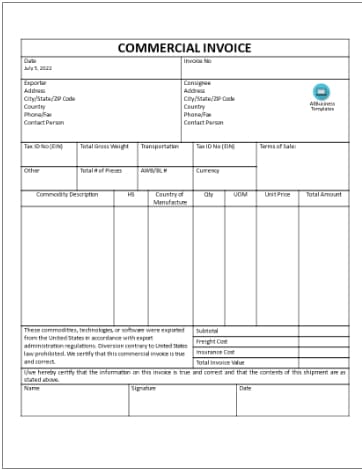

What is a Commercial Invoice?

A Commercial Invoice is a document that details the sale of goods between a seller and a buyer. Think of it as a friendly handshake between businesses, outlining the products or services provided and their respective costs. It is an essential record for both parties, aiding in smooth transactions and keeping things transparent.

Key Features of a Commercial Invoice

These features collectively serve as the backbone of the Commercial Invoice, ensuring that every party involved in the transaction understands and agrees upon the crucial details.

Buyer and Seller Information

Names and addresses of both the buyer and the seller are prominently featured.

Goods or Services Description

Clearly outlines a description of the goods or services being bought or sold.

Quantity

Specifies the quantity of the products or the extent of the services involved in the transaction.

Price

Clearly states the price associated with each unit of the product or service.

Payment Terms

Outlines the agreed-upon terms for payment, including any deadlines or

installment details.

The Role of Commercial Invoices in International Trade

These simple points below highlight how Commercial Invoices are like magical tickets that help products cross borders effortlessly in the world of international trade.

International Significance

Commercial Invoices become even more important when businesses engage in international trade.

Customs Assessment

Customs officials rely on Commercial Invoices to figure out the duties and taxes applicable to imported goods.

Passports for Products

Think of Commercial Invoices as passports for products – they help goods move smoothly across borders.

Seamless Border Journey

A well-prepared Commercial Invoice ensures that products can travel hassle-free between countries.

Business’s Best Travel Companion

In international transactions, a properly filled-out Commercial Invoice is like the perfect travel companion for your business, making sure everything arrives at its destination without a hitch.

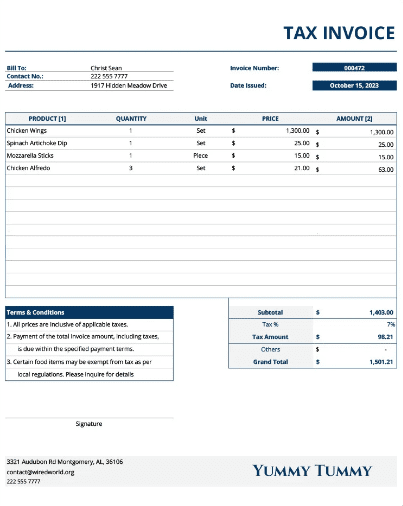

What is a Tax Invoice?

A Tax Invoice is a document issued by a seller to a buyer, just like a Commercial Invoice. However, its primary purpose is to serve as proof for the payment of taxes. It’s not just about the products; it’s about ensuring that the taxman gets his due.

Tax Invoice Requirements

These simple points outline the key requirements of a Tax Invoice, emphasizing the clarity and transparency it brings to financial dealings, particularly in the realm of taxes.

Seller and Buyer Information

Clearly mentions the names and addresses of both the seller and the buyer.

Unique Invoice Number

Assigns a distinctive invoice number to track and identify each transaction uniquely.

Date of Issue

Specifies the date when the Tax Invoice is created, ensuring a chronological record.

Description of Goods or Services

Provides a clear and detailed description of the goods or services involved in the transaction.

Inclusion of Applicable Taxes

Stands out as a crucial feature, highlighting the incorporation of taxes relevant to the transaction.

Transparency in Tax Transactions

The Tax Invoice ensures a transparent financial picture, especially regarding tax obligations.

Prevents Confusion

By including taxes in the invoice, it eliminates any confusion and establishes a straightforward understanding of the financial transaction.

When to Use a Tax Invoice?

Tax Invoices come into play when businesses need to account for taxes in their financial records. It’s not just about selling goods; it’s about fulfilling your tax obligations. Typically, businesses use Tax Invoices for transactions that involve the exchange of taxable goods or services.

Comparing Commercial and Tax Invoices

Now, let’s draw a side-by-side comparison between Commercial and Tax Invoices to understand their distinct purposes.

Purpose and Usage

- Commercial Invoices: Document the sale of goods or services, promoting a transparent understanding between buyer and seller.

- Tax Invoices: Extend beyond the transaction, serving as a vital tool for tax compliance, ensuring businesses meet their tax obligations.

Information Included in Each Invoice Type

Both Commercial and Tax Invoices feature details about the buyer, seller, and the exchanged products or services.

- Commercial Invoices: Focus on the specifics of the transaction without diving into tax details.

- Tax Invoices: Specifically highlight the taxes involved, providing a clear breakdown for businesses and tax authorities to monitor financial transactions.

Practical Implications for Businesses

- Tax and Financial Records: Commercial Invoices contribute to a business’s financial records, aiding in revenue and expense tracking.

- Tax Compliance: Tax Invoices directly impact tax calculations, ensuring businesses adhere to tax regulations and report accurate figures.

Operational Efficiency

- Commercial Invoices: Streamline day-to-day transactions and business operations, fostering smoother trade.

- Tax Invoices: Enhance operational efficiency by providing a transparent record of tax obligations, preventing potential legal issues.

Audit and Reporting

- Commercial Invoices: Primarily used for internal audits and reporting, focusing on business transactions.

- Tax Invoices: Play a crucial role in external audits and reporting, especially during tax inspections and assessments.

How Invoices Affect Taxation and Accounting

Commercial Invoices contribute to a business’s financial records, showcasing its revenue and expenses. Tax Invoices, on the other hand, directly impact tax calculations, ensuring that businesses adhere to tax regulations and report accurate figures.

Best Practices for Managing Different Invoice Types

Adopting these best practices ensures that businesses efficiently manage both Commercial and Tax Invoices, promoting accuracy, compliance, and overall financial health.

Understanding Distinctions

Ensure a clear understanding of the differences between Commercial and Tax Invoices to use them appropriately.

Documentation Accuracy

Maintain accurate and detailed documentation for each transaction, adhering to the specific requirements of each invoice type.

Stay Informed on Tax Regulations

Keep abreast of tax regulations and updates to ensure Tax Invoices comply with the latest legal standards.

Consistent Record-Keeping

Establish a consistent record-keeping system for both Commercial and Tax Invoices to facilitate easy retrieval and reference.

Use Reliable Invoicing Software

Employ reliable invoicing software to streamline the creation and management of invoices, reducing the risk of errors.

Train Staff

Provide training to staff involved in the invoicing process, ensuring they understand the nuances of both Commercial and Tax Invoices.

Timely Issuance

Issue invoices promptly to maintain a smooth cash flow and meet regulatory deadlines, especially in the case of Tax Invoices.

Regular Audits

Conduct regular audits to cross-check and ensure that all invoices align with business practices and legal requirements.

Consult with Experts

Seek advice from financial experts or tax professionals when in doubt, ensuring compliance with industry standards and regulations.

Communication with Stakeholders

Communicate clearly with both internal and external stakeholders about invoicing procedures, reducing misunderstandings.

Conclusion

In conclusion, Commercial and Tax Invoices are vital instruments in the business orchestra. They each have distinct roles, contributing to the harmonious flow of financial transactions and ensuring businesses operate within the bounds of legality and transparency.

FAQs

1. What are the penalties for using the wrong type of invoice?

Using the wrong invoice type may lead to financial consequences and legal issues. Penalties can include fines, audits, and potential disputes. It’s crucial to familiarize yourself with the correct invoicing practices to avoid such repercussions.

2. Can a commercial invoice be used for tax purposes?

No, a commercial invoice is not designed for tax purposes. While it records the sale of goods or services, it lacks the essential tax details. To fulfill tax obligations, use a dedicated tax invoice, ensuring transparency and compliance with tax regulations.

3. How do I know if I need to issue a tax invoice?

You typically need to issue a tax invoice when providing taxable goods or services. If your business is registered for VAT or other relevant taxes, issuing a tax invoice is necessary. Consult tax regulations or seek advice from a financial professional to determine your specific obligations.

4. What information is crucial in a tax invoice?

A tax invoice must include essential details such as the seller’s and buyer’s names and addresses, a unique invoice number, the date of issue, a clear description of goods or services, and the applicable taxes. Including this information ensures compliance and transparency in tax transactions.

5. Can I correct errors on an issued tax invoice?

Yes, you can correct errors on a tax invoice. However, it’s crucial to follow the guidelines provided by tax authorities. Generally, corrections should be made promptly, and a revised invoice should be issued to maintain accurate records and comply with tax regulations.